Content

One of the trickiest things business owners find about moving their accounting to Xero is the actual move itself. Moving over from spreadsheets and ledgers, or even other accountancy software like Sage can be a bit confounding, especially as accountancy admin is more of a chore than an exciting part of your business day to day.

In July, 2017 HMRC announced that all businesses and individuals will eventually have to file their accounts digitally. Small businesses often begin reporting on a cash basis, as it allows you to stay on top of your cash flow and is generally what makes more sense. Accrual accounting, whilst more advanced, does offer an important insight into whether your sales function is performing, and can be used to match expenses with revenues to determine your margins. Cash accounting is the method of recording transactions in the accounting system as and when the transfer of cash occurs. Accrual accounting, on the other hand, records the transaction when the transaction happens. This can be easily solved through having a PayPal account set up in Xero for each currency.

If you want to discuss tailoring your chart of accounts specific to your business or anything to do with the chart of accounts, feel free to give us a call. We are Specialist Xero Advisors helping businesses streamline their processes and grow. Try adding the accommodation and meals account and dividends paid account. See if you can guess which type of account you should use.

Sign up to our newsletter for the latest tips on running your business more efficiently. By making it easy to track the numbers that matter, you get an instant, real-time overview of the health of the business. And that’s a huge advantage when it comes to managing your finances, planning your future months’ activity and making important business decisions. Account type – these are grouped by Assets, Liabilities, Revenue, Expenses and Equity. If you’re not sure which one to use, it’s a good idea to check with your accountant first before making any changes.

It may surprise you to learn that, currently, Xero does not include a dedicated account code for Dividends in the default chart of accounts. Therefore, an account code needs to be created in your Xero to record dividends properly. It must be given the correct account type in the chart of accounts.

A trap we see a lot of business owners fall into is creating multiple income and expense accounts, based on each discrete type of transaction. While this can be a good resource for understanding the granular detail of your finances, it really only serves to slow down your reporting, drawing it out.

Edit And Import Your Chart Of Accounts In Xero

Here at Xenon Connect, we recognise that having to calculate this figure every time that you want to pay yourself a dividend can be tedious and complicated. An “illegal dividend” (i.e. a dividend which has been unlawfully issued) is one which has been paid when cumulative profit reserves are not high enough to cover the amount being paid. “Dividend Waivers” can sometimes be used by Shareholders to forego their dividend payment whilst other Shareholders of the same share class are still paid their dividend. However, Dividend Waivers can only be used in very specific circumstances. Generally, Shareholders that hold the same class of shares in a company must be paid equally in proportion to the number of shares they each hold. Most Limited Companies that have issued share capital can pay out dividends. This includes Private Limited Companies and Public Limited Companies .

Self-employed businesses can’t pay dividends as they do not have a corporate shareholding structure. Neither can Limited Liability Partnerships for the same reason. For example, a restaurant business would likely want to keep track of its stock so an asset account would be a useful addition for the business to keep track of how much stock is available at any given time.

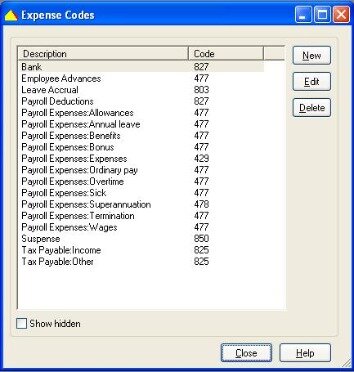

‘Description’ isn’t mandatory but feel free to add this if you like (it won’t appear in any reports but can be a helpful reminder). Amending your Xero codes so they’re more suited to the needs of the business makes a lot of sense, and adds real value to your Xero reporting. The Chart of Accounts uses numerical codes to track every incoming and outgoing transaction you carry out in the business. For example, ‘Sales’ are coded against the 200 code, ‘General Expenses’ are logged under the 429 code and ‘Printing & Stationery’ is assigned to the 461 code. It’s a way to codify your costs and income so you can make more sense of them. Xero have compiled an agriculture-specific chart of accounts template that you can use as a great starting point for getting your Xero account up and running.

Why Should I Customise My Xero Codes?

But with some small business owners still chained to their ledgers, switching over all your financial data to a cloud accountancy software programme can seem like a leap too far for many. And for micro businesses, it offers you an ease and simplicity of use that razes down the time you would usually spend on slogging through your accountancy admin, allowing you to spend more time doing what you love.

Report grouping lets you create fully customised reports – from high level overviews through to highly detailed reports. This gives you full control on how information is reported. Tracking categories can separate your financial data out even further – without having to create numerous new accounts. At Xero we’re always challenging the status quo and thinking about the best way of doing small business accounting from a design perspective.

If you’re using tracking categories for restricted and unrestricted then you’ll need to add columns for each and then total for the year. In case, while signing up to Xero, you select the option – not registered for GST, the tax will not be applied to accounts in the default chart of accounts. If you later register for GST, you will require editing accounts in the chart of accounts to apply the appropriate tax rate as per the requirement.

- Take note to remove any accounts you don’t think you’ll be using – i.e. if you’re a cropping farmer, you can remove any livestock accounts and vice versa.

- Come on Xero…you haven’t “revolutionised” anything here.

- Make sure you set these up using the correct names so they are later coded accurately, to ensure you get a clear view of how your business is running.

- We are specialists and innovators with expertise across a vast range of business process management services.

- Is it possible to have a tick box added to the Chart of Accounts to lock them down, just like the conversion balances once they are agreed.

If you can, switching to Xero at the start of the financial year is always more ideal. I have worked with a UK Charity where we had approx 10 projects and a mixture of restricted and unrestricted income. We set the chart of accounts so that expenses were consistent across all projects and for revenue, each grant funder had their own revenue account. As some funders funded more than one project we would always be able to see the total from them in any period. One tracking code was used for projects and the other for restricted/unrestricted. You can then set up report layouts in the format of the SOFA and run with the restricted/unrestricted tracking. One thing to remember is to add into the chart of account for reserves a reserve account from each fund.

Xero: Chart Of Accounts Download

These ranges aren’t concrete, but it’s always best to have a set range for the different sections. This makes it much clearer to read, and easier for you to find the accounts when you’re looking through the chart. Here are the key components you can expect to find in your Xero chart of accounts. Our expert business accountants can help you plan your tax and ensure compliance. Tax – generally the relevant tax rate will be 20% (VAT on Income/Expenses), but if you’re not sure then talk to your adviser to check the correct rate. We have a blog on VAT tax codes tax codes for expenses that you can read here.

But it’s reasonably simplistic; larger businesses may need a more in-depth approach. Your chart of accounts is designed to streamline your finances, so it should be kept as simple as possible.

Therefore, dividends can also be paid to other companies. Shareholders, that therefore hold share certificates in a company, are normally able to receive dividends from the company. There is generally no obligation for the company to pay dividends to Shareholders unless there is a provision in the company’s statutory records which states that dividends must be paid under certain conditions. A dividend is an amount of money that is paid out of a company’s profits to its Shareholders.

Click on a template and you’ll see the chart of accounts within it. We worked with Xero partner consultants to validate the templates and accounts within each business type.

With Stripe, the paid funds are transferred into your bank account as daily batches, instead of individual transactions. This can result in an inaccurate reporting where your individual sales and processing fees aren’t fully accounted for. We believe that Xero is best used alongside an accountant or financial advisor. Not because the software is lacking, but an accountant is best placed to help advise on best use, translate your findings into actionable strategies, and, moreover, do all that boring reconciling for you. We won’t lie, there are parts of Xero that are tricky to get used to. Some users have stated they’ve found refunds and credit notes awkward to make, based solely upon the existing information on the Xero resources page.

In another example, say your business is adding a new service to your repertoire, and you’re keen to track its profitability in a separate account. You could take the granular route, and create a different account for each specific use of this new service. Find out how Xero online accounting brings you a real-time overview of your key numbers, a better handle on performance and an improved view of what the future holds in store. The FD Works team of accountants are here to help you to get control of your financial destiny and achieve your key goals. From our Bristol and Bath offices our team help startups, scaleups and established firms throughout the South West and across the UK embrace their numbers and succeed. Talk to us about new ways to customise your Xero set-up with enhanced coding and tracking. We’ll help you to improve your scorekeeping and performance management, and will provide you with the important numbers you need for managing the business.

Please note that you can’t overwrite an existing client’s chart of accounts with a new template. Also, if you set up a client outside of Xero HQ, you won’t have the option to choose a template. You can choose a chart of accounts template when you onboard clients in Xero. After adding the client to Xero HQ, click ‘Connect to Xero’.

Amending The Chart Of Accounts

And if you choose to start using Xero halfway through the current tax year, it is a lengthy and for some, painful, process to reconcile all your existing data into the software. But a lot of the teething problems associated with the switch are just that, minor and fleeting issues.

One big benefit of your chart of accounts is that it’s customisable, so you can get the level of utility out of it that you need. How your chart of accounts works should depend on your business’ needs. Your chart of accounts brings this information together into one central location, providing you with a snapshot of all the different accounts in your business, at one time. A chart of accounts is designed to help you streamline your financials. In this article we’ll look at what a chart of accounts actually is, and how you can use Xero to create a comprehensive, living chart of accounts for your business. We know that when Xero partners have clients to set up in Xero, the one-size-fits-all chart of accounts isn’t always ideal. Now you can onboard faster and more accurately with the new chart of accounts templates in Xero HQ. This means you can now spend more time advising your clients during this difficult period.

This allows you to keep the same codes and naming conventions as used in your previous system, with just a few clicks. For larger businesses, your chart of accounts will allow for a more in-depth set of accounts. We’ll have a look at how this works later in the article, and how you can tailor this depending on what you’re tracking and reporting on. For example, if you’re a small-to-medium business, your chart of accounts should be relatively simple. You might group different income and expenses into a more condensed set of accounts. When you go into ‘Chart of Accounts’ under the ‘Practice’ tab in Xero HQ, you’ll see a read-only library of templates.