Content

Then in your Awaiting Payment section in your bills, highlight the Bills you want to pay by Check. I’ve created this Screenshot to show you what I mean. Since I don’t understand at all what using Bills to achieve the same thing means, I have to assume you’re talking about my approach. You all are the experts in your software platform, not we the end users.

However, from time to time, we do need to review our pricing structure. I can’t wait until the upgrades to invoicing are released and I’m socked with a per invoice additional charge. Not quite, Mani 😉 I’ve already mentioned above why this has taken time. We wanted to completely redo Expenses to take advantage of new technology and create a brand new experience.

- Say goodbye to manual data entry and reconciliation.

- If you have an accountant, you can seek their help with this decision.

- For example, this could be recognizing Amazon sales in full in December, whereas the cash accounting system would record the revenue sometime in January once you receive the payout.

- Additional automation abilities let users select inventory items from a preset list, quickly duplicate a previous invoice, or set up automatic invoices for repeat orders.

If the typist makes one typing mistake in the whole page, the hard work goes to recycle and the typist has to type everything again on a fresh paper. Xero takes today’s modern workforce to typists-age at a time most of the people today never heard the word “typist”. It is a big insult on the users for Xero to have a button “remove and redo”. In short, the trick was to approve a bunch of claims together. This way you will see one claim “awaiting payment” so that you can make one payment to pay it off. HI Robert, I’ve already approve my lists of expenses claims and pending issuing cheque now.

Data Not Linked To You

Select the one you want to pay, and click Make Payment. It’s much more gratifying to work with incoming payments, but the money has to go out sometimes, too.

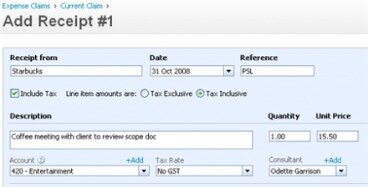

Xero accounting software can easily handle all of your expense claims for those times you’ve bought company items with your own money and need to be reimbursed. One solution is to only submit the expense claims as “Drafts” from the iPhone app. Then from the desktop program you can select multiple claims from the “Current claims” screen and submit for approve as one batch. From there you will end up with multiple receipts in one entry, ready to approve. This should leave you with one payment for multiple receipts. I run a small business so this works OK as I enter my own claims as drafts from the iPhone app and approve from the desktop in batches. In a larger business where different people approve or claims are approved one at a time, this won’t work.

Xero Expenses works seamlessly with Xero accounting, and has all the tools and insights small businesses need to efficiently track and manage expense claims. Capture expenses on the go and keep everyone up to date with push notifications. Claiming back your VAT– The VAT you pay as a business can be claimed back on costs that are essential to the running of your company (things like travel expenses, office equipment etc.). Use our mobile app to reconcile, send invoices, or create expense claims – from anywhere. If you are using the purchases area of Xero to enter bills, then when you come to the bank reconcile screen Xero will suggest bill payments that match the bank transaction.

Set Up Payroll

This means both sides are protected, in any transaction. We verify the identity of both sides of any transaction, your money is held securely in the Shieldpay vault and only released when you confirm you’re happy with the goods or service. Shieldpay is great for invoicing any size job over any period of time, whether you’re a contractor, manufacturer, exporter or simply dealing with someone you don’t know. Shieldpay for Xero gives me peace of mind that I’ll get paid on time, every time.

So if you buy a new laptop where the wholesale price is £500, you’ll pay 20% VAT (£100) and a total price of £600 for your shiny new computer. It is mandatory to procure user consent prior to running these cookies on your website. By clicking ‘Get my free guide’ you agree to occasional follow-up emails, from which you can opt-out at any time. Finally, if you work with one, ask your accountant to check your set up.

Quickbooks Vs Xero: Ease Of Use

This information needs to be displayed on any invoices you issue. With Shieldpay’s verified users, unlimited transaction size and funds held securely in Escrow, you’re in safe hands. Pay for little or large invoices over any period of time. We don’t release your money until you’re happy everything went well. Whoever initiates a Shieldpay transaction is responsible for paying the Shieldpay fee.

Zero-rated expenses – When expenses are ‘zero rated’ this means that the goods are still VAT-able, but the rate of VAT is 0%. Most items that have no VAT (i.e. where the VAT amount on the bill is £0.00) will be classed as zero-rated expenses. There are exceptions to the rule, though, and some of your expenses may end up being classified as either ‘Exempt expenses’ or ‘No VAT’. Something we get asked a lot is ‘Which VAT code should I use in Xero when entering expenses? Getting your head around how VAT works in Xero, and using the right codes from the start, will certainly reduce any VAT headaches in the long run. Forecast your cash with accuracy and make business decisions with confidence.

That’s quite normal for businesses and honest business owners not only keep track of their own spending and income but also the funds of their customers. There are places to find more information when it comes to Customer Accounting and understanding it when it comes to business. Overpayment occurs when your customer pays you more than what he owes. This article will guide you about how you can deal with situations involving Xero Overpayment. How to allocate overpayment to invoice and/or make a refund. Dext Prepare with Receipt Bank is the simplest way to get your client data into Xero!

If you’re unsure about the settings, make sure to check with your bookkeeper or accountant as part of your Xero Setup process. If you don’t have them set up with the right names, you run the risk of items being incorrectly coded. As a result, reports won’t be as clear about how your business is performing.

We keep your money safe in the Shieldpay vault until both parties agree they are happy. And, in case there is any dispute, we’re here to help you. Escrow is where a third party holds funds in safekeeping for two other parties carrying out a transaction, and only releases the funds when both parties confirm they’re happy. Once the buyer has funded the Shieldpay vault, we will only release the funds when both buyer and seller have agreed they’re happy to do so.

This option works well for businesses that do need that level of detail in Xero; however, it can also create additional work if there are heaps of transactions. A direct payment, prepayment, or overpayment submitted from a business account.

Accounting Entries For Refund Of Overpayment

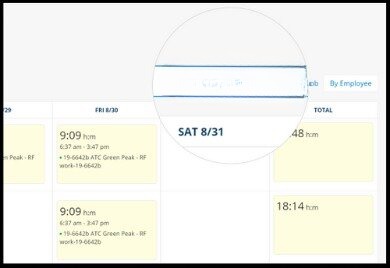

Overall, the cheaper cost of Xero’s time tracking abilities is likely to make them the more appealing option, even if QuickBooks includes more features. Some businesses may rely on those features, however, particularly if they opt for top-down oversight that requires greater control. Xero also lets users send quotes and estimates with modifiable templates that can quickly pull up data on contacts, inventory, and pricing. Alerts can be set to ensure no invoice slips through the cracks. Additional automation abilities let users select inventory items from a preset list, quickly duplicate a previous invoice, or set up automatic invoices for repeat orders. Plus, read receipts let users know when customers have seen an invoice and if it’s been paid.

It’s up to you to assess the performance, quality and suitability of any app before going ahead. Monitor employee spend in real-time with accurate views of your employee spend and when reimbursements are due to help manage cash flow. Unfortunately this charging change will likely be driven by Xero accountants and not the ‘user experience’ team. The big issue I have with the old and new expense system is that you cannot printout the scanned receipts in a batch which makes it difficult to keep a separate ‘off-site’ record from Xero. You always could submit multiple expenditure items on QB from the very earliest versions.