This is because years of retained earnings could be used for expenses or any asset to help the business grow. However, debt is the riskiest form of financing for businesses because the corporation must make regular interest payments to bondholders regardless of economic conditions. Bondholders are paid and liquidated before preferred shareholders, born and liquidated before common shareholders. Also known as Owner’s Equity, is the total amount of assets remaining after deducting all liabilities from the company.

About Liquidation

For example, return on equity (ROE), calculated by dividing a company’s net income by shareholder equity, is used to assess how well a company’s management utilizes investor equity to generate profit. A statement of retained earnings is a comprehensive summary of retained earnings and their calculation. Because the retained earnings are available for investments and expenditures, how they are spent is entirely up to the company. Retained Earnings are profits from net income that are not distributed as dividends to shareholders. Instead, this amount is reinvested in the business for purposes such as funding working capital, purchasing inventory, debt servicing, etc.

How Do You Calculate Equity?

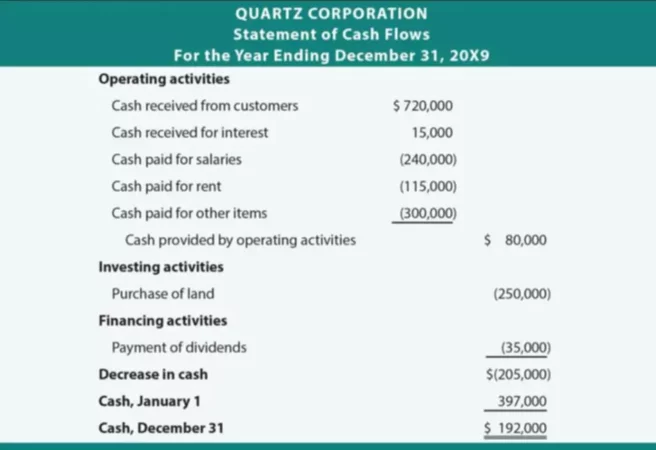

The net result of the four financing activities caused cash and cash equivalents to increase by $28,000. Cash outflows used to repay debt, to retire shares of stock, and/or to pay dividends to stockholders are unfavorable for the corporation’s cash balance. Many of the other adjustments in the operating activities section of the SCF reflect the changes in the balances of the current assets and current liabilities. For example, if accounts receivable decreased by $5,000, the corporation must have collected more than the current period’s credit sales that were included in the income statement.

Free Cash Flow

Under a hypothetical liquidation scenario in which all liabilities are cleared off its books, the residual value that remains reflects the concept of shareholders equity. Investors and corporate accounting professionals look to shareholders’ equity (SE) to determine how a company is using and managing its initial investments and to determine the company’s valuation. These two accounts—common stock and paid-in capital—are the equivalent of the Capital Contribution account we used for a sole proprietorship.

- Because all relevant information can be obtained from the balance sheet, this equation is known as a balance sheet equation.

- Negative shareholder equity means that the company’s liabilities exceed its assets.

- This is the property, plant and equipment that will be used in the business and was acquired during the accounting period.

- In our modeling exercise, we’ll forecast the shareholders’ equity balance of a hypothetical company for fiscal years 2021 and 2022.

- If a small business owner is only concerned with money coming in and going out, they may overlook the statement of stockholders’ equity.

How confident are you in your long term financial plan?

If a business has more liabilities than assets or does not have enough stockholders’ equity to cover its debt, then it will need to turn to outside sources of capital. Rather, they only list those accounts that are relevant to their situation. For example, if a company does not have any non-equity assets, they are not required to list them on their balance sheet. For example, if a company made $100 million in annual profits, but only paid out $10 million to shareholders, its retained earnings would be $90 million. Retained earnings are the profits that a company has earned and reinvested in itself instead of distributing it to shareholders. Shareholder equity is one of the important numbers embedded in the financial reports of public companies that can help investors come to a sound conclusion about the real value of a company.

Approximately half way down on the table of contents you will see Financial Statements. When you review the statement of stockholders’ equity you will see that it reports the amounts for each of the most recent three years. Negative stockholders’ equity occurs when a company’s total liabilities are more than its total assets.

Statement of stockholder’s equity, often called the statement of changes in equity, is one of four general purpose financial statements and is the second financial statement prepared in the accounting cycle. This statement displays how equity changes from the beginning of an accounting period to the end. Retained earnings are a company’s net income from operations and other business activities retained by the company as additional equity capital. They represent returns on total stockholders’ equity reinvested back into the company. For this reason, many investors view companies with negative shareholder equity as risky or unsafe investments. Shareholder equity alone is not a definitive indicator of a company’s financial health.

Other comprehensive income includes certain gains and losses excluded from net earnings under GAAP, which consists primarily of foreign currency translation adjustments. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. This type of equity can come from different sources, including issuing new shares or converting debt to equity. Long-term assets are possessions that cannot reliably be converted to cash or consumed within a year. They include investments; property, plant, and equipment (PPE), and intangibles such as patents.

This ending equity balance can then be cross-referenced with the ending equity on the balance sheet to make sure it is accurate. Every company has an equity position based on the difference between the value of its assets and its liabilities. A company’s share price is often considered to be a representation of a firm’s equity position. Conceptually, stockholders’ equity is useful as a means of judging the funds retained within a business. If this figure is negative, it may indicate an oncoming bankruptcy for that business, particularly if there exists a large debt liability as well. Next, the “Retained Earnings” are the accumulated net profits (i.e. the “bottom line”) that the company holds onto as opposed to paying dividends to shareholders.

However, when used in conjunction with other tools and metrics, the investor can accurately assess an organization’s health. Physical asset values are reduced during liquidation, and other unusual conditions exist. However, it’s important to remember that it is influenced by factors the company can control, such as dividends paid.

Companies may have bonds payable, leases, and pension obligations under this category. Current assets include cash and anything that can be converted to cash within a year, such as accounts receivable and inventory. The company can influence equity (in small amounts) by adjusting the dividends paid for the year. Total assets are the sum of all current and non-current (long-term) balance-sheet assets. Cash, cash equivalents, land, machinery, inventory, accounts receivable, and other assets are examples of assets.

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. In recent years, more companies have been increasingly inclined to participate in share buyback programs, rather than issuing dividends. The excess value paid by the purchaser of the shares above the par value can be found in the “Additional Paid-In Capital (APIC)” line item. To see a more comprehensive example, we suggest an Internet search for a publicly-traded corporation’s Form 10-K. Finance Strategists has an advertising relationship with some of the companies included on this website.

The retained earnings are used primarily for the expenses of doing business and for the expansion of the business. This is the percentage of net earnings that is not paid to shareholders as dividends. If a small business owner is only concerned with money coming in and going out, they may overlook the statement of stockholders’ equity. However, if you want a good idea of how your operations are doing, income should not be your only focus. As a result, from an investor’s perspective, debt is the least risky investment.

Since the cash received is favorable for the corporation’s cash balance, the amounts received will be reported as positive amounts on the SCF. The statement of stockholder’s equity displays all equity accounts that affect the ending equity balance including common stock, net income, paid in capital, and dividends. This in depth view of equity is best demonstrated in the expanded accounting equation. In the above example we see that the payment of cash dividends of $10,000 had an unfavorable effect on the corporation’s cash balance. This is also true of the $20,000 of cash that was used to repay short-term debt and to purchase treasury stock for $2,000. On the other hand, the borrowing of $60,000 had a favorable or positive effect on the corporation’s cash balance.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Overall, this article provides readers with a detailed definition of stockholders’ equity along with the most common misconceptions about the value. Successful investors look well beyond today’s stock price or this year’s price movement when they consider whether to buy or sell.

You can calculate this by subtracting the total assets from the total liabilities. To arrive at the total shareholders’ equity balance for 2021, our first projection period, we add each of the line items to get to $642,500. Since repurchased shares can no longer trade in the markets, treasury stock must be deducted from shareholders’ equity. If we rearrange the balance sheet equation, we’re left with the shareholders’ equity formula. A shareholders’ equity ratio of 100% means that the company has financed all or almost all of its assets with equity capital raised by issuing stock rather than borrowing money. The final item included in shareholders’ equity is treasury stock, which is the number of shares that have been repurchased from investors by the company.

This is often done by either borrowing money or issuing shares of stock, both of which can result in additional obligations. If a company does not have enough cash flow or assets to cover their liabilities, they are in what is known as “negative equity.” Positive shareholder equity means the company has enough assets to cover its liabilities. Negative shareholder equity means that the company’s liabilities exceed its assets. If a company’s shareholder equity remains negative, it is considered to be balance sheet insolvency. If the statement of shareholder equity increases, the activities the business is pursuing to boost income pay off.