Content

To make changes to voluntary deductions, the employee must contact the office responsible for that deduction . If a deduction does not appear on an employee’s pay statement after sufficient time for processing, the employee should contact the office responsible for that deduction. Employers can use this form to collect payroll deduction information from employees. If the employee has specifically authorized the deduction plan. For example, the employee may agree to contributions to a “flower fund” to pay for flowers for funerals, or for United Way or other charities. Employees must also agree to pay deductions for benefit contributions. Need information about the payroll deductions you see on every paycheck?

- Examples are group life insurance, healthcare and/or other benefit deductions, Credit Union deductions, etc.

- Federal income tax is applicable to salaries, cash gifts from employers, tips, gambling income, bonuses, and unemployment benefits, and is deducted from all U.S. workers’ wages .

- Your business accounting firm is also another expert in matters relating to payroll taxes and deductions.

- Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax.

- Employers don’t have any fiduciary liability because it’s not an employer-sponsored retirement plan.

The money an employee contributes now will benefit them when they retire. There are many different small business retirement options like an IRA or a 401.

Other employee-requested deductions, such as to the United Way, U.S. savings bonds, or union dues, should also have a signed agreement in the employee’s file. Another common voluntary payroll deduction is for additional employer-sponsored life insurance.

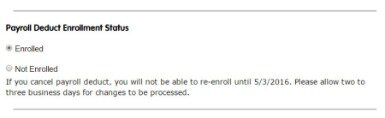

Set Up A Payroll Deduction Ira Plan

The Disability Insurance Trust Fund is one of two Social Security Trusts which pays benefits to individuals incapable of gainful employment. Medicare is a U.S. government program providing healthcare insurance to individuals 65 and older or those under 65 who meet eligibility requirements. Benefits of participation, contributions, effects of withdrawing money from the IRA. 1Amount subject to withholding is governed by the federal Consumer Credit Protection Act. There may be additional restrictions at the state level on withholding income to cover uniforms, cash register shortages and job-related expenses. Deduct 0.9% for Additional Medicare tax if year-to-date income has reached $200,000 or more.

Objective-focused – With objectives like growth, income and preservation, these funds of funds offer diversification and control in a single investment. Traditional IRA— Distributions are taxable, but can be taken without penalty after age 59½. Don’t think about firing employees because they filed a complaint. Federal and state laws protect employees against wrongful termination. These contributions are assessed as a percentage of your income. Social security is 6.2 percent of earnings, and Medicare is 1.45 percent.

To find out how much you need to withhold from an employee’s paycheck for state and local taxes, check with your state. If you are a new employer, consult our state-by-state list of payroll information for employers. By law, employers are required to withhold payroll taxes from employee wages and submit them to tax agencies. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time.

If your employees are unionized, they’ll likely have to pay for their membership and any taxable benefits offered through the union. Other types of job expenses that can be deducted from payroll include uniforms, meals and travel. Some states, however, may prohibit these kinds of deductions. Employers offer many different retirement saving options, but two of the most popular are 401 and Roth Individual Retirement Accounts .

Pledging Through Payroll Deduction

The employer is required by law to withhold payroll taxes from an employee’s gross pay prior to issuing a paycheck to comply with government regulations. Employers who fail to follow the law on mandatory deductions are open to lawsuits, fines, and even, going out of business. Some payroll deduction plans may also involve the voluntary, systematic payroll deductions to purchase shares of common stock. No matter how many hours an employee has worked, payroll deductions must be withheld from payroll checks. In the event that no deductions are withheld, the employer becomes liable and responsible for any mandated amounts that were supposed to be withheld. When an employee’s insurance deductions are not withheld, the employer becomes liable to pay the deductions or to cancel the employee’s insurance policy.

A carefully monitored retirement glide path means no more manual reallocation for you. Employers don’t have any fiduciary liability because it’s not an employer-sponsored retirement plan. Roth IRA— Distributions up to the amount contributed can be made at any time without taxes and penalty. Employees determine how much of their paychecks they want to contribute to their IRAs. The 2019 contribution limit for IRAs is $6,000, or $7,000 for investors age 50 or older.

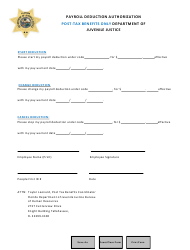

Payroll Deduction Plan

For all states where the employee works which have income tax, the employee must also complete a withholding form. The withholding form allows the employer to take withholding from employee pay.

Employers are required to take this money out after tax and send it directly to the garnishor. These amounts are taken out only after the employee has paid tax on their income. To deduct health, dental or vision insurance before tax, ensure your insurance plan is considered a pre-tax benefit. Health Savings Account, Flexible Spending Accounts and Dependent care contributions are all made before tax as well.

Say goodbye to filing cabinets, and say hello to secure, centralized, and organized employee data. Learn about the employer’s role in a Payroll Deduction IRA program. Today’s digital landscape means limitless possibilities, and also complex security risks and threats. At ADP, security is integral to our products, our business processes and our infrastructure. Learn more about the senior executives who are leading ADP’s business. At ADP, we are committed to unlocking potential — not only in our clients and their businesses, but in our people, our communities and society as a whole. Take your organization to the next level with tools and resources that help you work smarter, regardless of your business’s size and goals.

Employees are responsible for setting up a traditional or Roth IRA and must meet IRA eligibility requirements. Employers need to know that employees have the right to contact the state employment department or state labor board if their pay is cut without consent . As an employer, you don’t want the state labor department coming into your business in response to employee complaints. They will do a complete audit and may find other employment law violations. They also may decide to contact federal agencies if they find federal violations. Employment taxes required to be paid by employers, such as federal unemployment tax or state unemployment tax. If you’re working out the deductions manually, then set a decent amount of time aside for the job.

Common examples include Roth IRA retirement plans, disability insurance, union dues, donations to charity and wage garnishments. Employees can decline to participate in all post-tax deductions but wage garnishments. Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax. Every employee must complete Form W-4 at hire specifying the amount of withholding for federal taxes.

The amount of withholding is based on the number of exemptions that the employee has claimed on tax forms W-4 and NC-4 and the current year’s federal and state tax tables. This fixed federal or state tax deduction may be for any amount and may be discontinued at any time by processing a change using the Duke@Work module. Payroll deductions are amounts taken out of an employee’s paycheck each pay period. An employee’s gross pay is different than their net pay, or take home pay, because of the deductions subtracted. Examples of payroll deductions include federal, state, and local taxes, health insurance premiums, and job-related expenses. Many Americans who have health insurance purchase it through their employers via payroll deductions. This offers considerable cost savings because the premiums can be withheld from their wages on a pre-tax basis under a Section 125 plan.