There is a tremendous impact on the resale value when it comes to the model of the car, wherein the build-year plays an important role. Because of this, even the COGS varies due to fluctuation in the ending inventory; possibilities of either having an immense profit in the business or vice-versa. As the COGS is calculated, this can also help you to calculate your yearly gross income. Once you know the exact purchasing amount and thereafter deciding your profit margin is not an ideal strategy. Chances are that you might have added more profit margin or less in comparison to your competitors in the market. In such a situation, if your prices are high in the market then nobody will purchase your product and you will incur a loss.

List all costs, including cost of labor, cost of materials and supplies, and other costs. Check with your tax professional before you make any decisions about cash vs. accrual accounting. This “how-to” takes you through the calculation of the cost of goods sold, so you can see how it is done and the information you will need to give to your tax professional. Average cost flow assumption is a calculation companies use to assign costs to inventory goods, cost of goods sold and ending inventory. During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount.

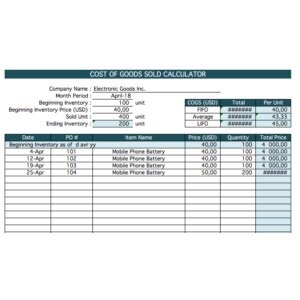

Beginning inventory is nothing but the unsold inventory at the end of the previous financial year. Whereas, the closing inventory is the unsold inventory at the end of the current financial year.

Assuming that prices rose from January to June, Shane would have paid more for the June inventory and LIFO would increase his costs and decrease his net income relative to FIFO. This free cost of goods sold calculator will help you do this calculation easily. Inventory includes the merchandise in stock, raw materials, work in progress, finished products, and supplies that are part of the items you sell. You may need to physically count everything in inventory or keep a running count during the year. Beginning inventory, the value of all the products, parts, and materials in your inventory at the beginning of the year, must be the same as your ending inventory at the end of the year before.

Add Inventory Purchases For The Period

Principles for determining costs may be easily stated, but application in practice is often difficult due to a variety of considerations in the allocation of costs. When the goods are bought or produced, the costs associated with such goods are capitalized as part of inventory of goods. These costs are treated as an expense in the period the business recognizes income from sale of the goods. If you’re in the market for an accounting software application that can calculate your cost of goods sold, be sure to check out The Blueprint’s accounting software reviews. That means that for the month of May, Anthony’s cost of goods sold was $23,400. If Anthony were manufacturing the books, he would need to include direct labor cost in his cost of goods sold calculation.

For obsolete inventory, you must also show evidence of the decrease in value. Indirect Costs are costs related to warehousing, facilities, equipment, and labor.

Accounting Analysis Of Cogs

If you own a cabinetry company, examples of COGS would include the wood, screws, hinges, glass, paint, and labor used to make the cabinets you sell. However, the costs to market the cabinets, the electricity needed to operate the machinery, and shipping are not included in the COGS. The cost of goods sold over the year for this retailer was $550,000. The second part of the COGS formula calls for tabulating whatever purchases or additions you made to your inventory over the period or quarter in question. Rolling dough, cutting noodles, and prepping sauces and toppings are a lot more labour intensive than a restaurant that does not transform the raw product as much. Grilled steaks and steamed seafood, for example, don’t require much beyond proper seasoning, cooking, and storage/handling. A restaurant can be profitable with a 40% food cost, as much as a restaurant with 20% food cost can be losing money.

Costs of goods made by the businesses include material, labor, and allocated overhead. The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value.

Supply Chain Management Learn about how supply chain management is all about getting the right products at the right time. When use properly, however, COGS is a useful calculation for both management and external users to evaluate how well the company is purchasing and selling its inventory. Thus, Shane would sell his June inventory before his January inventory.

The benefit of using FIFO method is that the ending inventory is represented at the most recent cost. Thus, FIFO method provides a close approximation of the replacement cost on the balance sheet as the ending inventory is made up of the most recent purchases. The COGS to Sales ratio showcases the percentage of sales revenue that is used to pay for the expenses that vary directly with the sales of your business. This ratio indicates the efficiency of your business to keep the direct cost of producing goods or rendering services low while generating sales. Now, if the company uses a periodic inventory system, it is considered that the total quantity of sales made during the month would have come from the latest purchases.

If your business sells products, you need to know how to calculate the cost of goods sold. This calculation includes all the costs involved in selling products. Calculating the cost of goods sold for products you manufacture or sell can be complicated, depending on the number of products and the complexity of the manufacturing process. In theory, COGS should include the cost of all inventory that was sold during the accounting period. In practice, however, companies often don’t know exactly which units of inventory were sold. Instead, they rely on accounting methods such as the “First In, First Out” and “Last In, First Out” rules to estimate what value of inventory was actually sold in the period. If the inventory value included in COGS is relatively high, then this will place downward pressure on the company’s gross profit.

After year end, Jane decides she can make more money by improving machines B and D. She buys and uses 10 of parts and supplies, and it takes 6 hours at 2 per hour to make the improvements to each machine. Thus, Jane has spent 20 to improve each machine (10/2 + 12 + (6 x 0.5) ). If she used FIFO, the cost of machine D is 12 plus 20 she spent improving it, for a profit of 13. If she used LIFO, the cost would be 10 plus 20 for a profit of 15. Materials and labor may be allocated based on past experience, or standard costs.

That is to say that the decreasing COGS to Sales ratio indicates that the cost of producing goods and services is decreasing as a percentage of sales. That is to say, the Perpetual Inventory System records real time transactions of the inventory purchased or sold using an inventory management software. COGS is an important metric on the income statement of your company. This is because the COGS has a direct impact on the profits earned by your company. The Product Cost helps you to determine the selling price of your finished products and know whether your business has earned profits, incurred losses, or has achieved the break-even point. The indirect costs such as sales and marketing expenses, shipping, legal costs, utilities, insurance, etc. are not included while determining COGS. Therefore, we can say that inventories and cost of goods sold form an important part of the basic financial statements of many companies.

Accounting Articles

Knowing your COGS is a must for anyone selling products, whether you manufacture products in-house or purchase them for resale. It’s impossible to know how much money you’re making on the goods and services you sell if you don’t calculate your cost of goods sold.

Value added tax is generally not treated as part of cost of goods sold if it may be used as an input credit or is otherwise recoverable from the taxing authority. The final cost of your goods sold will always depend on the inventory accounting method you’re using. This information can also alert you if you’re overspending on products or materials, and allows you to make proactive adjustments to increase your net profit. As an added bonus, your financial statements will accurately reflect the true cost of selling your products. If you purchase or make products to sell, and you don’t sell any products, you can’t deduct these costs. This is one reason major oil companies such as ExxonMobil are able to buy up assets of struggling and bankrupt competitors during energy gluts.

If COGS is not listed on the income statement, no deduction can be applied for those costs. Because COGS is a cost of doing business, it is recorded as a business expense on the income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate the company’s bottom line. While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher. The cost of goods sold for a business is essentially the amount of costs in a given period required to manufacture and sell the business’s goods.

Also known as cost of sales, knowing your cost of goods sold can help you price products correctly. If you sell products, it’s important to calculate your cost of goods sold. Are you tracking the numbers and data you need to compute your cost of goods sold? TradeGecko makes it easy to record your business expenses by integrating with best-in-class accounting software. For sole proprietors and single-member LLCs using Schedule C, cost of goods sold is calculated in Part III and included in the income section . The Cost of Goods Sold – also referred to as cost of sales or cost of services – is the total of all costs incurred in creating your product or services.

Then, in order to calculate COGS, the ending inventory is subtracted from the cost of goods available for sale so calculated. So, the cost of goods that are not yet sold but are ready for sale can be recorded as inventory in your balance sheet. However, as soon as such goods are sold, they become a part of the Cost of Goods Sold and appear as an expense in your company’s income statement.

- However, certain types of labor costs can be included in COGS, provided that they can be directly associated with specific sales.

- If COGS is not listed on the income statement, no deduction can be applied for those costs.

- After year end, Jane decides she can make more money by improving machines B and D.

- This information can also alert you if you’re overspending on products or materials, and allows you to make proactive adjustments to increase your net profit.

- Inventory is a particularly important component of COGS, and accounting rules permit several different approaches for how to include it in the calculation.

- This is because such service-oriented businesses do not have any Cost of Goods Sold .

As the name suggests, under the Periodic Inventory system, the quantity of inventory in hand is determined periodically. All inventories obtained during an accounting period are recorded as Purchases. In addition to the above mentioned costs, there might be other costs including marketing, traveling, administrative, and selling expenses. Since all these costs are indirect costs, these would not be considered while calculating COGS of Zoot for the year 2019.

Depending on the type of business, the cost of goods sold can be much easier or much more difficult to calculate. A retailer, for example, has a pretty clear understanding of what the goods and inventory are that are needed in the calculation. A different industry with more manufacturing requirements may require a more complicated calculation.