Content

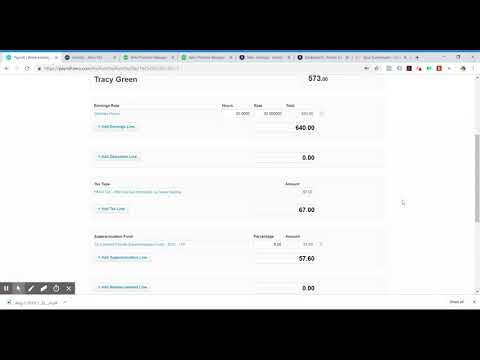

After adding deduction types go into account transactions and “unreconcil” and “remove & redo” each of the payments coded to the payroll liability account. Then go into payrun, reverted it to draft, put in a deduction against each person for the earnings amount, then posted the pay run again – do this for all the payruns affected. After that, add invoices into bills and reconciled the bank dashboard payments that you had unreconciled to the actual invoices/bills. Hi Wendy – I’m glad my crazy thoughts could help. Just a FYI I have done my negative fixed line as a wage expense not a deduction just so that I know it is going in and out of the same liability account. More for lazy reconcilling in that I only have to teach the client to check the balance of the payroll liability account in case they forget to minus off the fixed amount. Then when I do the pay run, can just put in a negative fixed amount which would be the same as the earnings amount and the superannuation amount will stay there for payment.

Now that you need to have a Superstream compliance system set up before the 30th June 2016 to pay superannuation, I am setting up Xero payroll for these contractors (some are transferring to employees as the business grows!). With easy-to-use payroll software and online accounting in the cloud, you can organise all your business information in one handy place. Still using MoneySoft for a client with 50+ employees, lots of starters, leavers, part-timers, shift bonuses, attachments, SMP SSP the lot. Integration really is a very small issue for bigger payrolls.

Wagepoint is the same company that handles the QuickBooks Online payroll. We haven’t started bringing in any clients with payroll into Xero yet, we are leaving them all with QuickBooks Online at the moment. Once we are ready, I’ll look to the Xero Learning Hub for instructions and testimonials on how to properly integrate. I wish it was integrated in Xero, but, while Wagepoint is not cheap, it will handle automatic filing and paying monthly CRA remittances as well as preparing, distributing, and filing T4 info and even ROEs.

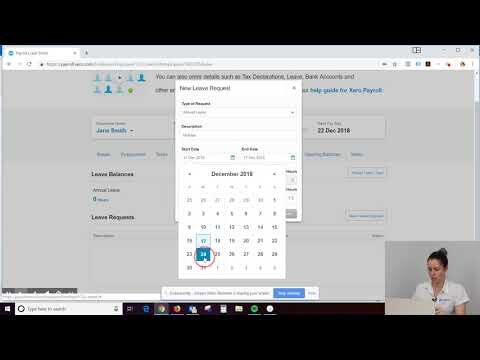

Employee leave balances are automatically adjusted when a leave request is submitted and approved. Xero payroll comes with all the standard types of leave set up – plus you can set up rostered days off and time in lieu. Set up Xero payroll so paying employees takes just a few clicks. Payroll data feeds into Xero accounts automatically. Alternatively you can set up another pay type in the payroll settings called overtime allowance and then add this in the employee’s pay template for the 3.5 hours.

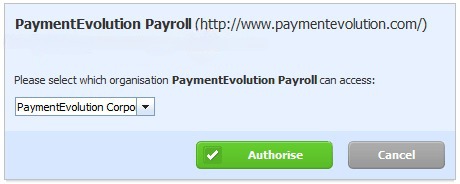

Payroll Apps Integrated With Xero

With Xero’s Payroll Only plan you can tap into the tools and insights you need to efficiently track, assign and manage your payments, giving you time back to focus on what matters. Users of Xero and Gusto benefit from their deep integration. Your Xero sign-on gets you into Gusto as well.

- With Xero’s Payroll Only plan you can tap into the tools and insights you need to efficiently track, assign and manage your payments, giving you time back to focus on what matters.

- Single Touch Payroll, also called STP or one touch payroll, is an initiative from the ATO to encourage frequent salary reporting.

- If you have smaller clients though Xero would make sense if the client pays cost directly.

- Auto super sends employee super contributions electronically to the nominated super fund.

- Then I put the invoice in as normal, through the bill system.

I do the invoices so have done it as per your advice with the deduction. Works a treat and now my client can do his automated super. Then go straight to a payrun and do one for the subcontractors where all I type in is the gross earnings amount from their invoice then I type in an earnings deduction for the same amount as the earnings. XERO then works out the Superannuation to pay – their nett pay is $0 as I paid on their invoice. I think you would be better to use an add-on timesheet to capture the time so that you could have the contractors log in/off the jobs.

You are right for the tips via CSV and the vacation balance. I thought you meant that Wagepoint would not support paying tips or accruing/paying out vacation. I was under the impression that Tips could not be imported by CSV, which is what I currently do. Vacation balance can only be found by checking old paystubs, which means another window.

Get Started With Payroll Only

As a Canadian accounting firm, we were pretty ready to jump all in with Xero. I even started going through the training modules. However, no payroll is going to be a deal breaker. And I don’t think we are willing to wait until a potential 2021 launch. I am an Australian consultant who is a massive champion for Xero in our country. The payroll function is fantastic and as a program it is far superior than anything else in the market for small business. I have a Canadian client who I have just transitioned to Xero and am incredibly frustrated there is no payroll function.

Payroll software with all the tools you need to help you comply with Single Touch Payroll. Payment summaries will be a thing of the past, saving you hours at tax time. Access all Xero features for 30 days, then decide which plan best suits your business. Add 1099 contractors as contacts, then set up rules so expenses are automatically recorded on 1099 forms. File 1099 forms with the IRS using Track1099, Tax1099 or a service like PayPal. If you submit a paper form, export the 1099 in CSV format.

Pay employees with ease with local, state and federal payroll taxes automatically calculated, filed and paid. Use Gusto payroll to calculate pay and deductions, pay employees, simplify compliance, and update the Xero accounts. With Xero, payroll and accounting are seamless – they are one and the same system. OnPay data will sync with Xero each time you run payroll.

How To Get Started With Payroll In Xero (australia)

WIth the app for payslips it would solve the problem of sending out secure passwords. I know sage want to charge 12p per payslip per month to use a secure portal. With Sage’s ever increasing prices to use Sage 50 and extra costs to send secure payslips it would be an ideal opportunity for Xero to gain more market share in payroll. I too would like to be able to use Xero for Payroll as a standalone product. I use Sage payroll for several clients who then use another method for their accounting, to be able to use Xero instead would be advantageous.

As a business owner in the start up phase we are currently searching for a system for our accounting software. Xero is interesting to me, however being from Canada, it is clear that Xero has no intentions of setting up an integrated payroll to date.

I specifically switched from Freshbooks to Xero because the site listed payroll as an option. You’ve now released Payroll for UK, NZ, AU and the US. Then you could use similar ideas to our discussion to manage the superannuation requirements and the bill processes in Xero to manage the TPAR. And use your timeclock app to have a oversight for times if you needed it. As the payroll is not a part of the TPAR requirements the only way to capture those subcontractors is through the purchases section and creating a group of contacts to report on. The TPAR report in Xero links to this group that you create and generates the report from there- which will require you to enter the bill from each contractor to generate the amounts for that report. Our discussion above was about paying super for individual subcontractors which will not apply if your contractor is a company.

I am trying to find out whether I have been processing payroll incorrectly. I have set up a template for a salary paid employee with 40 hours per week and the annual salary amount.

If client is doing payroll in house it would make sense to use the Xero payroll option. So if you were doing 30 payrolls then Brightpay would be cheaper. If you are a first-time employer since 1 Oct 2017, you’ll need to make sure you select Yes to this option in the HMRC tab. When you then start employing staff, Xero will calculate a Duty Start Date when a pay run is posted, based on the earliest employee start date.

You wouldn’t need to have the timesheet sync to Xero as you will still need the invoice so you could potentionally use any app even a freebie for this purpose. My opinion only – I don’t think the Xero timesheet funcion is the answer to the system you are trying to create.

Do they still need to provide a invoice if they are entering time on Xero? I have a client who has about 15 contractors and I’m just setting them up on Xero. As for the payslip, yeah that is how it shows up and this is what I email out to the sub contractors – that way they can see their invoice amount and the total amount of Super that I will pay on that amount. It also like a message to say I have paid their invoices (I don’t send them remittance advices) cause I do this all on the same day each week. oh and I forgot to add that in my set up I would simply reduce the negative fixed line wage amount by the amount of the tax. Which if you are also entering their invoices in the purchases section of Xero will see you doubling up the expense – as you will only be paying their invoice once but having the expense twice. The ATO has listed a low cost Xero option of $10/month on their website?

I cant however work out how to get the gross amount to come up on her payslip as it calculates the hourly rate from the salary and the hours she worked on her pay slip. i understand xero needs to calculate the 38hours for annual leave etc but we would prefer it to no show the hourly rate or hours. I’ve tried all the payroll options that were listed by Fabien above. There’s also the more traditional payroll services which now have an online interface as well, like ADP I believe, which I have not tried. Removing the timestamp is Xeros way of dodging and prolonging adding payroll. Our company is considering switching to QuickBooks just for this reason alone, wonder how many other customers have done the same!

The date a thread was started doesn’t really have bearing on if, or when it’ll be developed. We did post to let everyone know of the changes, and you can read more on the development process in our Blog post here. I just moved from Quickbooks but we will see how it goes, We are paying more for Xero and getting less in a way but we also moved because of Workflowmax looks good . Quickbooks projects is behind and you cant properly job cost on it yet. Definitely understand that Pay Run is limited in functionality and that a dedicated Canadian Payroll would provide a much better experience.

Keep your business moving while you’re on the go. Log in to Xero any time, anywhere, on any device, to make pay runs a walk in the park. Payroll software is used by companies to streamline and automate employee payment and tax filing. The software typically calculates wages, handles taxes and deductions, and delivers checks.

Reasonable Personal Use Of Business Van

The numbers are correct when it comes to employee fixed monthly payroll (even though the presentation on payslips is a little confusing to everyone as the rate & units each month change). the issue with a subcontractor is that they give you a bill which may have 15 or 30 days to pay and would normally be at a rate higher than the award or normal rate for a position and the bill may or may not have GST on it.

The date is May 2nd, 2018 for those wondering when I post this. I want to use the timesheets function and get the contractors to input their time and pay them through a sub contractor payrun which will be separate to my employee pay run. If you want to work out the super to pay on each invoice yourself – do the setup the way Debbie Glynn has (marked her reply as best one – so you can find it easier). Remember to be superstream compliant is simply about how we advise a superannuation fund of their members accrued super and we must make the payment electronically.

In Xero staff can create and submit timesheets from their online employee portal which managers can login and approve. Payroll administrators can also create Timesheets on behalf of employees before processing the payrun. OnPay’s top-rated online payroll services make it easy for small businesses like yours to calculate paychecks, process taxes automatically, and free yourself up to do what you do best. Named to Entrepreneur magazine’s list of the best small business payroll systems of 2017. Payroll HR, Time tracking Tanda 43 Payroll HR, Time tracking Pay staff correctly for the time they work.

I moved off QBO to Xero for several reasons payroll being one of them. Hopefully we can get a great integrated Canadian payroll system in Xero. Wouldn’t need much – maybe for 10 employees tops with just some basic options. I did some research, and it looks like Wagepoint can work with Xero.

Give your employees online access via web browser or smartphone and reduce your payroll admin. How about just opening the API so that others can develop it. All the current Canadian payroll integrations are done through the Purchase module and totally separate from the Pay Run functionality – no employees get setup, no access to pay run reports, and so forth. Does anyone have a recommendation for the best Canadian cloud payroll service that will work easily with Xero? I only have a few employees who also use timesheets.