Since adjusting entries involve a balance sheet account and an income statement account, it is wise to monitor the balances in both Prepaid Insurance and Insurance Expense throughout the year. The amount that has not yet expired should be the balance in Prepaid Insurance. The revenue cycle refers to the entirety of a company’s ordering process from the time an order is placed until an invoice is paid and settled. The inability to apply payments on time and accurately can not only lock up cash, but also negatively impact future sales and the overall customer experience. Our solutions complement SAP software as part of an end-to-end offering for Finance & Accounting. BlackLine solutions address the traditional manual processes that are performed by accountants outside the ERP, often in spreadsheets.

BlackLine’s Modern Accounting Playbook delivers a proven-practices approach to help you identify and prioritize your organization’s critical accounting gaps and map out an achievable path to success. Streamline and automate intercompany transaction netting and settlement to ensure cash precision.Enable greater collaboration between Accounting and Treasury with real-time visibility into open transactions. Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital.

The Benefits of Reporting Prepaid Expenses Using an Automated Accounting Software

By doing so, companies can rest assured that their financial reports and statements are consistently accurate and reliable. That way, Kolleno helps to ensure that the business can manage its finances in the most user-friendly and efficient way, as well as strengthen its customer relationships. The prepaid insurance journal entry follows the same accounting principle for all prepaid expenses. Sometimes, in business, some expenses are paid for in advance even when the full benefits or services are yet to be received during that period. Such expenses are known as prepaid expenses which are one of the types of adjusting entries in accounting.

Automatically process and analyze critical information such as sales and payment performance data, customer payment trends, and DSO to better manage risk and develop strategies to improve operational performance. Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results. – According to the standards set by the Generally Accepted Accounting Principles (GAAP), expenses that have yet to be incurred cannot be documented on the company’s profit and loss statement. – Prepaid expenses are defined as expenses incurred for assets that the company will be receiving at a later date. In exchange, the insurance company usually offers the customer a discount on the premium price, so the business saves money on the policy.

When the insurance coverage comes into effect, it is moved from an asset and charged to the expense side of the company’s balance sheet. In this case, the company’s balance sheet may show corresponding charges recorded as expenses. Prepaid insurance refers to premiums for insurance that are paid in advance. A premium is a regular, recurring payment made to a provider for the benefit of having insurance coverage. BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence.

Finance and accounting expertise is not only needed to prevent ERP transformation failures, but F&A leaders are poised to help drive project plans and outcomes. Transform your order-to-cash cycle and speed up your cash application process by instantly matching and accurately applying customer payments to customer invoices in your ERP. The balance at the end of the year is shown on the asset side of the balance sheet and the amount is carried forward to the next year. If you recently attended webinar you loved, find it here and share the link with your colleagues. Explore our schedule of upcoming webinars to find inspiration, including industry experts, strategic alliance partners, and boundary-pushing customers.

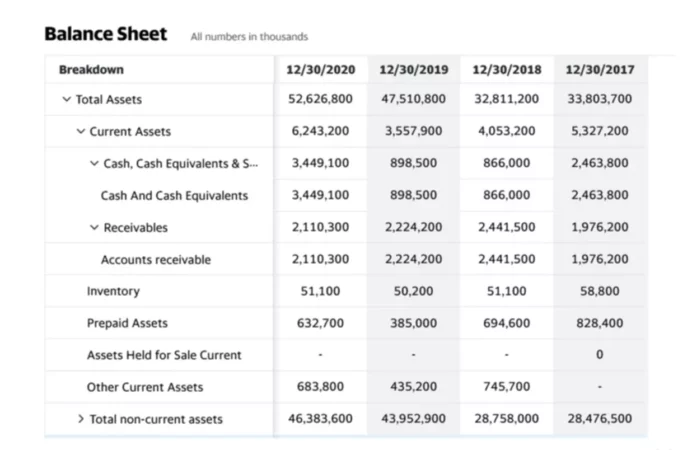

Prepaid insurance is usually charged to expense on a straight-line basis over the term of the related insurance contract. When the asset is charged to expense, the journal entry is to debit the insurance expense account and credit the prepaid insurance account. Thus, the amount charged to expense in an accounting period is only the amount of the prepaid insurance asset ratably assigned to that period. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within 12 months). Once expenses incur, the prepaid asset account is reduced, and an entry is made to the expense account on the income statement. Insurance providers prefer to bill insurance in advance and so knowing the right journal entry for prepaid insurance is very important.

- In essence, the benefits and drawbacks linked with the prepayment of an expense would be largely dependent on the specific situation.

- The most important calculation regarding prepaid insurance reflects the unexpired portion of the policy.

- In other words, it could get a refund of the premiums for those four months.

- If the prepayment covers a longer period, then classify the portion of the prepaid insurance that will not be charged to expense within one year as a long-term asset.

- Each month, as a portion of the prepaid premiums are applied, an adjusting journal entry is made as a credit to the asset account and as a debit to the insurance expense account.

BlackLine Magazine provides daily updates on everything from companies that have transformed F&A to new regulations that are coming to disrupt your day, week, and month. Go beyond with end-to-end transformation.Powerful technology is only part of the story. Explore offerings that unlock new transformation opportunities and make transformation a reality. Rising labor costs and shifting expectations are contributing to unprecedented change in the labor market and altering the way companies and their executives think about talent management.

This allocation is represented as a prepayment in a current account on the balance sheet of the company. Prepaid expenses must be initially noted down as a type of asset on the firm’s balance sheet. Upon the realisation of its benefits, the related expense will then need to be acknowledged on the firm’s profit and loss statement.

Journal entry of prepaid insurance when paid

Whatever the cause of the credit balance in the prepaid insurance account, the account needs to be switched to a liability or zeroed out by making payment before issuing a balance sheet. On July 1, the company receives a premium refund of $120 from the insurance company. The company records the refund with a debit to Cash and a credit to Prepaid Insurance. At December 31, the balance in Prepaid Insurance will be a credit balance of $120, consisting of the debit of $2,400 on January 1, the 12 monthly credits of $200 each, and the $120 credit on July 1. Prior to issuing the December 31 financial statements, the company must remove the $120 credit balance in Prepaid Insurance by debiting Prepaid Insurance and crediting Insurance Expense. Prepaid expenses are basically future expenses which have been paid in advance, with common examples being insurance or rent.

Upon the end of every accounting period, a journal entry will need to be recorded for the expense incurred during that timeframe and in accordance with the amortisation schedule. By doing so, this documents the incurring of the expense during that financial period as well as lower the prepaid asset by the corresponding quantity. Prepaid expenses are considered current assets because they are amounts paid in advance by a business in exchange for goods or services to be delivered in the future. Prepaid expenses usually relate to the purchase of something, such as rent or insurance, that provides value to the business over several accounting periods (often six months or a year).

Centralize, streamline, and automate end-to-end intercompany operations with global billing, payment, and automated reconciliation capabilities that provide speed and accuracy. Ignite staff efficiency and advance your business to more profitable growth. Standardize, accelerate, and centrally manage accounting processes – from month-end close tasks to PBC checklists – with hierarchical task lists, role-based workflows, and real-time dashboards. Prepaid expenses are recognised as a type of asset because they represent products and services whose benefits will only be incurred at a later date. Now, that we understand this, what journal entries will one make to record the $100 worth of insurance used and the $1,100 worth of prepaid insurance remaining? Prepaid insurance is also considered an asset because of its redeemable value.

BlackLine and our ecosystem of software and cloud partners work together to transform our joint customers’ finance and accounting processes. Together, we provide innovative solutions that help F&A teams achieve shorter close cycles and better controls, enabling them to drive better decision-making across the company. – Once the expense has been incurred and the asset is realised, an entry can then be made to the profit and loss statement’s expense account, whilst the balance sheet’s prepaid asset account may be deducted equally. If nothing is prepaid, then the prepaid insurance account must be a zero balance. If an insurance premium is owing to the insurance company then there would be a liability account with a credit balance for the amount owed as of the balance sheet date.

Examples of journal entry for prepaid insurance

For example, if a business had purchased six months of insurance and decided to cancel the policy after two months, it could redeem the value of the four remaining unused months of coverage. In other words, it could get a refund of the premiums for those four months. In this way, prepaid insurance has economic value, not unlike an investment in stocks or bonds, that can be redeemed at a later time.

When the $2,400 payment is made on January 1, the company debits Prepaid Insurance and credits Cash. It also sets up automatic monthly adjusting entries to debit Insurance Expense for $200 and to credit Prepaid Insurance for $200 on the last day of each month. BlackLine Account Reconciliations, a full account reconciliation solution, has a prepaid amortization template to automate the process of accounting for prepaid expenses.

Prepaid rent is the payment of a lease that has been made for a set timeframe in the future. This involves the company making a cash payment to the renting firm, though as the rent expense would not have been incurred yet, the business will need to record the prepaid rent as an asset. Moving forward, this prepaid rent will be utilised in the future to lower the rent expense as it gets incurred. The business’s records would show four months of insurance policy as a current, prepaid asset. It would be entered into the general ledger as a debit of $12,000 to the asset account and a credit for the same amount to the cash account.

Example of Prepaid Insurance

Ensure services revenue has been accurately recorded and related payments are reflected properly on the balance sheet. Increase accuracy and efficiency across your account reconciliation process and produce timely and accurate financial statements. Drive accuracy in the financial close by providing a streamlined method to substantiate your balance sheet. Thankfully though, companies may still drastically lower their risk of encountering minor errors by automating their entire accounting procedure using smart credit control platforms like Kolleno.

A legalretainer is often required before a lawyer or firm will begin representation. When a company pays a retainer, it is recorded as a prepaid expense on the balance sheet. It’s not expensed immediately because the company has not yet benefited from the services. As future invoices come in, the company would recognize an expense and draw down the prepaid asset by the same amount. Prepaid expense amortization is the method of accounting for the consumption of a prepaid expense over time.

Prepaid Insurance is the amount of insurance premium which has been paid in advance in the current accounting period. However, the related benefits corresponding to the insurance amount prepaid will be received in the next accounting period. In other words, the insurance premium is paid before it is actually incurred. While you are innovating to produce safe, reliable, and sustainable products and services, our solutions help accounting teams save time, reduce risk, and create capacity to support your organization’s strategic objectives. As an example, the whole purpose of buying insurance is to purchase proactive protection for any unforeseen incidences in the future, as there is no insurance firm that would sell insurance covering a previous event.

Meanwhile, prepaid expenses are not eligible for tax deductions since the benefits will not be incurred within the same financial year, as that would not be in compliance with the GAAP standards. Prepaid insurance is nearly always classified as a current asset on the balance sheet, since the term of the related insurance contract that has been prepaid is usually for a period of one year or less. If the prepayment covers a longer period, then classify the portion of the prepaid insurance that will not be charged to expense within one year as a long-term asset. Prepaid insurance is commonly recorded, because insurance providers prefer to bill insurance in advance. If a business were to pay late, it would be at risk of having its insurance coverage terminated.

For instance, the providers of medical insurance usually insist on advance payment, and if a business were to pay late, it would be at risk of having its insurance coverage terminated. Prepaid insurance is reported on the balance sheet as a current asset because the term of the related insurance contract that has been prepaid is usually for a period of one year or less. To help businesses stay on track with their prepaid expenses, it would always be a good idea to consider adopting an automated accounting software to ensure that no information slips through the cracks.

This translates to five months of insurance that has not yet expired times $400 per month or five-sixths of the $2,400 insurance premium cost. Prepaid insurance is usually considered a current asset, as it becomes converted to cash or used within a fairly short time. But if a prepaid expense is not consumed within the year after payment, it becomes a long-term asset, which is not a very common occurrence. The payment of the insurance expense is similar to money in the bank—as that money is used up, it is withdrawn from the account in each month or accounting period. Prepaid insurance is considered a prepaid asset because it benefits future accounting periods. It relieves them of the monthly premium expense, and in doing so, reduces their costs, while at the same time still conferring the benefit of having coverage for the business.

When insurance is due and its coverage expires for each quarter, the accounts will be adjusted by the amount of the policy the company uses. Since the insurance lasts one year, we will divide the total cost of $10,000 by 12 (i.e we will adjust the accounts by $833 each month). Insurance providers may allow a business to pay multiple monthly premiums in advance, in the form of one lump sum. For the insurance company, it generates more working capital and greater customer retention. Companies come to BlackLine because their traditional manual accounting processes are not sustainable. We help them move to modern accounting by unifying their data and processes, automating repetitive work, and driving accountability through visibility.

Therefore, as per the modern rules of accounting for assets an increase in assets will be debited. Whether you’re new to F&A or an experienced professional, sometimes you need a refresher on common finance and accounting terms and their definitions. BlackLine’s glossary provides descriptions for industry words and phrases, answers to frequently asked questions, and links to additional resources. Accelerate adoption and drive productivity and performance.One of the critical success drivers for any software technology is effective user training and adoption.

Why would Prepaid Insurance have a credit balance?

The business records a prepaid expense as an asset on the balance sheet because it represents a future benefit due to the business. As the benefits of the good or service are realized over time, the asset’s value is decreased, and the amount is expensed to the income statement. As mentioned above, the premiums or payment is recorded in one accounting period, but the contract isn’t in effect until a future period. A prepaid expense is carried on an insurance company’s balance sheet as a current asset until it is consumed. That’s because most prepaid assets are consumed within a few months of being recorded. For the majority of businesses, handling prepaid expenses is a time-consuming and manual procedure that is extremely vulnerable to human errors.