In this instance, one asset account (cash) is increased by $200, while another asset account (accounts receivable) is reduced by $200. The net result is that both the increase and the decrease only affect one side of the accounting equation. The ledger is a book in which all accounts relating to a business enterprise are kept. In other words, it is the collection of all accounts of a business enterprise. The following rules are applied to record these increases and decreases in individual ledger accounts. All entries recorded in the general journal must be transferred to ledger accounts.

Recording Transactions in Ledger Accounts

But since bookkeeping by hand takes 1,000 times longer, most business owners and bookkeepers use accounting software to build their general ledgers. By no means are these the only accounts that will show up in the ledger. As a business has an expansive list of accounts, you will need to make as many as required to track all types of transactions.

- An accounting journal is filled with individual entries that record the transactions of a business’s accounts.

- Also commonly referred to as a general ledger, it is the repository of all of your financial transactions.

- For instance, the ledger folder could have a cash notebook, accounts receivable notebook, and notes receivable notebooks in it.

- In the double-entry bookkeeping method, financial transactions are initially recorded in the journal.

- According to CPA Practice Advisor, only 18% of small- to medium-sized businesses do not use accounting software.

Is a General Ledger Part of the Double-Entry Bookkeeping Method?

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. With the help of ledgers, users can gain a better idea of what is going on inside their company so they may make more informed decisions and effectively manage their finances. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. A bank statement is essentially a record of all the activity within an individual account, showing the date of each transaction. For example, when furniture is bought on credit for $4,000 from Fine Furniture Co., we will need to make an entry of $4,000 on the debit side of the furniture account (i.e., because this asset is increasing).

Create your own general ledger with a template

When a business owner notices a sudden rise in expenses, they can investigate the general ledger to determine the cause of the increase. If there are accounting errors, an accountant can dig into the general ledger and fix them with an adjusting entry. A general ledger account that holds all subsidiary ledger accounts is known as a control account.

What Is Posting?

Such information is used internally and externally to measure the success of a business and ensure that all dealings meet governing body regulations. An accounting ledger is part of the bookkeeping system where a business records all its financial transactions. A business will create separate categories for such transactions- these are known as accounts. All accounts of a company will be listed and contained within the general ledger, or principal book of accounts. This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis.

How can I set up a general ledger in QuickBooks?

If he draws any money or goods from the business, this will reduce his capital, meaning that an entry should be made on the debit side of his capital account. Transactions result in an increase or decrease in the value of various individual balance sheet items. Also known as the general ledger, the ledger is a book in which all accounts relating to a business enterprise are kept. Now, any business with a full-time bookkeeper is likely to use computerized accounting. A sales ledger is a detailed list in chronological order of all sales made.

A ledger provides users with the ability to keep track of their financial transactions. It is divided into several different accounts that show what assets are, liabilities and equity, revenues/income, and expenses/costs. Preparing a ledger is vital because it serves as a master document for all your financial transactions. Since it reports revenue and expenses in real-time, it can help you stay on top of your spending.

This information can help management make financial and data-based decisions. For example, a bookkeeper or accountant could use an accounting ledger, or general ledger, to identify the source of increased expenses and make the necessary corrections. Users can prepare an accounting ledger by first gathering all their financial transaction details from journals and then drawing the same details into separate columns on the ledgers. To gather journal information, users must understand debits and credits. Once they have done so, it will be much easier for them to post transactions correctly onto ledgers. In the double-entry system, each financial transaction affects at least 2 different ledger accounts.

Trial balances are a financial tool specific to double-entry bookkeeping. If you choose to set up a double-entry ledger, you should be ready to prepare trial balances regularly. The general ledger is where you can see every journal entry ever made. Subsidiary ledgers include selective accounts unlike the all-encompassing general ledger.

For instance, cash activity is usually recorded in the cash receipts journal. The account details can then be posted to the cash subsidiary ledger for management to analyze before it gets posted to the general ledger for reporting purposes. An entry will also be made for an equal amount on the credit side of the cash in hand account because this asset is decreased in so far as the business is concerned. Banks and other financial institutions are examples of business organizations that use self-balancing ledger accounts.

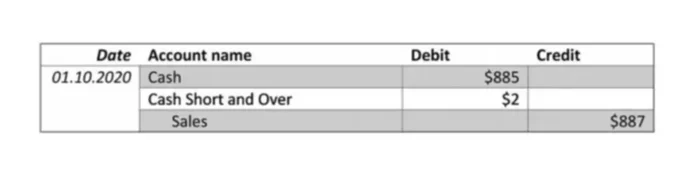

In the case of certain types of accounting errors, it becomes necessary to go back to the general ledger and dig into the detail of each recorded transaction to locate the issue. At times this can involve reviewing dozens of journal entries, but it is imperative to maintain reliably error-free and credible company financial statements. Companies can maintain ledgers for all types of balance sheet and income statement accounts, including accounts receivable, accounts payable, sales, and payroll. Transactions from subsidiary ledgers are periodically summarized and transferred to the general ledger, which contains transaction data for all accounts in the chart of accounts. To correctly record an increase or decrease to an account within your business, you will need to use a debit and credit for the double-entry bookkeeping method. This is a principal method of accounting in which transactions are recorded in at least two journal entries- a debit to an account and a corresponding credit to an account.

For example, the amount of capital that Mr. John has on the first day of the accounting period (see the previous example) will be shown on the credit side of Mr. John’s capital account. For example, the amount payable to United Traders on the first day of the accounting period is recorded on the credit side of the United Traders Account. This is why this type of account is also called the periodical balance format of a ledger account.

Ledgers also provide the ability to prepare reports such as balance sheets and cash flow statements which can be used by business owners, managers, and employees for decision-making purposes. Journal entries are recorded in chronological order, making it easy to identify the transactions for a given business day, week, or another billing period. By contrast, entries in a ledger might group like transactions into specific accounts to assess the data for internal financial and accounting purposes. As a document, the trial balance exists outside of your general ledger—but it is not a stand-alone financial report. Think of your general ledger as growing the wheat before you make the bread that is your financial statements.

Each entry is recorded in two columns, with debit postings on the left and credit entries on the right of the ledger. The company’s bookkeeper records transactions throughout the year by posting debits and credits to these accounts. The transactions result from normal business activities such as billing customers or purchasing inventory. They can also result from journal entries, such as recording depreciation. Every accounting period, these entries and account listings are compiled into the essential financial statements of a business, including the balance sheet and income statement. It is these documents that reflect the overall financial position of a company.