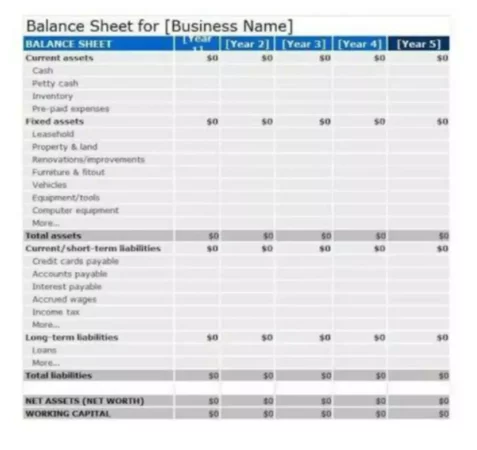

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Short-term, or current liabilities, are liabilities that are due within one year or less. They can include payroll expenses, rent, and accounts payable (AP), money owed by a company to its customers.

Short-term liabilities

The non-housing factor includes everything else, from auto loans, student loans, and credit card payments to child support and alimony. A larger amount of total liabilities is not in-and-of-itself a financial indicator of poor economic quality of an entity. Based on prevailing interest rates available to the company, it may be most favorable for the business to acquire debt assets by incurring liabilities. Divide the total debt obligation of $4,225 by income of $11,000 (in the percentage formula below) to get a TDS ratio of 38.4%, which is not much higher than the low benchmark (36%) and well below the max (43%). Lenders prefer borrowers with total debt service (TDS) ratios of 36% or less; borrowers with TDS ratios that exceed 43% are rarely approved for mortgages. Less liquidity is required to pay for long-term liabilities as these obligations are due over a longer timeframe.

Advantages of Total Liabilities

Many lenders prefer a ratio of 36% or less for loan approval; most do not give mortgages to borrowers with TDS ratios that exceed 43%. TDS and GDS are similar ratios, but the difference is that GDS does not factor any non-housing payments—such as credit card debts or car loans—into the equation. However, when used with other figures, total liabilities can be a useful metric for analyzing a company’s operations.

What Is the Difference Between TDS (Total Debt Service) and GDS (Gross Debt Service)?

The total debt service (TDS) ratio—total debt obligation divided by gross income—is a financial metric that lenders use to determine whether or not to extend credit, primarily in the mortgage industry. To calculate the percentage of a prospective borrower’s gross income already committed to debt obligations, lenders consider all required payments for both housing and non-housing bills. The total debt service (TDS) ratio is very similar to another debt-to-income ratio used by lenders—the gross debt service (GDS) ratio. The difference between TDS and GDS is that GDS does not factor any non-housing payments—such as credit card debts or car loans—into the equation.

Used to evaluate a company’s financial leverage, this ratio reflects the ability of shareholder equity to cover all outstanding debts in the event of a business downturn. A similar ratio called debt-to-assets compares total liabilities to total assets to show how assets are financed. Remember, there are several other factors in addition to the total debt service (TDS) and gross debt service (TDS) ratios that lenders take into consideration when determining whether to advance credit to certain borrowers. Long-term liabilities, or noncurrent liabilities, are debts and other non-debt financial obligations with a maturity beyond one year. Liabilities consist of many items ranging from monthly lease payments, to utility bills, bonds issued to investors and corporate credit card debt. The housing factor in the TDS calculation includes everything paid for the home, from mortgage payment, real estate taxes, and homeowners insurance to association dues and utilities.

- Investors can discover what a company’s other liabilities are by checking out the footnotes in its financial statements.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- The total debt service (TDS) ratio—total debt obligation divided by gross income—is a financial metric that lenders use to determine whether or not to extend credit, primarily in the mortgage industry.

- Everything the company owns is classified as an asset and all amounts the company owes for future obligations are recorded as liabilities.

They are settled over time through the transfer of economic benefits, including money, goods, or services. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

Total liabilities are the combined debts and obligations that an individual or company owes to outside parties. Everything the company owns is classified as an asset and all amounts the company owes for future obligations are recorded as liabilities. All lenders will compare your TDS to their benchmark TDS range—usually from 36% to no more than 43%—before they decide whether you can manage an additional monthly payment on top of all other bills.

For instance, a small lender—one with less than $2 billion in assets and 500 or fewer mortgages in the past 12 months—may offer a qualified mortgage to a borrower with a TDS ratio exceeding 43%. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning. Investors can discover what a company’s other liabilities are by checking out the footnotes in its financial statements.

When something in financial statements is referred to as “other” it typically means that it is unusual, does not fit into major categories and is considered to be relatively minor. In the case of liabilities, the “other” tag can refer to things like intercompany borrowings and sales taxes. Future pay-outs on things such as pending lawsuits and product warranties must be listed as liabilities, too, if the contingency is likely and the amount can be reasonably estimated. Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

Investors and analysts generally expect them to be settled with assets derived from future earnings or financing transactions. Borrowers with higher TDS ratios are more likely to struggle to meet their debt obligations than borrowers with lower ratios. However, the total liabilities of a business have a direct relationship with the creditworthiness of an entity.

In general, if a company has relatively low total liabilities, it may gain favorable interest rates on any new debt it undertakes from lenders, as lower total liabilities lessen the chance of default risk. Larger lenders may also be more likely to approve mortgages for borrowers with large savings accounts, especially if they can make larger down payments. Lenders may also consider granting additional credit to borrowers with whom they have long-standing relationships. People with high credit scores tend to manage their debts more responsibly; they hold a reasonable amount of debt, make payments on time, and keep account balances low.

In isolation, total liabilities serve little purpose, other than to potentially compare how a company’s obligations stack up against a competitor operating in the same sector. Because payment is due within a year, investors and analysts are keen to ascertain that a company has enough cash on its books to cover its short-term liabilities. Liabilities can be described as an obligation between one party and another that has not yet been completed or paid for.