Having to go back to General Settings / Financial Settings and changing the lock dates each time can be time consuming. I am not comfortable having to unlock my finalized accounts so that credits from within the locked period can be applied within the Sales and Purchases areas. If you are importing the statement data manually then it sounds like you need to reverse the amounts. Many banks provide credit card or loan account data reversed from operating/savings account data. Xero is expecting deposits to be positive and payments out to be negative.

When you come to doing your bank reconciliation this should show as a green line for you to reconcile. Small businesses, accountants and bookkeepers in your neighbourhood and across the world trust Xero with their numbers. Keep your practice a step ahead with Xero accounting software.

Types Of Xero Courses

Boost Your Career Visions with an Industry Certified Accreditation and Xero training. To be a certified professional, may increase your worth in the accounting industry. Future Connect provides advance level and beginner level Xero accounting training. Other than that, Xero certification has a list of career opportunities to grow. Sometimes you’ll need to account for an overpayment in Xero accounting software, whether it’s a payment you’ve made or one that you’ve received. When you need to create a credit for a customer using Xero accounting software, there are a couple of ways to do it.

Xero’s certification is one step on a long road of points and kickbacks that can help you gamify your whole business and could lead to a major change in your workflow. QuickBooks certification is like many other certifications, in that it’s a resume booster. There’s obviously a lot of value in knowing the information, but the real value probably comes from the credibility the certificate lends to you and your business. If you choose a bank account as the ‘Paid to’ account you should now be able to reconcile both transactions. I had responded to a review request and outlined this issue in the review. So very disappointing that this doesn’t seem to be getting anywhere. It is really isn’t ok to compromise the accounting process in such a way and surely it would be a fairly easy change to make.

Supplier Credit Notes In Xero

Like the OP, I have pretty much the exact same problem. I am having a problem with my client’s several of my bank accounts in Xero.

- It could be nice to be able to show what you know as Credit stars.

- If you have an accountant, you can seek their help with this decision.

- We are having to unlocked closed financial periods to allocate old credits and invoice sales orders received during the locked period dates.

- applying the credit does not change any ledger details nor the total owed by the supplier.

- Instead of allocating the old credit to one of the invoices choose Cash Refund and add today’s date for the refund and choose the bank account that the receipt has been paid into.

No one wants to do business with the company pumping the best deals for its own employees – people want to work with companies that put the client’s interests first. This feels like a pretty big bug – there is no reason why this type of allocation should be prevented by a locked period and the workaround should not be necessary. Log support with Xero and make sure you tick the box to give Xero access to your account. You can book a live remote Xero support session with me or self-paced Xero training for a very reasonable price. Please vote for my feature request “Bank Statement Import field for Payment Amount.” If the statement data is coming through a bank feed, then do as Tracy suggests.

Accept Invoice Payments Instantly

You can add, customise, or delete these accounts to match the needs of your business. Single Touch Payroll in Xero makes it easier for businesses and their employees to receive JobKeeper payments. Xero online invoices and payments provide better protection from fraudulent activity. Accept online invoice payments and get paid up to twice as fast by connecting to Stripe, GoCardless and others. Xero certification takes place over a series of seminars and requires 40 Xero University credits for the initial certification. XU credits are similar to college or CPE credits, and you’ll generate them from a variety of classes offered by Xero. Xero also has a program designed specifically for accountants and bookkeepers.

I can’t believe something so trivial and annoying has not been fixed yet. I locked the accounting period a couple of days ago and constantly been asked to open it again just to reallocate prior date payments to match a supplier rec. Go to the credit note and ‘Make a cash refund’ against the credit note. Go to the invoice that the credit note relates to and ‘Receive a payment’, ensuring that in both instances the same date and account has been used. You should be able to apply payments and credit memos to bills created in the locked period. It should not matter as the bill, payment and credit memo are already approved and exist in the locked period. Applying them to each other has no ledger impact as the entries are created at the time the bill, payment, and credit memo are created and saved.

Unlocking closed financial periods leaves the possibility of additional transactions being processed into these periods. Can’t understand why I should have to unlock closed periods to simply allocate an existing credit, or change the date on a sales order that has not yet been approved . Currently if there is an old credit note in a period that has been locked in the Financial settings, if that credit needs to be applied the lock has to be removed. This is a rather annoying feature that serves no purpose. the credit note will remain in the period it was created. applying the credit does not change any ledger details nor the total owed by the supplier.

The credit notes needs to be allocated from an accounts receivable and account payable function to work correctly. e.g. if a credit note was not applied to a supplier invoice you could possibly overpay their account. SOLUTION – Customer has paid a number of invoices less the value of an old credit note. Go to the old credit note and choose to allocate the credit. Instead of allocating the old credit to one of the invoices choose Cash Refund and add today’s date for the refund and choose the bank account that the receipt has been paid into.

When you go to your bank to reconcile the receipt be sure to choose Match and tick show spent items. Then search for your client this will bring up all the outstanding invoices and also the credit. Great work around Laraine but it should not be necessary and it obscures the history trail.

The course content was excellent with a good balance between theory and practical application, which I think was a great way to learn. Payroll Certification gives you an understanding of using Xero payroll and how it integrates with the core accounting product. You will learn the valuable tips to help you work efficiently, minimize errors, and overcome or prevent any issues. Xero certification is to be intending to give you the understanding and skills you want to get the most out of Xero’s features. Setting up payment reminders and organising your credit control systems can help you to get paid faster. If you have an accountant, you can seek their help with this decision. However, if you are your own bookkeeper then we recommend using Xero’s default chart of accounts.

Invest in a Xero training course – learn a cloud-based software that is designed to manage the accounts for small-to-medium businesses efficiently. With plenty of flexible learning pathways like the opportunity to study Xero courses online, now is the perfect time to expand your skill set.

Small businesses, accountants and bookkeepers locally and across the world trust Xero with their numbers. Offer direct debit to collect payment automatically from your customers’ bank account when your invoices are due.

Learn More About Xero

Today, we’ll take a look at how those programs work and what the benefits of joining up are. There are no dates on these posts so I don’t know how long ago this issue was first brought up. It’s very frustrating to have to unlock prior periods just do one of the simplest things in the world, allocate a credit note. I’m an administrator so I have access to this but I imagine for an AR or AP clerk it would be super frustrating to have to wait for admin to unlock the periods. Have you tried to do an invoice the same as the credit note and date today.

Xero this is not a request for a feature but rather a request for you to fix an error in your software. The simple solution would be that we can allocate a date the credit note should apply as in MYOB. “You can delete a draft or awaiting approval credit note, but you need to void an awaiting payment or paid credit note.” Hi Laraine thank you for your suggestion, but I don’t want to allocate this credit note as it is wrong and needs to be reversed or voided.

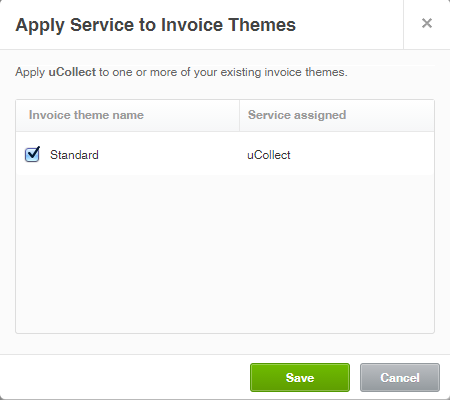

Access all Xero features for 30 days, then decide which plan best suits your business. Any transaction approved by 5PM PST on a given day will deposit to your Chase business checking account that night. Add Chase Integrated Payments as a payment service in Xero, then apply it to a branding theme so customers can pay their invoices online. From Instant Onboarding to Same-Day Deposits, Chase Integrated Payments makes it easier for you to accept payments through Xero and receive your money fast. Future connect is the best in terms of relevancy and content. Xero Certification will give you the skills to carry out your client work in Xero.

Then credit the invoice again with today’s date, this will create a current credit in your bank. Allocate the two new current transactions with no need to unlock periods. Explore features and tools built for small businesses, accountants and bookkeepers. The first time you get certified, you will earn 40 credits. After that, it’s easy to make the 20 credits you need to renew each of your certifications each year merely for the latest education offerings. Courses are specific to each certification, so you will be able to select the ones that are relevant to you.

We are not talking about Cash Refunds but about Allocating a Credit Note against an invoice that is dated in a locked period. It should be able to be allocated according to the date of the allocation process or the very least the date the Credit Note was issued. It should NOT be based on the date the original invoice was issued. I can only repeat that the credit note was raised incorrectly, so I have no intention of allocating it. I need to reverse it and the costs that went to the ATO. To add further information, I did a search of Xero topics on voiding a credit note and the following information says.