Content

If a company has receivables, it means the company provides credit as payment method to customers/clients for purchasing products/using services. Also, it is to avoid cash or direct payment for specific transactions, especially for frequent customers. In trading businesses, it applies to distributor/resellers who purchase product in regular basis. In service businesses, it is given to clients who subscribe for monthly services, like electricity, gym memberships and internet subscription. While AP is the debt a company owes to its suppliers or vendors, accounts receivable is the debt of the buyers to the company. Accounts Receivables are important assets to a firm, while Accounts Payable are liabilities that must be paid in the future by the company.

Use our research library below to get actionable, first-hand advice. News Learn how the latest news and information from around the world can impact you and your business.

Accounts Receivables Vs Accounts Payable

If you sell goods or services to your customers on credit, your business will always have an accounts receivable balance in your general ledger. Accounts receivable reflects the amount of money owed your business from the goods and services that you provided your customers on a credit basis. Accounts receivable is a current asset and represents money owed to you by your customers for goods and services sold to them on credit. Anytime you sell products or services to your customers on credit, it should be recorded in accounts receivable. Properly managing your accounts receivable balance is vital for any business, particularly small businesses with limited cash flow.

You can download other accounting templates like Cash Book, Petty Cash Book, and Purchase Return Book. The information technology department monitors the company’s enterprise resource planning system and any hardware and software the AP department is using. The IT team approves and installs new versions of software as needed. The CTO’s team considers any proposals from AP for new technology and determines how to integrate it with the company’s legacy systems. The AR Manager would require the credit analysts to identify credit-worthiness of the customer. Unlike paper invoices, electronic invoices are less expensive and convenient. As such, small firms mostly opt to use the mails to deliver the invoices.

Treasury Department’s Office of Foreign Control list of organizations that are banned from business in the United States. The Purchasing department places the order and transmits a copy of the purchase order to the AP department. The organization receives the goods or services—either through the Receiving department or the employee who ordered them—and the vendor sends the invoice to AP.

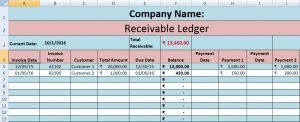

For some of us, the words “accounts receivable” and “accounts payable” conjure up images of a clerk with a giant calculator and a pencil behind the ear. However remote that image seems, we’ve all been on both sides of the transaction at some point in our lives. You can modify this account receivable spreadsheet to suit your needs. On top of the table you can see the total amount of the receivables for those periods. You can replace it with any dates if you want to measure account receivable for specific period. Some companies measure it by applying specific Key Performance Indicator to help them finding the problems and improve it.

Contents Of Accounts Receivable Template

Today, you might receive a bill via snail or electronic mail and pay the balance. Tomorrow, you might purchase something for friends or family – maybe a block of movie tickets, for example – and ask the movie-goers to reimburse you. For example, you can create chart to visualize all five KPIs above and add your own company’s KPIs. I do not want the Balance to change until the invoice has been paid. Invoice Date, Invoice number, Customer name, Total Amount of Bill, payment 1, and payment 2 and their respective date are details to be put while entering data.

The credit is to the allowance for bad debts account, which is a reserve account that appears in the balance sheet. Later, when a specific invoice is clearly identifiable as a bad debt, the accountant can eliminate the account receivable with a credit, and reduce the reserve with a debit. Most companies operate by allowing a portion of their sales to be on credit. Sometimes, businesses offer this credit to frequent or special customers that receive periodic invoices. The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service. When a company owes debts to its suppliers or other parties, these are accounts payable.

Accounts receivables can be considered as an investment made by the business that includes both risks and returns. Returns in the form of easily acquiring new customers and risk in the form of non-payments called bad debts. Many businesses use accounts receivable aging schedules to keep taps on the status and well-being of AR accounts. Accounts payable is similar to accounts receivable, but instead of money to be received, it’s money owed. Accounts receivable is a critical component in a company’s financial management practices.

In addition, accounts receivable is a permanent account and is not affected by closing entries. Accounts payable is a current liability that represents money you owe your vendors and suppliers. Whenever you receive a bill from a vendor or supplier, it should be recorded into accounts payable and paid by the specified due date. Advanced Administrative Services receives the following invoice for office supplies it purchased from Kay’s Office Supplies. Because Advanced Administrative Services is able to purchase items on credit, when this invoice is received, it’s recorded as an accounts payable item. The challenges faced in accounts receivable have easy solutions in the many billing systems available online. Furthermore, when invoices are outstanding for longer periods, they refer to accounts receivable aging.

Invoices that have been past due for longer periods of time are given a higher percentage due to increasing default risk and decreasing collectibility. The sum of the products from each outstanding date range provides an estimate regarding the amount of uncollectible receivables. Read our review of this popular small business accounting application to see why. If Johnson Fabrics don’t pay by then, Shannon’s Pens will need to follow up and possibly start the collection process, with an option to also add a late fee to the past-due balance. Get clear, concise answers to common business and software questions. Has there ever been a circumstance where you didn’t pay a bill on time? Maybe you incurred a late fee, or if the bill was late enough you might start receiving calls from a collection agency.

If this is a notification of an invoice sent by a department independently, please select “Notification of Invoice Sent.” Tack on late fees for customers who don’t pay within the required timeframe. Experiment with these types of options to see what works best for your customer base. Some may be responsive to shorter payment terms without a discount, while others may only be incentivized by late fees.

Accounts Payable Vs Accounts Receivable: Learn The Differences

Remember, because accounts receivable is an asset account, we’ll need to debit it. Once the invoice has been paid, you’ll then debit your cash account while crediting accounts receivable, which has decreased. Recording accounts payable will increase your accounts payable liabilities by the amount of the invoice or expense. When it’s time to pay the bill, you would debit accounts payable and credit your cash account to indicate that the bill has been paid, thus reducing your liability account.

Companies will use the information on an accounts receivable aging report to create collection letters to send to customers with overdue balances. Accounts receivable aging reports mailed to customers along with the month-end statement or collection letter provides a detailed account of outstanding items. Therefore, an accounts receivable aging report may be utilized by internal as well as external individuals.

The aged receivables report, or table, depicting accounts receivable aging provides details of specific receivables based on age. The specific receivables are aggregated at the bottom of the table to display the total receivables of a company, based on the number of days the invoice is past due. The typical column headers include 30-day windows of time, and the rows represent the receivables of each customer. Any time you sell goods or services to your customers, you’re increasing your accounts receivable balance. Accounts receivable represents the money owed to you by your customers who have been extended credit terms. This report is used to derive the allowance for bad debts, and is also a key tool of the collections department, which uses it to determine which invoices are sufficiently overdue to require follow-up action. Accounts receivable is an asset, as it both represents the amount owed by the customer to a business, and is convertible to cash at a future time.

Businesses will always face some level of difficulty in getting paid and paying their own suppliers. Ask your suppliers for automated payments, or set one up with your online banking account or other payment source. Automated payments benefit both the customer and the business – the business gets paid on time, and the customer doesn’t have to remember to manually pay a bill. Some companies even outsource the task of managing accounts receivable and accounts payable, to take the element of worry out and focus solely on their work and customers. Many businesses’ biggest asset is time, and spending as much of their time on customers as possible. Hours wasted managing the invoicing and payment processes and repeated follow-ups with customers to obtain payment both take away valuable time to could be spent on customer needs.

Alternatives Looking for a different set of features or lower price point? Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process. There is some setup required when first implementing an online billing system, but it takes on the burden of work over the long haul and helps businesses scale.

- Accounts receivables arise when the business provides goods and services on a credit to the clients.

- When using a cash basis of accounting model, you record the transaction directly into your company’s accounting record’s systems once payment is accepted.

- Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs.

- If a company experiences difficulty collecting accounts, as evidenced by the accounts receivable aging report, specific customers may be extended business on a cash-only basis.

- The IT team approves and installs new versions of software as needed.

The AR Officer also oversees a team of clerks, analysts, and accountants in addition to debt collectors. The customer is then given the chance to choose whether they want to receive electronic or physical invoices. The first step is for the company to develop a credit application process. However, using economies of scale, the process may differ for large and small firms. Large firms have a larger cash inflow, so they typically invest in highly skilled credit management teams and IT systems to help improve and manage the process efficiently. E.g. The Indian Auto Parts Ltd sold some truck parts to Mr. Unreal on credit. Since IAP has already incurred various expenses called the cost of goods sold for the sales he has made but not been paid.

This Account Receivable template below is an Excel spreadsheet to help you managing your invoices and respective receivables. For the Due date, you can set a function that automatically calculates several days for you and show the exact date of payment. Use A/R to enter only those invoices, debit memos, and credit memos that do not result from the sale or return of inventory items. Just like in Accounts Payable, manual processes in the Accounts Receivable departments create major inefficiencies and excessive overhead, wreaking havoc on a company’s cashflow. A typical day for an AR Officer would involve activities such as verification of credits data, classifying the debts, and making journal entries for the transactions.