Content

This method is a mix of straight line and diminishing balance method. Thus, depreciation is charged on the reduced value of the fixed asset in the beginning of the year under this method. However, a fixed rate of depreciation is applied just as in case of straight line method. This rate of depreciation is twice the rate charged under straight line method. Thus, this method leads to an over depreciated asset at the end of its useful life as compared to the anticipated salvage value. We help track and depreciate fixed assets, even fully expensed items for operational reasons, while still helping finance teams stay on top of depreciation. Invite your Maintenance staff into Asset.Guru for Job Management, Asset Tracking and reminders for regular tasks and safety certificates.

This report is included in Xero’s SPFR report packs, but you’ll need to fill in the details manually. The key here is that the primary function of depreciation is informational, we’re not talking about taxable or assessable income.

Asset Guru

Instead, they can more easily be associated with an entire system of production or group of assets. Let us assume that the company prepares annual financial statements only, and the depreciation journal entries can be prepared for the fiscal years as of the last day of each year. The company intends to follow the straight-line method of depreciation over the 3 years life. Briefly, ledger or book depreciation models the real world decline in value of assets, xero uses this configuration to make ledger entries which will show on your profit and loss. Tax depreciation has no place in your ledger, there’s no journal entries for tax depreciation. Therefore in your statement of financial performance, the ledger depreciation values will be listed, with no mention of tax depreciation amounts. For example, we might determine that the prime mover mentioned above has a useful life of 10 years, so using the diminishing value method it would decline in value at a rate of 20% per year.

Thus, the method is based on the assumption that more amount of depreciation should be charged in early years of the asset. This is on account of low repair cost being incurred in such years. As an asset forays into later stages of its useful life, the cost of repairs and maintenance of such an asset increase. Hence, less amount of depreciation needs to be provided during such years.

Methods Of Calculating Depreciation

If you’ve made a mistake with depreciation processing, you can always roll it back. Go back into the depreciation window by clicking “Depreciation” and click “Rollback Depreciation”, fill in the details requested and click “OK”. Fill in detailed description of your asset in the description area. E.g. insurance policy number, make, model, color and anything else that would be useful. This can be easily prevented, however, by locking in your dates each time a reporting period is finalised, utilising the ‘lock dates’ feature of Xero.

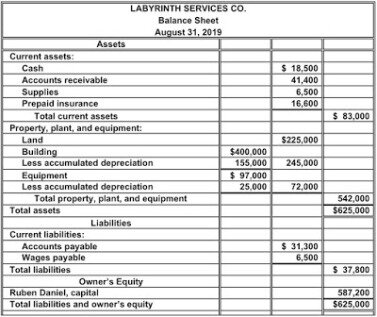

The journal entry for depreciation refers to a debit entry to the depreciation expense account in the income statement and a credit journal entry to the accumulated depreciation account in the balance sheet. From the view of accounting, accumulated depreciation is an important aspect as it is relevant for assets that are capitalized.

Expressions of opinion are as of the date of the post and are subject to change without notice. Sort the report in ascending or descending order of the data in any column by clicking on the column heading. Residual Value – Salvageable value at the end of the effective depreciation period. This value will limit the minimum book value amount for depreciation.

This is the most commonly used method to calculate depreciation. Under this method, an equal amount is charged for depreciation of every fixed asset in each of the accounting periods. This uniform amount is charged until the asset gets reduced to nil or its salvage value at the end of its estimated useful life. Finally, depreciation is not intended to reduce the cost of a fixed asset to its market value. Market value may be substantially different, and may even increase over time. Instead, depreciation is merely intended to gradually charge the cost of a fixed asset to expense over its useful life.

Generally, the method of depreciation to be used depends upon the patterns of expected benefits obtainable from a given asset. This means different methods would apply to different types of assets in a company.

Fixed Assets In Xero

However, S380 of the act provides a Small Business Entity Pool which completely ignores the actual value of specific assets and simply provides a rate of 15% in the first year and 30% in subsequent years. I get asked about Xero’s tax depreciation more than any other aspect of the software. It’s not something you see in any other accounting software platform, and is the source of much confusion. A good understanding of the concepts will make it much easier to set up and maintain your depreciation.

- To get rid of fixed assets from the fixed assets register, you’ll need Xero adviser status.

- If you incur costs on behalf of another company – you may wish to recharge them.

- Purchase Date/Opening Cost will be automatically calculated and will include any cost base adjustments if applicable.

- Assuming you purchased the same computer with a loan, this would be the journal entry.

- However, the cash reserve of the company is not impacted by the recording as depreciation is a non-cash item.

Suppose a small business with a turnover of $30k buy’s a new vehicle for $20k on the first day of the period, which is eligible for immediate writeoff. Let me show you a super simple example to break down how this might look in a set of financial statements. “Xero” and “Beautiful business” are trademarks of Xero Limited. Hi, my answer was posted 10 months ago and I have since learnt of a better solution! The best thing to do is to change your own access level so that you become an ‘adviser’.

As Xero automatically matches your accounting record with statement lines, a lot of small business owners mistakenly think they can skip this particular step in both the initial step up and daily use. But reconciling your bank is vital to ensuring an accurate account, allowing you to pick up on any missing or duplicated transactions. This can be easily solved through having a PayPal account set up in Xero for each currency.

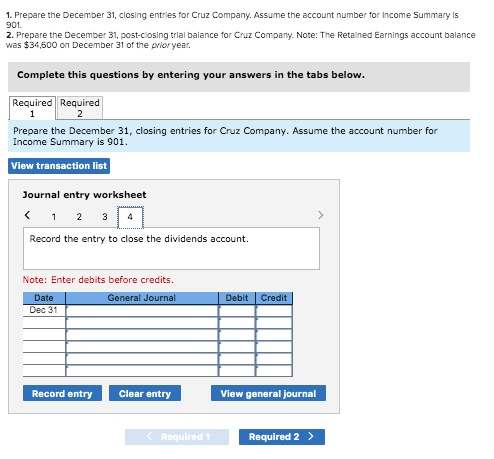

I won’t go over it again, however, just to give you an idea, here are some of the accounts that you need to create in Xero to complete the whole disposal process. Select the date in the “To” field to select the date till when you want to run the depreciation. Only those fixed assets which are depreciable between the from and to dates will be listed. You can even also select a month in the future and Xero will calculate and post depreciation in the books ahead of the time.

This gives you more control of your own account and adds more features. I won’t explain here all the things your can do as an adviser, only how to become one. This looks right to me, but I’m not an accountant and I’d be happy for a professional to tell me otherwise if I’ve got it wrong. Then manually enter a payment from this account (e.g. 721) to pay the bill.

Xero Guide: Corporation Tax

Let us consider the example of a company called XYZ Ltd that bought a cake baking oven at the beginning of the year on January 1, 2018, and the oven is worth $15,000. The owner of the company estimates that the useful life of this oven is about ten years, and probably it won’t be worth anything after those ten years. Show how the journal entry for the depreciation expense will be recorded at the end of the accounting period on December 31, 2018. Know the financial position of your business any time of the year.

You and your advisor can share information and run reports in Xero to show what fixed assets are on the books and their value whenever you want. While most business expenses are tax-deductible, they’re not all depreciable. Consumables like stationery can be deducted from tax but you have to claim for them in the year you bought them. For most businesses, only fixed assets can be depreciated. A transport company with old trucks may not be worth as much as a transport company with new trucks, for example. Your assets are listed on your balance sheet, on what is called the fixed asset register. Make sure you update the register whenever you work out depreciation.

Click the “Summary” button to see the disposal summary. This entails all the financial information as a result of the said disposal.

Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation. Following is the formula for sum of years’ digits method. Put the Loss/Gain on Disposal to a suitable account – you might need to create a new one.