Content

Otherwise, the cost of QuickBooks to cover the same features I use in Xero would have been very expensive; even a QB consultant told me it’s overkill for a business of my size. I forget which other products I looked at, but Xero was recommended by several owners of similar businesses. Established in 2006, Xero is a web-based accounting system designed for small and growing businesses. Xero connects small businesses with their trusted advisors and provides business owners with instant visibility of their financial position. If you select the “Awaiting Payment” option, that means OnPay will automatically approve the bills.

There is more information in the project tabs than what you can obtain in the report which is disappointing. For the purpose of tracking the movement of money to your Asset, Work in Production, and Cost of Goods Sold accounts, vintrace operates as a sub-ledger to Xero. We strongly recommend that you only make changes to your account setup under the direction of your accountant and/or vintrace Support. Browse to the Excel trial balance file saved for your client, and select it. Save the Excel file with the client name to the folder designated to file exported trial balances.

- Go to Generate Reports and select Detailed Trial Balance.

- A trained bookkeeper can quickly see how a transaction affects the five big accounts, but it doesn’t come naturally to most of us.

- You can create groups and smart lists within the module, making it easy to track customers who order regularly or who always pay late.

- Xero Cashbook is for clients who need Xero’s automated bank feeds but don’t need invoicing.

If you have an accountant that you work with, then you should seek their guidance with this decision. However, if you manage your own books then I recommend that you use the Xero default chart of accounts; you can add, delete or modify accounts to meet your business’s needs. This functionality allows you to import general ledger data from your client accounting software into the workpapers. Depending on the software you are using, different instructions apply to import data.

Why Is It Important To Set Up A Chart Of Accounts?

Editorial content from The Blueprint is separate from The Motley Fool editorial content and is created by a different analyst team. In Xero’s case, the answer is yes to all of the above.

“Xero” and “Beautiful business” are trademarks of Xero Limited. Figure 5, Think about where value comes and goes from when you do business. Double-entry bookkeeping is designed to reflect the greatest truism of business – you don’t get anything for nothing. If something comes into your business, it’s because you gave something up. As with other Xero business plans, Xero Cashbook and Xero Ledger integrate with other Xero practice tools.

For example, I use cloud storage for receipts and tax invoices. For example, if you want Invoices from all your Relationships to go to Accounts Receivable, select ‘Company’ in your Default Sales Account On as show above. It is essential to set it up correctly because this is how your sales total will be tracked on. Discounts or credits, which are processed as ‘negative costs’ in WorkflowMax must therefore be mapped to an income account, NOT to an expense or cost of sales account. All task and cost lines are ‘sales’ and are therefore mapped to income accounts in Xero.

All trademarks are property of their respective trademark owners. At the “Actuals” field heading, select “12 months” from the drop down. Note you could also do shorter budget.An example for when you’d use the budget manager to do shorter period budgeting, is for a special project e.g. a new kitchen fit out. Fixed Assets – review that all your assets are in here. This will be needed for your accountant to run depreciation. With effect from 23 Sept 2020, Xero Integration’s help documentations will only apply to existing customers or prospects that have created trials before said date.

This would allow you to report on your catering work, broken down by region. , or simply select an existing job category to modify. additional fields become available on the WorkflowMax job categories screen, and on the tasks and costs screens . These fields allow you to apply account codes and tracking categories in these areas if you wish. Learn what information you need to record, and find out how modern bookkeepers get the job done. When you enter a transaction into your software, it may ask you where to record the opposing credit or debit. Or you can teach the software where to make the opposing entry and it will happen automatically.

How To Export Accounting Data From Xero

The complete online accessibility and easy product setup means you’ll be up and running quickly. Best suited for sole proprietors and small and growing businesses, Xero offers three versions, so you can scale up to a more robust plan as your business grows. There are several accounts created by Xero for basic accounting purposes, like accounts payable and accounts receivable. Because these accounts are essential to reporting for any business, you will be restricted in the changes that you can make to them.

Next, click the Export button and welcome a CSV file with your Xero fixed assets data. Click Show Advanced to expand an optional parameter – Cell address. This lets you specify the first cell where the Xero data will be imported to. A detailed report imports an extended list of fields.

Add a New Account to the chart of accounts in Xero. By completing these fields, you can add the accounts that you need to track all income and expenses for your business. For the remainder of this lesson, we will use a fictitious company called Acme Web Pros Plus to demonstrate how to customize the chart of accounts for your business. Welcome to the Fit Small Business Xero training course!

Additionally, it is also prone to errors and data corruption. Therefore, it is not sustainable especially if you are growing your business. It also isn’t “professional” double-entry bookkeeping and can’t be audited. Outright can’t handle Cost of Goods Sold properly and requires manual workarounds. It can’t generate professional reports needed when applying for loans. Our Setting Up a Ledger Account article details how to configure your ledger accounts in vintrace. Coupler.io also provides a Xero Reports importer to automate export of reports from Xero to Google Sheets.

This will ensure that your chart of accounts does not get cluttered with a bunch of accounts that you never use and it will ensure that accounts are not accidentally selected. Step 3 – From the dropdown, select the sales tax rate that should be assigned to this account and click the “save” button to make the change. Tax – In this field, select from the drop down the appropriate sales tax rate.

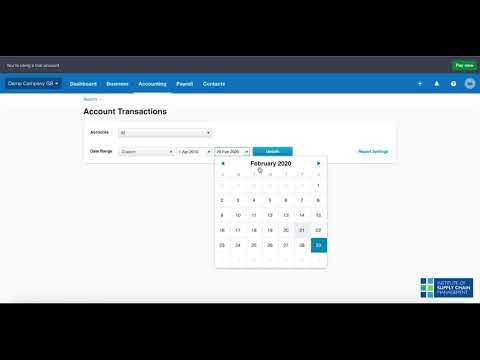

For multiple parameters, add each of them in a new line. Select the date range and comparison period to generate the report and click Export. Click the Export button and choose either CSV or PDF format to download to your device. Select the invoices you want to include in the batch deposit, and click Deposit. You’ll need to repeat the flow to export bills as well.

Accounting

From my own experience, I found that Xero is very user-friendly and its accounting interface is streamlined, almost seamless, and uncluttered. The Demo Company is very useful as you can manipulate data without worrying about messing up vital information in your practice company. Quickbooks had been the leader of accounting software for small businesses for quite some time but Xero is becoming more popular because of its competitive offering and value proposition. Xero’s starting plan is very affordable and you have the option to add-on some features depending on your need.

If the account can be synced to your general ledger, select the Syncable checkbox. For each account you want to track in Xero, you’ll need to set up an account in vintrace that will be linked to the account in Xero. Based on this configuration, vintrace will determine what production transactions are journaled each time you sync the account with Xero. Adding OneSaas’s powerful data integration tools will help our QuickBooks customers gain more meaningful insights about their eCommerce businesses.

Xero importer by Coupler.io lets you automate export of Contacts, Groups of Contacts, Employees and Users from Xero to Google Sheets. To do this, select the corresponding type of data in the “Data entity” field and run or schedule the importer. With Coupler.io, you can export invoices and bills in one Google Sheets file . To do this, select Invoices in the Data Entity field and run the Xero importer. Once you’ve set up your Xero importer, click Save or Save & Run to initiate the first data export. Suspense or clearing accounts – the balance of these accounts should be zero. Bank Reconciliation Summary – make sure all your bank reconciliations have been done.

This will help you to easily identify what type of transactions it should be used for. Below each account type are examples of the accounts that would fall within each type. For example, when you purchase products to sell to your customers it is classified as an asset, as indicated in the chart below. good recommendation from another provider who had a similar size busness. Was SUPER easy to set up, and the account reconciliation was a godsend.

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process.

Create A Custom Ledger Account For Xero

Figure 4, Transactions are coded using the chart of accounts which then feed into the financial reports that reveal how your business is doing. The mapping process takes a bit longer but is important. As both Actionstep and Xero have their own general ledger, currencies, and sales taxes, it is important to map the two together. Transactions will only flow through to Xero after you integrate the systems. Any existing invoices, account balances or payments you have made in Actionstep, will not be created in Xero. Once you integrate, you may want to consider moving any open invoices back into draft and saving them again.