Content

This allows outstanding receivables, instant reconciliation of customer payments, and quicker cash flow in your Xero register. You can also create multi-currency invoices, and Xero will keep track of exchange gain/ loss resulting from movement in foreign currency. With Xero, your invoices are not only customised for your business needs but creating, and tracking those invoices is also fast and straightforward. Many business owners find the Xero user interface customer friendly and easy to navigate. Xero allows for cash-based and accrual accounting systems, so it is perfect for companies adhering to UK GAAP or IFRS. Simple integration with LivePlan software and many other third-party apps.

It’s also used in the calculation of the pre-populated hours in leave requests. For a monthly employee who works 38 hours per week, this field would be 164.67 (38 x 52 / 12). On 38 hours the annual leave accrued each year is 152 hours. Hours in a twice monthly pay period I know does change a little but if you calculate 38 hours a week x 52 weeks in a year divided by 24 pay periods in a year you will get 82.33 hours in a twice monthly pay period. You can speed up the preparation of reports and tax submissions by giving your accountant access to your business accounts through Xero. For example, the £10 starter plan gives you a monthly limit of 20 bank reconciliation, 5 invoices, and bills, while the £24 plan contains unlimited transactions, unlimited bills and unlimited invoices. Xero accounting software can be accessed on your Smartphone and does not require any type of IT maintenance or software installation.

Xero Accounting Growing Plan

Hey Team – Yes, with monthly employees, the system will divide the number of hours in a monthly pay period by the number of business days in that month. Would be great if these employees with monthly pay and salaries, could just have leave request hours calculated based on the number of days per year accrued divided by the average days per month. @Neil – It sounds like these leave accruals are set up to be a fixed amount per pay period. If this method is used, the accruals won’t reduce when unpaid leave is processed. The recommended calculation method is ‘Based on Ordinary Hours’. This way, they’ll take into account unpaid leave, as well as employees who are part time. @Tom – The ‘Hours in a Monthly pay period’ will determine the amount that accrues each pay period, based on hours worked.

However I have just switched back to 2 part-time staff and it looks like Xero still have not fixed the problem. After one 14 day pay period, one staff member has accrued 38 hours annual leave and 38 hours sick leave, while the other had accrued about 29 hours annual leave.

When you set up the leave accruals in their pay templates you can select ‘calculate rate based on ordinary earnings’. Is this possible to be set up for Xero to calculate on 152 hours leave accrual for each year on ordinary hours?

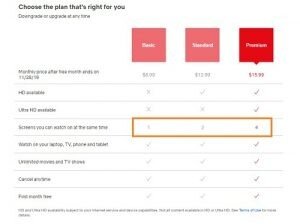

Additionally, although these limitations are alleviated with the Growing plan, the difference between the cost for these two plans is substantial, with the Growing plan costing over three times as much as the Early plan. Comparatively, you can find other solutions on the market—Wave, QuickBooks Online, etc.—who have plans with similar capabilities at a lower cost than the Growing plan. Moreover, Xero provides three distinct plans, giving you the ability to choose the offering that works best for your business. With Xero Projects, you’ll be able to track time, enter expenses, and record deposits—thereby monitoring project performance with up-to-date time tracking and invoicing reports once the project is complete. You’ll also be able to attach unlimited monthly bills if you choose the Xero Established plan. Kathy Yakal has been writing about PC applications since 1983, when she joined the editorial staff of COMPUTE! She began specializing in financial solutions in 1989, writing a newsletter for CPAs who were exploring the use of personal computers in their firms.

Xero Accounting Software Is Especially Good For:

With the Xero accounting Early plan, you’ll only be able to use five invoices and quotes per month through your account. The Early plan is the most basic version of Xero accounting software. Although this solution will be the most affordable of the three Xero plans, it will also place the greatest limitations on your capabilities.

Please do not tell us that you are working on this – forget about fancy features like the Assurance Dashboard – we need help to generate sales, which will cause us to appreciate the assurance dashboard. Plus, with only one plan option and no third-party integrations, Wave limits you to the specific tools they provide within their one platform.

Start Using Xero For Free

Like Xero accounting, Wave is a web-based platform known for its accessibility, mobility, and ease of use. Unlike Xero, however, Wave is one of the only truly free accounting solutions on the market. You can sign up for a Wave account at no cost and receive access to the platform’s income, expense, invoicing, reconciliation, and reporting features. Wave accounting also offers two paid add-ons, payroll and payments, allowing you to add these functionalities to your Wave account.

The data model exposed by our ODBC Drivers can easily be customized to add or remove tables/columns, change data types, etc. without requiring a new build. These customizations are supported at runtime using human-readable schema files that are easy to edit. Our drivers enhance the data source’s capabilities by additional client-side processing, when needed, to enable analytic summaries of data such as SUM, AVG, MAX, MIN, etc. Easily connect live Xero Accounting data with BI, ETL, Reporting, & Custom Apps. Data Sync Straightforward Apps for data replication with on-premise and cloud databases. BizTalk Adapter Easily integrate BizTalk Orchestrations with Application, Database, & Service data. JDBC Driver Pure Java Type 4/5 JDBC Drivers with bi-directional access from Java Apps.

Xero also offers an add-on subscription to Gusto, a full-service payroll solution, starting at $39 per month plus $6 per month per person. Phone support, online features, and other services vary and are subject to change. 14,500+ participating financial institutions as of October 1, 2018.

As it stands, Reports are a priority to the team, if you haven’t already taken a look at our latest update you can do so on our Blog. Still some more work to do on the custom columns, and to bring the new reports at parity with the old – but we’ll get there. As I mentioned, the team are also working on Contact reports, and US Report Templates.

- Competitors in this class do not offer a comparable feature.

- You can only choose one of these rates to be ‘ordinary hours’ in the employment tab.

- Moreover, Xero provides three distinct plans, giving you the ability to choose the offering that works best for your business.

- And also increasingly frustrated with the bland ‘one response suits all’ from the Xero team.

ODBC Driver Standards Compliant ODBC Drivers with powerful Enterprise-level features. Please keep in mind third parties may use a different credit score when evaluating your creditworthiness. Also, third parties will take into consideration items other than your credit score or information found in your credit file, such as your income. Quicken for Mac software and the Quicken App are not designed to function outside the U.S. Quicken for Windows imports data from Quicken for Windows 2010 or newer, Microsoft Money 2008 and 2009 . Quicken for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. Purchase entitles you to Quicken for 1 or 2 years , starting at purchase.

Recent improvements to its setup process and new business overviews solidify it as an excellent choice for small businesses. Sales Tax softwareThe sales Tax software has a price range of $50-$1500. Traxit costs $50 a month; Utility Software pricing goes for $85, and GreenGIST for a one-time charge of $1500. Intuit ProSeries has a plan which goes for $270 a year, and EcomTax for $19 per month. It’s the number 1 cloud accounting software and MTD compliant. Create custom invoices that include project materials, time, fixed prices, and progress payments.

If you seek products that support customizable dashboards and predictive analysis to identity possible trends and facilitate decision making, you may have to pay higher for all the customization features. Recurring cost is greater as customers are required to make monthly payments as subscription fee. Additionally customers using premium support services must pay an extra fee. Debt Collection SoftwareUsers can expect to pay $59-$239 a month for Debt Collection Software subscriptions.