Content

Xero GST Cashbook is for clients who don’t need invoicing but do need GST reporting. Get daily bank feeds of client bank transactions and generate GST returns in addition to all the features of Xero Ledger. You can let clients code their transactions and view their data and reports. Xero Non-GST Cashbook is for clients who don’t need invoicing or GST reporting. Get daily bank feeds of client bank transactions in addition to all the features of Xero Ledger.

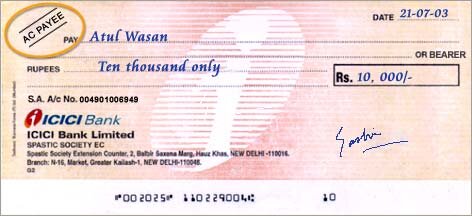

And do spend money transactions, or pay supplier bills, to account for how the cash was spent. Hi Narelle, if you’ve been made payment on an invoice/bill to this cash/cheque clearing account, once deposited the statement line will flow into your bank account in Xero.

You then need to do a journal Debit equipment purchases and Credit the liability account. You may need to consider interest on the loan – not sure how your tax laws work, would be worth discussing with your accountant. If you deposited cash then you would simply allocate the deposit to account 835. When you repay yourself, in part or in full, record the payment as a transfer from the main current account to this directors loan. As per my accountants instructions I recorded a directors loan by creating a “payment” to the “Directors Loan Account ” from my bank account. Building a cash reserve puts you in a position of strength.

As receivables age, their quality goes down, so you should act sooner rather than later. Your cash flow is only as good as your accounting and reporting.

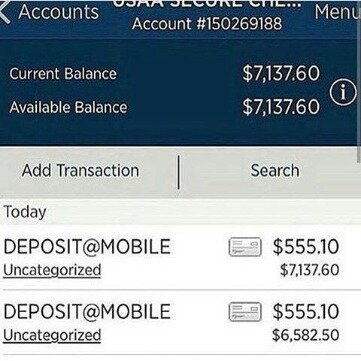

Import Bank Transactions

Nor, If I “spend Money” there is no “To” that is The Director Loan account. All that appears to have been setup in the Import is a “Current Liability” account of Director Loan. For example, you may have the opportunity to pick up inventory at a deep discount, or take on a large order or new client.

The first question is, are you going to reimburse yourself for those costs through a payment from the bank account? If so then you can simply reconcile this transfer to claim the costs. on starting my company I opened a bank account and a credit card, transferred $50,000 personal funds into my business transaction bank account.

I know the future will be no cash, but here in South Africa we are a bit slower. Most customers pay via Electronic Transfer from banks online and other regulars pay cash on collection.

Small businesses, accountants and bookkeepers locally and across the world trust Xero with their numbers. Keep your practice a step ahead with Xero accounting software. Explore features and tools built for small businesses, accountants and bookkeepers.

Enter And Submit Expense Claims In Xero

Resolving this can be a problem, particularly when farming breeds of animal that reproduce all year round or outside the usual seasons. Usually the simplest solution is to go with the government’s definition of significant dates and livestock ages when doing your accounts. It may not be always be factually correct, but it’ll save you going through more complex calculations in the future.

You can’t reduce profit without increasing a liability or decreasing an asset . If you are treating it as wages then you either pay it to him or credit his loan account . Hi, I would like to know the journal to pay wages to director from his loan account . I am a small business owner with limited accounting experience. The directors loan will now show with an “overdrawn” balance – that means the company owes you the money – same as for a normal overdraft where you owe the bank the money. Find the invoice in Accounts payable and pay the invoice from this directors loan.

I have also just started a new business and started using xero. When I started the cash was in a CURRENT ASSET account – and i now see my mistake.

For Accountants And Bookkeepers

Enter an accounts payable invoice into Xero and then pay the invoice via the “Owners Funds Introduced” code. Make sure you go into the account code and “enable payments to the account” first. And yes, the payment to the credit card from your bank account to the credit card would be a “transfer”. For supplier invoices that you need to track more formally via Bills, enter as per normal, and then select the directors loan or drawings account as the method of payment. Xero Ledger is for clients who need annual accounts preparation but not GST reporting. It includes bank reconciliation, budgeting tools, fixed asset management, financial statements, and document storage in the Xero file library.

I’ve just set up the business and the bank accounts aren’t ready yet. I’ve received some money into my personal bank account. Firstly you should not have set up a directors loan account as a non-current asset. Shout if you need further help – because your accounts are distorted if you accounting this incorrectly. When you withdraw money from your business if correctly recorded as a current liability you would recode it to that account. Seeking advice on how to treat an invoice when it has been paid in cash and the cash has not been paid into the business bank account but spent on non-business purchases. Example, I create a receive bank rule “ABC” that points to sales accounts.

Also in today’s release we’re extending the ability to import data so you can now bring in transactions using CSV format. The easiest way to manage your petty cash is to set up a “bank account” in Xero. It is mandatory to procure user consent prior to running these cookies on your website.

- Usually the simplest solution is to go with the government’s definition of significant dates and livestock ages when doing your accounts.

- Some governments may pay farmers to return farmed land to its ‘native’ state by planting indigenous species and letting them grow wild.

- Then you can see the financial state of your business at a glance.

- You can use a common reference to relate the trasnactions to one another.

- It is mandatory to procure user consent prior to running these cookies on your website.

A useful quick guide to how your farm’s performing right now, but no help in predicting future cash flow or profits. Keep track of what you buy and account for its depreciation each year. These pay farmers to change land use to forestry, as a way of ‘locking up’ carbon in new tree growth. Some governments may pay farmers to return farmed land to its ‘native’ state by planting indigenous species and letting them grow wild. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. Finally, if you work with one, ask your accountant to check your set up.

There is physically no money in these accounts, as its more of a tracking account than a transactional account. In Xero, these are usually set as Liability Accounts , and will have the “enable pay to/from” check box ticked. They can be set up as a bank account, but there is no real necessity for this to occur. Laura, When you deposit the money in the bank it will show up in the bank feed. Simply put your names in the Who field and enter the ledger account number/name in the What field. I do wish there were more walkthroughs for very common accounting tasks that most small businesses would be wanting to do, such as EOFY director loans. Wherever you have coded the payment into the business is where you should code the payment out of the business.

It might mean paying yourself a little less in the short term, but in the long term it will put your business on the path to success. This is essential if you want to understand your business cash flow and forecast how it might change. Mixing your business and personal finances can leave you uncertain about business performance.So keep them separate.