In general, the greater the risk that you lose money on an investment, the higher returns it provides. It can be difficult, then, to compare the opportunity costs of very risky investments, like individual stocks, with virtually risk-free investments, like U.S. Assume the expected return on investment (ROI) in the stock market is 10% over the next year, while the company estimates that the equipment update would generate an 8% return over the same time period. The opportunity cost of choosing the equipment over the stock market is 2% (10% – 8%).

Opportunity cost vs. sunk cost

” says Adem Selita, chief executive officer at The Debt Relief Company in New York, N.Y. Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How we make money

Opportunity cost serves as a valuable tool in guiding decisions, ensuring that each choice is evaluated in the context of its potential benefits and sacrifices. Investors consider the foregone returns from the next best alternative, helping them make informed choices, maximizing their overall portfolio performance and achieving their financial goals effectively. Every dollar spent today could have been saved or invested for a potentially higher value in the future. By comparing the benefits and drawbacks of different alternatives, decision-makers can make more informed and logical decisions that align with their objectives and long-term goals, minimizing the risk of regret or suboptimal outcomes.

Do you own a business?

They’re not direct costs to you but rather the lost opportunity to generate income through your resources. And that’s not even considering inflation, or the steady loss in purchasing power cash falls victim to over time. If you choose to stay in cash long term, not only are you missing out on the opportunity to grow that money in the stock market, but your dollars are also losing value by around 2% each year. This theoretical calculation can then be used to compare the actual profit of the company to what its profit might have been had it made different decisions.

In this example, the opportunity costs are continued interest gains on bond “A” and the initial loss of $10,000 on bond “B” while hoping to recover it and increase your profits in the future. It’s obvious that decisions around what to invest in are inherently informed by opportunity cost. But once you understand opportunity cost is a factor you should weigh, the amount of opportunities to consider may seem intimidating. You don’t want to choose the wrong investment option and incur the wrong opportunity cost, after all. Everyday examples of opportunity costs might include choosing to commute using public transit for 80 minutes instead of driving for 40 minutes.

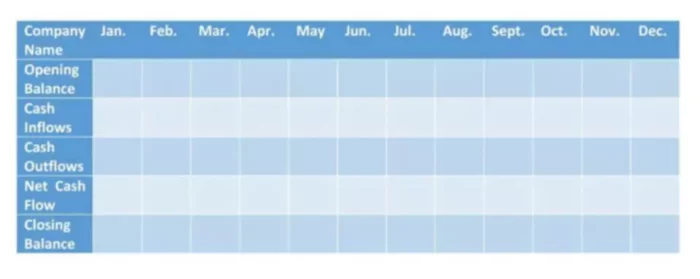

In accounting, collecting, processing, and reporting information on activities and events that occur within an organization is referred to as the accounting cycle. Accounting is not only the gathering and calculation of data that impacts a choice, but it also delves deeply into the decision-making activities of businesses through the measurement and computation of such data. A sunk cost is money already spent at some point in the past, while opportunity cost is the potential returns not earned in the future on an investment because the money was invested elsewhere. When considering the latter, any sunk costs previously incurred are typically ignored.

You might save on the cost of gas but double the trip length and miss out on other things you could have done during that time. When calculating opportunity costs, it’s important to consider more than just flat returns, however. Any effort to make a prediction must rely heavily on estimates and assumptions.

In contrast, opportunity cost focuses on the potential for lower returns from a chosen investment compared to a different investment that was not chosen. For example, a college graduate has paid for college and now may have outstanding debt. This college tuition is a sunk cost, since it’s been incurred and cannot be recovered. If the graduate decides to change career fields, any decision should factor in future costs to do so rather than costs that have already been incurred. So the opportunity cost of changing fields may include more tuition and training time, but also the cost of the job this is left behind (as well as the potential salary of a job in the new field). The opportunity cost of a future decision does not include any sunk costs.

Diversification, the practice of spreading investments across various assets or asset classes, can minimize potential opportunity costs. Sunk costs should be irrelevant for future decision making, while opportunity costs are crucial because they reflect missed opportunities. That’s not to say that your past decisions have no effect on your future decisions, of course.

- In business, opportunity costs impact various areas from production decisions to capital allocation.

- Watch this video to see some more examples and to develop a deeper understanding of opportunity cost.

- If a business decision is made to go with the securities option, its investment would theoretically gain $2,000 in the first year, $2,200 in the second, and $2,420 in the third.

The reality is that the opportunity cost of hiding a valuable invention is so great that inventions worth more than they cost are quickly made available. Hidden inventions exist only in economically uninformed imaginations…. Opportunity cost refers to what you have to give up to buy what you want in terms of other goods or services. When economists use the word “cost,” we usually mean opportunity cost. If you have a second house that you use as a vacation home, for instance, the implicit cost is the rental income you could have generated if you leased it and collected monthly rental checks when you’re not using it. It doesn’t cost you anything upfront to use the vacation home yourself, but you are giving up the opportunity to generate income from the property if you choose not to lease it.

Generally speaking, the stronger the liquidity, versatility, and compatibility of the asset, the less its sunk cost will be. Your opportunity cost is what you could have done with that $30 had you not decided to add the new item to the menu. You could have given that $30 to charity, spent it on clothes for yourself, or placed it in your retirement fund and let it earn interest for you. Opportunity cost is the proverbial fork in the road, with dollar signs on each path—the key is that there is something to gain and lose in each direction.

For instance, if you spend an evening studying for an exam rather than going to a movie, your opportunity cost is the enjoyment and relaxation you would’ve gotten from the movie. Every decision made, whether it’s in our personal lives, investments, or business endeavors, comes with a sacrifice. Because resources are finite, investing in one opportunity causes another opportunity to be forgone. See this interesting survey which shows people have very different responses when they understand the opportunity cost involved in a tax cut. If the government build a new road, then that money can’t be used for alternative spending plans, such as education and healthcare. The idea behind opportunity cost is that the cost of one item is the lost opportunity to do or consume something else; in short, opportunity cost is the value of the next best alternative.

You’ll still have to pay off your student loans whether or not you continue in your chosen field or decide to go back to school for more education. In the investing world, investors often use a hurdle rate to think about the opportunity cost of any given investment choice. If a potential investment doesn’t meet their hurdle rate, then investors won’t make the investment. So the hurdle rate acts as a gauge of their opportunity cost for making an investment.

If a business decision is made to go with the securities option, its investment would theoretically gain $2,000 in the first year, $2,200 in the second, and $2,420 in the third. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas.

If you have 12 hours at your disposal during the day, you could spend these hours in work or leisure. The opportunity cost of spending all day watching TV is that you are not able to do any study during the day. We can increase both goods and services without any opportunity cost.