Content

Many small businesses choose to create income statements on a monthly basis to find patterns in profits and expenditures. An income statement or profit and loss statement is an essential financial statement where the key value reported is known as Net Income. The statement summarizes a company’s revenues and business expenses to provide the big picture of the financial performance of a company over time. The income statement is typically used in combination with a balance sheet statement. An income statement shows the income and expenses of a company over a specified period of time. Investors and business managers use the income statement to determine the profitability of the company.

By connecting Google Sheets, Sheetgo allows you to automate all your data processing tasks and generate automated reports and dashboards. This will ensure that your Income Statement, Expenses/Income reports always contain the latest data from the Input spreadsheets. In this file, your colleague should enter all invoices paid in the Expenses tab. As you can see, these tabs have a padlock icon to remind you not to edit this data. Secondly, open the Income Inputs file by clicking on Workflow or Files on the right-hand side. To open the Income Inputs or Expenses Inputs file, click Workflow in the sidebar on the right-hand side of the screen and double-click on either of the files. And if your business reaches the point where it doesn’t make sense to do your own bookkeeping, let us know.

Are You Working Alone Or Running A Small Business?

For small to medium-sized enterprises , creating an income statement can be a time-consuming and costly process. Also referred to as a profit and loss statement , revenue statement, or operating expenses statement, an income statement helps you measure the performance of your company. On top of that, it can be used to secure financing as well as to calculate and pay taxes. A balance sheet gives a point in time view of a company’s assets and liabilities, while the income statement details income and expenses over an extended period of time .

Understanding these concepts will help you put together, and analyze, profit and loss statements. Put another way, a profit and loss statement tells you whether or not your business is making money. Small business owners can use a P&L statement to assess business performance, identifying room for improvement and new strategies for growth.

A simple or basic income statement may only include income, expenses, and net profit . For most small businesses, a simple income statement is sufficient for internal reporting. However, investors may request a more complex income statement. You’ll find profit and loss templates in Excel are easy to use and configure to any business in minutes—no accounting degree necessary. On your income statement, include a breakdown of your revenue, expenses and the net income on your income statement. The income and expense statement template from FreshBooks includes blank, easy-to-use fields for all of the information that you need to include. Make sure the income statement fits your business by adding and removing line items as you go.

If revenues are higher than total business expenses, you’re making a profit. If your business expenses over the period being examined were higher than your income, the company has made a loss.

Store your data on the cloud that is protected by gold standard encryption. FreshBooks has other free resources, such as general ledger templates, expense reports and more. Selling, General and Administrative Expenses (SG&A) – this covers a wide range of items including business property rental, transportation, employee salaries, business rates and more. Are you invoicing clients overseas, or working with suppliers based abroad, but waiting around for slow international transfers to finally reach your account? TransferWise can cut down on the cost and time of international transfers into your multi-currency account. For service businesses, COGS might not be such a large factor, so that is why the SingleStep worksheet doesn’t have a separate COGS section.

Everything You Need To Know About Income Statements

The two types of templates included in the file are shown below. Selling and administrative expenses should be listed as individual line items under operating expenses. The pre-written formulas in the template use this data to generate the automated Income Statement. The template creates an automated Expenses report and a separate Income report. The Sheetgo connections import data from the Expenses and Income Inputs spreadsheets into the master sheet. The template uses the data in the Expenses tab to automate an Expenses report in the Summary per Month tab. If you want to automate the data entry process, you can connect other spreadsheets to this file using Sheetgo connections.

Depreciation expense is listed under “Expenses” on a single-step income statement and listed under “Operating Expenses” on a multi-step income statement. Supports one full page to provide a cover letter for the financial statements. You can attach an unlimited number of pages to the financial statements for notes. FSG eliminates all these page formatting chores by automatically setting up the page for you. Dollar signs appear where they are required, columns setup is automatic, underlining and double underling are printed on the correct locations on the page.

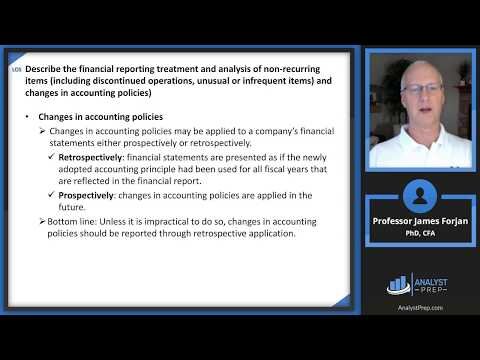

A balance sheet helps determine a company’s current financial situation and make important financial decisions. The income statement can be run at any time of the fiscal year to determine profitability and compare one period of time to another to show growth. Understand how your business is performing with an income statement. The income statement, also known as the profit and loss statement, gives you a better understanding of your total revenue, net income, and net profit over a specific time period.

Should You Include Interest Paid On An Annual Basis In A Monthly P&l?

This template does not import information from multiple spreadsheets — but it provides a simple way to create an income statement in one single file. This spreadsheet-based workflow template is a pre-built system that allows you to pull together real-time income and expenses data from across the company.

Simply download the financial statement template and follow the steps below to get started. Take bookkeeping into your own hands with FreshBooks income statements. A contribution margin income statement is used to generate contribution margin, as well as overall net profit. This calculation is useful for business owners and investors as it shows the net profitability of a business, and how efficient a company is at generating net income.

Here’s a working profit and loss template complete with gross margin calculation built-in. By now, you might be ready to tackle your very own profit and loss statement. One last important note about P&L statements is that they do not represent your business’ financial health by themselves. They may reflect it in some cases, but they can be skewed by billing practices or fraudulent reporting of transactions . Lenders will look at P&L statements to determine whether or not your business is likely to make a profit in the future big enough to pay back loans and interest.

If there are any earnings remaining, the difference is considered profit. A contribution income statement is generally only used for internal reporting as a tool for planning and analyzing product costs.

Partial Income Statement

It calculates the Operating Income and then adjusts for interest expense and income tax to give the Income from Continuing Operations. Break-even analysis can be performed by using profit and loss statements by working backward to determine how much you need to sell to be profitable in a given period.

Everything you need, including income statement, breakeven analysis, profit and loss statement template, and balance sheet with financial ratios, is available right at your fingertips. The blank income statement has customizable fields for you to plug in your revenue and expenses. From there, you can calculate your profit or loss for the given period. Some business owners even create monthly income, quarterly or yearly statements.

- The income statement is one of the three key financial statements used to assess a company’s financial position.

- The five components of the income statement are sales , cost of goods sold, gross profit, operating expenses, and net income or loss.

- It is the required format for external reporting according to GAAP.

- For small to medium-sized enterprises , creating an income statement can be a time-consuming and costly process.

- Learn double entry bookkeeping with an online balance sheet & income statement.

Creating income statements will help you track your income, net profit and more to keep you organized. A multiple step income statement is a more complex income statement which splits out different types of revenue and expense, allowing detailed analysis of the business. Operating revenues and expenses are segregated from nonoperating income and costs, for example. This document will also generate a gross profit figure for your business. An income statement shows a company’s income versus expenses over a given period. It shows whether the company is making profit or is in loss, by subtracting total expenses from total income. Both the income statement and balance sheet are important financial statements – but each has a different function for business owners and investors.

If you require more line items, simply insert additional rows in the section where you need to add revenues or expenses. Then check to make sure the formulas adding up the totals capture those new rows. included in the free Excel file can be easily edited and changed to suit your own business. Fill out the form above to download the free annual P&L template Excel file. The monthly P&L template is perfect for businesses that require regular reporting and detail. By showing all of the information in a series of monthly columns, much more detail is visible than if only the annual figures were shown.

Operating Expenses (opex)

After downloading the Excel file, simply enter your own information in all of the blue font color cells which will automatically produce a monthly or annual statement as the output. The income statement for a service company is generally less complex than the income statement for a merchandising company. A merchandising company may include COGS, refunds and returns, discounts, and more. Because a service company does not deal with tangible materials, these sections are unnecessary. However, a service company may have other expenses to consider, such as travel, promotional materials, etc. The single-step income statement is simple to prepare and offers an overview of the company’s financial position. The multi-step income statement is a little more complicated to prepare and offers a more detailed view of the company’s financial position.

These income statements are often used by both small and large companies. However, they only provide a general overview of the company’s financial position, so many larger companies require a more complex income statement.

No matter how often you want to calculate your profit or loss, the FreshBooks income statement example will be a helpful resource for you. A P&L statement, also referred to as an income statement, measures your business revenue and expenses during a given time period. A comparative income statement compiles income statements for multiple periods into one document using separate columns for easy analysis. For example, a comparative income statement might include the months of January, February, and March, with separate column headings and a full income statement prepared for each month. Using this information, management can easily spot dips and surges in revenue, expenses, and overall profit over the course of time. Cost-Volume-Profit income statements are specialized internal financial statements used to analyze the profitability of various production scenarios.

We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions. The FreshBooks interface allows you to work with your team on accounting projects.