Content

It can be an extremely useful tool for savvy small business owners, but it isn’t for everyone. While business lines of credits’ pay-as-you-go format may make it seem ideal, the fees can quickly add up. These additional costs will vary from lender to lender and will depend on the other agreement terms. Like any loan product, lines of credit are potentially both useful and dangerous. If investors do tap a line of credit, that money has to be paid back . Accordingly, there is a credit evaluation process, and would-be borrowers with poor credit will have a much harder time being approved. A secured business line of credit means you are putting up assets such as inventory or property as collateral.

Instead, you—as the loan’s cosigner—will be next in line for creditors if your business fails to pay its debts. Obviously, that makes things risky for you if the business starts to struggle. First, you’ll need to make sure your business is official to credit bureaus and lending companies. Grab an employer identification number from the IRS, choose an entity designation, and make sure your business address and phone number are separate from your personal ones. You’ll also want to open a separate bank account for your business. Online lenders will require less for your application—just be prepared to pay more in rates and fees once you start borrowing that money. Banks and credit unions will usually want your business to prove solid revenue over multiple years before they offer you a line of credit.

Who Qualifies For A Business Line Of Credit?

small-business term loan finances large one-time expenses, like equipment purchase. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. We believe everyone should be able to make financial decisions with confidence.

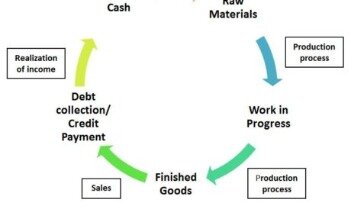

You can also find an alternate lender if you need the LOC right away. And a line of credit can smooth out month-to-month expenses because of its flexibility. A line of credit is revolving credit—it allows you to borrow money and repay it as many times as you need. A line of credit shares even more in common with a business credit card. However, the key differences involve the use of cash and reward incentives.

Understand Key Characteristics Of A Business Loan

Personal FICO credit scores and other credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit or financing type you are eligible for. Nav uses the Vantage 3.0 credit score to determine which credit offers are recommended which may differ from the credit score used by lenders and service providers.

Secured credit lines may be preferred over unsecured lines by traditional financial institution like a bank or credit union. The lender is taking on less risk, so they may grant a higher credit limit at a lower interest rate for a secured credit line.

Payday is coming up, but your biggest client hasn’t paid their invoice yet. A business line of credit is a type of business loan that functions more like a business credit card, allowing you to draw money when you need it and pay it back over time.

When interest rates rise, your line of credit will cost more, not the case with a loan at fixed interest. There are also typically fewer restrictions on the use of funds borrowed under a line of credit. A mortgage must go toward the purchase of the listed property, and an auto loan must go toward the specified car, but a line of credit can be used at the discretion of the borrower. Like a traditional loan, a line of credit requires acceptable credit and repayment of the funds and charges interest on any funds borrowed.

Other Small Business Loans

Frequently asked questions Learn more about Idea Financial, the business line of credit and business loans. The most unique aspect of Idea Financial’s business line of credit is that when a borrower makes a draw, the full balance of the line of credit is re-amortized over a new payment term. So, if a borrower is six months into an 18-month repayment period and makes a subsequent draw, the borrower is then given an additional 18-months from the date of that draw to repay the balance. Some new online lenders offer financing with more lenient requirements. Most online lenders require $100,000 in annual revenue, a credit score of 600, and one year of operations at a minimum. Some online lenders even claim to process applications by completely different metrics like the applicant’s social media presence.

A line of credit comes with a credit limit, which is the maximum amount that you can borrow from it at any one time. Unlike a credit card, the line can incur interest as soon as you use any portion of the funds. The interest rate you’ll be charged for the amount you borrow is usually lower for a credit line than a credit card.

Best For Longer Repayment Term

Online lenders, banks and credit unions offer business lines of credit. Banks and credit unions typically require strong business revenue and at least a few years of history to qualify. Online lenders have looser qualifications, but may charge higher rates. Compare your options to find the one that best fits your financing needs.

The lender might also want to see your accounts receivable to examine how well your business collects on any funds you’re owed. Depending on how your business is taxed, your lender might need to look at either your personal or business tax returns—or both. Pass-through entities, which bypass corporate income taxes, will probably need to show personal tax returns. Each type of business financing comes with its own strengths and weaknesses. Many businesses will take advantage of multiple forms of financing at different stages of the business or for different purposes. The only way to apply for these loans is through an SBA authorized lender.

But that doesn’t mean you can’t or shouldn’t use a business line of credit for business purchases, too. They address the fact that banks are not terribly interested in underwriting one-time personal loans, particularly unsecured loans, for most customers. Likewise, it is not economical for a borrower to take out a loan every month or two, repay it, and then borrow again. Lines of credit answer both of these issues by making a specified amount of money available if and when the borrower needs it. When individuals need money, seeking a line of credit is often the last thing that occurs to them. In the direst of circumstances, there are pawnshops or payday lenders.

- Additionally, you are only required to pay interest on what you use.

- Some business lines of credit require a monthly certification process.

- Online lenders offer business lines of credit up to $250,000 for short-term financing needs.

- The vast difference between a revolving line of credit and a non-revolving line of credit is in the name alone.

- But that doesn’t mean you escape any personal consequences if you don’t repay the loan.

With a secured line of credit the borrower puts up collateral as a security deposit on the line of credit. Putting up property as a form of collateral is common, but this could also be other assets owned by the business, such as equipment or inventory. Although interest is only charged on the amount of credit accessed, depending on the lender, there may be a monthly maintenance fee for letting your line of credit sit unused. For any line of credit you consider you need to carefully read the terms offered to make sure you understand any fees that may be included. For example, say you’re waiting on a payment from a customer, and you need to pay the bills, so you take out a $25,000 line of credit.

A business line of credit gives access to a pool of funds to draw from when you need capital. Unlike a traditional business loan, you have the flexibility to borrow up to a set amount (typically anywhere from $50,000 to $500,000), repaying only the amount you withdraw, with interest. Draw on your small business line of credit to handle cash flow gaps, get more working capital, or address almost any other emergency or opportunity. For example, a retail store that makes most of their sales during the holiday season may be short on cash during other times throughout the year, making it difficult for them to make payroll.

A business line of credit is usually smaller than term loans, because you can use it over and over again and but you only need to pay interest on whatever amount you use. They’re similar to business credit cards but are often larger and charge lower interest. Business lines of credit are best for smaller to medium sized and ongoing expenses like business expansion, marketing campaigns or restocking inventory. One of the most common forms of small business financing are business lines of credit, term loans, business credit cards, and other more specialized products like asset backed financing. Among these products, a business line of credit provides great flexibility and quick access to cash that can be used for business expenses.

How Do I Qualify For A Business Line Of Credit?

Get free, unbiased financing recommendations based on your business needs from our team of Credit & Lending Experts. Once that’s paid off, you can continue making additional draws up to the $25,000 maximum, only paying interest on what you’re borrowing at any given time. The maximum amount of funding available, introductory duration of the credit line, and repayment terms depend on your business’s revenues, credit rating, history, and other factors. Note that you’ll sometimes hear lines of credit differentiated as short-term lines of credit and medium-term lines of credit.

But that doesn’t mean you escape any personal consequences if you don’t repay the loan. Otherwise, your business credit score won’t be moving in the direction you want.