Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. The Galaxy Blend has transitioned from Raw Materials (imported beans) to Finished Goods (roasted and packed beans).

Which of these is most important for your financial advisor to have?

Managing inventory and determining the turnover rate can help companies determine just how successful they are and where they can pick up the slack when the profits begin to dry up. Items like manufactured smartphones, ready-to-sell garments, or packed food items are assets. They are direct outcomes of the production process and represent immediate or future sales revenue for a business. For businesses in the food industry, items like fresh produce, dairy products, or meat are assets.

Inventory Considered as Assets

Starry Night Coffee currently holds 10,000 bags of Galaxy Blend, of which 3,000 have been sold. If your business undergoes a financial audit, the auditor will verify the correct classification of inventory. Any discrepancies or misclassifications will be highlighted to ensure accuracy. Recognize the inventory valuation method in use (FIFO, LIFO, Weighted Average, etc.).

The Ultimate Guide to Revenue Run Rate

Though they have a limited shelf life, they hold value due to their potential for immediate sales. The main advantage of inventory accounting is to have an accurate representation of the company’s financial health. However, there are some additional advantages to keeping track of the value of items through their respective production stages. Namely, inventory accounting allows businesses to assess where they may be able to increase profit margins on a product at a particular place in that product’s cycle. Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated.

How Does a Small Business Calculate the Value of Unsold Inventory at Year End?

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Finished goods inventory is inventory that has been completely built and is ready for immediate sale. Regardless of the inventory cost method mentioned above, finished goods inventory consists of the raw material cost, direct labor, and an allocation of overhead. At a minimum, you should count all of your inventory once a year to ensure the actual inventory on hand matches what’s in your records. This helps you spot potential problems—such as inventory that’s being mishandled or stolen—before it costs the business too much money. Current assets are typically presented first on the balance sheet and arranged in order of their liquidity, or the order in which the company expects to turn them into cash.

What Can Inventory Tell You About a Business?

Also called stock turnover, this is a metric that measures how much of a company’s inventory is sold, replaced, or used and how often. This figure provides insight into how profitable a company is and whether there are inefficiencies that need to be addressed. For instance, a company runs the risk of market share erosion and losing profit from potential sales.

This operational efficiency builds customer trust and satisfaction which leads to increased sales and business growth. If you enjoyed this article, you might also like our article to determine if inventory is a long term asset or our article on fixed asset inventory. Given that they’ve sold 3,000 out of 10,000 bags in just a month, their turnover suggests a decent rate, indicating some of the inventory is becoming an expense but a good portion remains an asset. High inventory turnover (indicating rapid selling) might suggest more inventory is becoming an expense. Goods that have been sold or dispatched but haven’t reached their destination are still assets. They represent a value as they’re either expected to be received in inventory or result in revenue once delivered to the customer.

This includes merchandise, raw materials, work-in-progress and finished products. Your balance sheet lists inventory as an asset, because you spend money on it and it has value. Inventory is defined as anything that you will incorporate for future use in your business operations. This definition covers items you have bought for resale, such as pants and shirts for a clothing store.

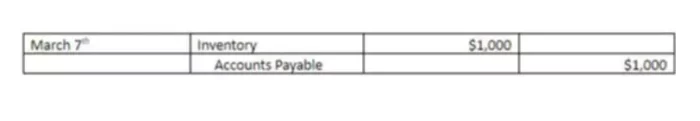

Accounts payable turnover requires the value for purchases as the numerator. This is indirectly linked to the inventory account, as purchases of raw materials and work-in-progress may be made on credit — thus, the accounts payable account is impacted. Below is an example from Proctor & Gamble’s 2022 annual report (10-K) which shows a breakdown of its inventory by component.

Inventory is reported as a current asset as the business intends to sell them within the next accounting period or within twelve months from the day it’s listed in the balance sheet. Current assets are balance sheet items that are either cash, cash equivalent or can be converted into cash within one year. Higher sales (and thus higher cost of goods sold) leads to draining the inventory account.

- If the item has been sold, its cost will move from the balance sheet to the income statement.

- Your business spends money on inventory, so you may wonder why you can’t simply record purchases of inventory as an expense.

- Look for one that integrates with your point-of-sale system or accounting software.

- This definition covers items you have bought for resale, such as pants and shirts for a clothing store.

Inventory goes into your bookkeeping system as an asset, but in practical terms it can be either an asset or a liability depending on the type of item and how you manage it. In this article, we will explore if inventory is an asset based on its characteristics and several factors. Starry Night Coffee’s annual audit confirms the classification of Galaxy Blend’s inventory. The auditors adjusted for the write-offs and confirmed the COGS as per the FIFO method. There’s an entry under “Cost of Goods Sold” (COGS) for $45,000, indicating the cost for the sold bags. Sales invoices confirm that 3,000 bags were sold for a total revenue of $90,000.

For example, you probably want to make sure you have more high-value items coming in if you’re on the low side. Meanwhile, if you have a ton of low-value items, you can probably wait on that order. Your business spends money on inventory, so you may wonder why you can’t simply record purchases of inventory as an expense.

Noncurrent assets, on the other hand, are long-term assets and investments by a business that cannot be liquidated easily. Generally, a high inventory turnover ratio indicates strong sales and a low inventory turnover ratio indicates weak sales or decreasing market demand for the products. However, a good inventory turnover ratio depends on the industry and type of inventory carried. For example, a luxury auto dealer’s inventory turnover ratio will be much lower than an office supply store.

Consignment inventory is the inventory owned by the supplier/producer (generally a wholesaler) but held by a customer (generally a retailer). The customer then purchases the inventory once it has been sold to the end customer or once they consume it (e.g., to produce their own products). Their assets include building materials such as cement, wood, and nails, essential for completing construction projects.