While each component—inventory, accounts receivable, and accounts payable—is important individually, collectively, the items comprise the operating cycle for a business and thus must be analyzed both together and individually. The formula to calculate working capital—at its simplest—equals the difference between current assets and current liabilities. Working capital management is focused on maintaining a sufficient cash flow that can meet short-term liabilities like operating costs or debt obligations.

What is the approximate value of your cash savings and other investments?

One common mistake made by people is that they simply add the terminal value derived directly to the present values of cash flows. Remember, the exit value computed is a value as of the terminal year, and we will need to convert it to present value by multiplying it with the terminal year’s discount factor. Getting the discount rate (WACC in this case) is another topic of its own and we generally estimate the WACC of a business using the CAPM model with reference to market data of listed comparable companies. For terminal year capital expenditure, please note it should always be slightly higher or at least equal to the Depreciation (D&A) expense. If fixed assets depreciate faster then your capital expenditure, then in the long-term, there will be no fixed assets left in the business which doesn’t make sense for a going concern.

How do you calculate working capital?

To reduce short-term debts, a company can avoid unnecessary debt, secure favorable credit terms, and manage spending efficiently. Even a profitable business can face bankruptcy if it lacks the cash to pay its bills. For example, if a company has $1 million in cash from retained earnings and invests it all at once, it might not have enough current assets to cover its current liabilities. The net working capital (NWC) metric is different from the traditional working capital metric because non-operating current assets and current liabilities are excluded from the calculation. If, on the other hand, a company has a negative working capital number, then it does not have the capacity to cover all of its short-term debts or cash needs using its current assets. If a company has a positive working capital number, this means its current assets are greater than its current liabilities.

The inventory turnover ratio

Calculating FCFE would require you to project the financing cash flow (like borrowings, repayment and interest). Still, it’s important to look at the types of assets and liabilities and the company’s industry and business stage to get a more complete picture of its finances. By definition, working capital management entails short-term decisions—generally, relating to the next one-year period—which are “reversible”. These decisions are therefore not taken on the same basis as capital-investment decisions (NPV or related, as above); rather, they will be based on cash flows, or profitability, or both. In this case, the retailer may draw on their revolver, tap other debt, or even be forced to liquidate assets. The risk is that when working capital is sufficiently mismanaged, seeking last-minute sources of liquidity may be costly, deleterious to the business, or, in the worst-case scenario, undoable.

If the company’s equity value is $10,000,000, a buyer looking toacquire the 30% position would not pay $3,000,000 because of the lack ofcontrol attached to this minority shareholding. You can sell shares in a listed stock at the click of abutton, with a minimal brokerage cost; there is a visible level of investordemand. Selling shares in a private business is somewhat more laborious andmore costly. Please note that the equity value here is on a controllingand marketable basis. You need to apply a discount if you are deriving thevalue of a private business or a minority stake of a business.

Working capital can’t be depreciated as a current asset the way long-term, fixed assets are. Certain working capital such as inventory can lose value or even be written off, but that isn’t recorded as depreciation. The exact working capital figure can change every day depending on the nature of a company’s debt. What was once a long-term liability, such as a 10-year loan, becomes a current liability in the ninth year, when the repayment deadline is less than a year away. This absence of control reduces the value of the minority equityposition against the total value of the company. You may view it as selling the business at the end of the forecast period based on an exit multiple.

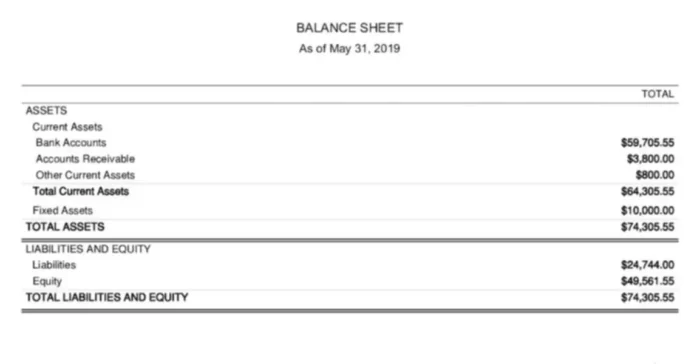

Working capital is the difference between a company’s current assets and current liabilities. It is a financial measure, which calculates whether a company has enough liquid assets to pay its bills that will be due within a year. When a company has excess current assets, that amount can then be used to spend on its day-to-day operations. Working capital is the amount of current assets left over after subtracting current liabilities. Working capital can be a barometer for a company’s short-term liquidity.

- Working capital management relies on the efficient management of the cash conversion cycle, which is the relationship of key activities that can be viewed through financial ratios.

- Working capital should be assessed periodically over time to ensure that no devaluation occurs and that there’s enough left to fund continuous operations.

- Working capital is calculated by subtracting current liabilities from current assets.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- In the case of a manufacturing business, the average stock retention period needs to be calculated for each type of stock (i.e., for raw materials, work-in-progress, and finished goods).

Hence, the company exhibits a negative working capital balance with a relatively limited need for short-term liquidity. On average, Noodles needs approximately 30 days to convert inventory to cash, and Noodles buys inventory on credit and has about 30 days to pay. Suppose an appliance retailer mitigates these issues by paying for the inventory on credit (often necessary as the retailer only gets cash once it sells the inventory). Imagine that in addition to buying too much inventory, the retailer is lenient with payment terms to its own customers (perhaps to stand out from the competition). This extends the time cash is tied up and adds a layer of uncertainty and risk around collection.

That being said, since we cannot predict the future, most forecasts typically go up to 3-years or 5-years. Some businesses may be able to forecast more accurately for even longer periods (say 10 years) because they have more predictable cashflows which could be due to signed agreements/concessions. Current assets are economic benefits that the company expects to receive within the next 12 months.

Working capital is the difference between a company’s current assets and current liabilities. Current assets are assets that a company can easily turn into cash within one year or one business cycle, whichever is less. They don’t include long-term or illiquid investments such as certain hedge funds, real estate, or collectibles. To determine the changes in working capital in the projection period, very often we will need to do a forecast by ourselves if we don’t have a projected balance sheet. Common techniques in forecasting the working capital includes benchmarking to the revenue and turnover days etc.

Software technology companies have low working capital needs because they do not sell any physical product, and therefore, have very little inventory expense. The suppliers, who haven’t yet been paid, are unwilling to provide additional credit or demand even less favorable terms. One nuance to calculating the net working capital (NWC) of a particular company is the minimum cash balance—or required cash—which ties into the working capital peg in the context of mergers and acquisitions (M&A). Keep in mind that while working capital is highly useful when assessing potential investments, it should always be considered in context and alongside other metrics. Below is more information about specific sectors as well as additional factors that play a role.

A healthy business has working capital and the ability to pay its short-term bills. A current ratio of more than one indicates that a company has enough current assets to cover bills that are coming due within a year. The higher the ratio, the greater a company’s short-term liquidity and its ability to pay its short-term liabilities and debt commitments. Working capital is the difference between a business’s current assets and liabilities.

A negative amount indicates that a company may face liquidity challenges and may have to incur debt to pay its bills. Working capital is the difference between a company’s current assets and current liabilities. The challenge here is determining the proper category for the vast array of assets and liabilities on a corporate balance sheet to decipher the overall health of a company and its ability to meet its short-term commitments. Working capital represents a company’s ability to pay its current liabilities with its current assets.

Having positive working capital can be a good sign of the short-term financial health of a company because it has enough liquid assets remaining to pay off short-term bills and to internally finance the growth of its business. With a working capital deficit, a company may have to borrow additional funds from a bank or turn to investment bankers to raise more money. A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses.

For instance, you need to invest in production capacity (more capital expenditure), you will have more inventories and receivables (more investment in working capital). Personally, I prefer using FCFF (except for certain industries, such as financial services) as it doesn’t require projecting the financing cash flows. As the risk of equity and debt is different(i.e., lower risk to debt holder given more protection), FCFF and FCFE alsorequire different discount rates in the DCF. FCFF is often discounted byweighted average cost of capital (WACC), while FCFE is discounted by cost ofequity.