Content

Strategic planning for growth-oriented small business owners can truly drive the essential changes you are most likely to benefit from for the future of your business. Having this kind of efficiency will allow you to think about your business in new ways and likely uncover new possibilities for what’s next. A successful CFO should also prepare presentations of the company’s financial information, allowing potential investors or lenders to understand the data and the companies performance.

Before joining Macromedia, Nelson spent eight years at Hewlett Packard, where she held a variety of positions in both finance and corporate development. She was involved in numerous acquisitions, equity investments, divestitures and joint ventures both domestically and internationally. Before that, she was a consultant with Robert Nathan Associates, an international economic consulting firm based in Washington, D.C. But since CFOs are made, not born, how can you increase your likelihood of becoming one—and thus being the right hand of the CEO? In addition to having excellent “soft” or “people” skills, you need extensive technical knowledge. In today’s business environment, however, the experts say there’s so much overlap between hard and soft skills it’s sometimes difficult to distinguish between them.

For example, if to make $1 you spend $0.50 in variable costs and $0.30 in fixed costs, you’d be left with $0.20, which equates to a 20% rate of return. Work with your CFO to identify priorities for your business and its rate of return. Allow your CFO to conduct an in-depth and holistic analysis of your business.

We often see that the role of a controller changes by industry. If the owner doesn’t have time or can’t monitor the team’s peformance, the best solution is often a CFO. To simplify the major difference, a CFO will often be involved in fundraising and finance strategy, whereas a controller’s responsibilities usually stop at ensuring accurate reporting.

Vp Of Finance

A chief financial officer is the senior executive responsible for managing the financial actions of a company. The CFO’s duties include tracking cash flow and financial planning as well as analyzing the company’s financial strengths and weaknesses and proposing corrective actions.

If you don’t already partner with a trusted provider for outsourced accounting and bookkeeping services, put extra care into your hiring process. Look for contracted CFOs with experience in your niche, and ideally, who have helped companies around the same size as yours. The primary benefit of hiring fractional CFOs vs. full-time CFOs is the price. It’s great when businesses have the means to hire c-suite executives full-time, but many of us don’t have that luxury. While the specific insights they provide will depend on your company’s goals, the benefits remain the same. You can hand-off these high-level financial functions to CFOs who can draw upon their own experiences to solve problems in your company.

The CFO should be using the data from the KPIs to assess business performance in real-time. Making changes that directly improve KPIs can help build the future value of the company. Cash flow problems can kill businesses that might otherwise survive. Your CFO should be monitoring cash flow and analyzing cash flow projections regularly to ensure your business does not run out of cash. The CFO role within an organization depends on several factors. These components may include the expectations coming from the CEO and board of directors, and may also vary depending on the industry, corporate strategy, and the goals of the business. A company’s size can also have a significant influence over the CFO’s role.

For example, project-based businesses like general contractors might have a controller support the purchasing process to keep expenses in line and establish reporting to enable job/project profitability monitoring. the average cash compensation for a CFO in a private company with less than $20MM in annual revenue is $194,354. CFOs for private companies with $21-$99MM in annual revenue make an average of $237,983 in base salary. (Private company CFOs make 45% less than those at public companies.) Tack on benefits and bonus and you can expect to pay $225,000 to $275,000 depending on business size. contract CFO services, but some $500K businesses benefit as well. The common factor for those $500K companies is that they’re hungry to get and use financial insights. At $1MM, the controller is likely doing some of the harder transactions for a bookkeeper (playing “down” in the role), serving as a sounding board for the bookkeeper, and overseeing basic reporting and processes.

Go through your clients and book time for them to come in and talk about their business. Don’t mention anything in this meeting about playing the CFO role for their business, and don’t try to sell them anything. Most of us understand there’s an opportunity to deliver more accounting services to our clients. But we’re often so under water with day-to-day work that we don’t have the time to move to a new paradigm and take on a CFO role.

Match Financial Help To Business Size

All of these responsibilities should be considered ongoing processes that are revisited on a regular pre-determined schedule and modified based on the most recent financial information available. Your CFO should maintain consistent communication with tax preparers to minimize your company’s potential tax liability. You don’t really understand accounting but trust the software to tell you everything you need to know. As CEO, you are constantly making decisions about your business, including some that have significant bearing on its success. When it comes to those big decisions, Small Business CFO can help you anticipate the long-term result of your options.

Select to receive all alerts or just ones for the topic that interest you most. She suggests that not being able to see the big picture is “the single biggest thing” that holds CFO candidates back. “I’ve seen really good people get overlooked because they were put in a box,” she explains. For example, Scott says that heading up the internal audit and tax departments can be dead-end jobs because they are perceived as being too narrowly focused. A job interview is a way to put together a consulting proposal for a long-term, expensive project. Minimum requirements for a public company include a review of the company’s 10Ks and those of its key competitors. For a private company, review the Dun & Bradstreet Credit Reports for the company and its key competitors.

Help them troubleshoot issues and modify goals as they go along. Say, for example, they have a financial goal to get to 20% net profit, month on month.

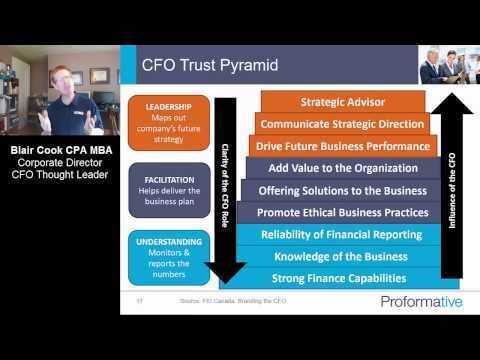

The CFO role has emerged from focusing on compliance and quality control to business planning and process changes, and they are a strategic partner to the CEO. The CFO may assist the CEO with forecasting, cost-benefit analysis, and obtaining funding for various initiatives. In the financial industry, a CFO is the highest-ranking position, and in other industries, it is usually the third-highest position in a company. A CFO can become a CEO, chief operating officer, or president of a company. Often, a CFO is the third-highest position in a company, playing a vital role in the company’s strategic initiatives. Chief financial officers are responsible for forecasting and the strategic financial direction of the company.

Ccb Data & Analytics Cfo Team

As a third party, I’m making them look at their business in black and white. Helping clients improve their cash flow situation will relieve a lot of anxiety and vastly improve their outlook. Use it as a first step to a bigger, wider-ranging advisory role. Business owners are starting to look for sophisticated advice.

Many of these professionals manage their duties with help from a clerk, bookkeeper or administrative assistant. Most businesses save money by hiring professional financial staff to manage their daily business operations. However, depending on the size of your business, your industry, and other factors, you might just need a part-time bookkeeper or require a full financial staff that includes a controller and CFO. Deciding what financial staff your business really needs is a complex decision that depends on many factors. Your needs will almost certainly change over time, and if your business grows successfully, you might cycle through all these positions. We provide critical financial services to small businesses and non-profit organizations in the areas of profitability analysis, cash flow management, financial systems, and management accounting.

- A fractional CFO will be able to compare your processes, accounting software systems, and bookkeeping productivity against similar businesses with which they’ve worked.

- They should act as the company’s compass, and the CFO serves as the navigator.

- It is a main responsibility of a CFO to identify profitable areas the business should focus on, and which areas the company should wind down.

- Traditionally we might check the figures to see if the business can afford a new hire – but the issue is probably deeper than that.

- Many small and medium-sized business owners don’t have the skills to deal with cash flow issues in an organized manner.

The chief financial officer of a company is the top-level financial controller, handling everything relating to cash flow and financial planning. By $10MM, the controller is more involved with managing internal controls, closing processes and report generation, as these tasks are more intensive and time-consuming than in smaller companies. At this size, there are many more moving parts in the accounting function, so the role is that of a classic controller. In addition to preparing reports, the controller’s responsibilities may also include compliance audits, monitoring internal controls, participating in the budgeting process and analyzing financial data to varying degrees. At some companies, financial controllers are involved in evaluating and selecting technology for use within the finance department or other related departments within the organization. As a small company, the CFO also completes a portion of the accounting and finance activities and creates the financial statements and reports. The bigger your business grows, the more likely you will need more than just a bookkeeper.

Chief Financial Officer

If you are asking those questions, give yourself a pat on the back. Want to gain full control over your firm’s finances but aren’t sure where to start? With consistent effort and focus, we helped this client reach a goal that was a defining moment for him personally and professionally. And it’s the sort of fulfillment you get from filling a virtual CFO role. “Now I can prove this business amounts to more than talk,” he said. The constant feedback on business performance will help keep them focused, but it won’t work without your involvement. Check in with them regularly to discuss what the dashboard’s saying.

In fact, FEI’s Albergo says, many an accountant who hopes to become a CFO has returned to school to pursue an MBA. CFOs NEED CORPORATE EXPERIENCE in either the controller or treasury functions. It’s critical to keep up with continuing professional education, especially in today’s regulatory environment. EXECUTIVE SUMMARY TO INCREASE THE LIKELIHOOD OF BECOMING A CFO, you need a broad range of skills beyond knowing the ABCs of accounting. You must be a business strategist, think like someone on the board of directors and be familiar with technology. It is important to understand the Controller function because every business needs to ensure that these tasks are achieved. Put another way, whether or not you hire or have a Controller, you need to act like you do, ensuring that your accounting operations are, indeed, in control.

When your CFO knows they won’t be penalized for being a straight shooter, you’ll establish a foundation of transparency, trust, excellence and respect. This column offers CFOs and their teams insights and ideas related to challenges of the position, in light of market demands and global economic conditions. Jeff Thomson, CMA, is president and CEO of IMA , one of the largest and most respected associations focused exclusively on advancing the management accounting profession. One final indicator is when a business is preparing for a merger or acquisition. In this situation, the CFO must be able to choose the correct team to evaluate a target acquisition.

The above functions can be thriving in your business for much less expense. Your initial instinct is that a CFO at a $200,000 per year salary isn’t relevant for your small business. As you can see, maximizing the relationships with your CFO is crucial for your success. Stay tuned for the second part of this two-part series on effectively working with the CFO of your small business.

Companies continue to increase profits leading to a demand for CFOs. The U.S. Bureau of Labor Statistics predicts the job outlook for financial managers to grow 7% between 2014 and 2024. In the financial industry, a CFO is the highest-ranking financial position within a company. The key to understanding how a growing business or struggling business can afford this type of help is in understanding the accounting alternatives that a business has.

And it’s always a good idea to speak with current and former employees of your potential employer. Preparing for the First Step Here are some suggestions for the job candidate going off to the first round interview for a CFO position.

Bookkeeper, Controller Or Cfo?

That’s where you can begin to take on a virtual CFO role for them. Small and medium-sized businesses, and high-growth businesses, now feel the need to have a sounding board – someone they can reach out to before a big business decision is taken. Accountants and legal advisors are becoming that sounding board. The trend towards using consultants puts you in a unique situation to partner with clients to grow their businesses, and yours. Small Business CFO offers a level of financial and accounting expertise that is unsurpassed by anyone handling large corporations, yet at a much more affordable rate. Small Business CFO insightfully examines everything from existing accounting systems, to current balance sheets and P&L’s, to improve your business’ bottom-line.

Our highly experienced accountants can act as your entire accounting department . CFO. The CFO duties are as varied as the companies that hire them, but in general include all forward-looking tasks from planning strategy to modeling mergers.