Content

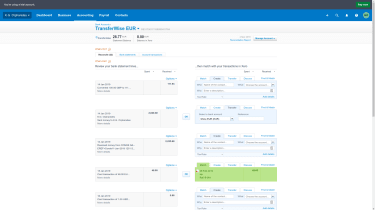

Another option that you have is that you can save it as a template to use again next pay period. This will make it quicker next time around and you will only need to enter the variations.

There’s a check box when you scroll further down, which gives you the option to display the balance of the RDOs on the employees’ payslips. Although you can’t see it in the screen shot, there are more fields underneath. Where it saysExpense Account, select the wages and salaries expense account you’d like to link this to.

Leave A Reply Cancel Reply

Try it for a few pay runs and see if that produces the same calculation as you would have done manually. My previous support case came with the response “manually adjust the number of hours to reflect what you would like processed”. I can’t see how many, many small businesses aren’t in the same situation. Then select a date, generally the end of the last month or quarter, so no changes can be made to the data prior to that date.

The pay run has drawn the ordinary hours from the timesheet and the RDO from the approved leave application. If you compare it to the screen shot earlier, you’ll see that the dollar value is exactly the same, as we’re still paying 38 hours. You can revert back to a draft if you need to correct anything.

Adjusting entries occur at the end of the accounting period and affect one balance sheet account and one income statement account . An accrued expense occurs when an accounting period is coming to a close and there are unpaid expenses and unrecorded liabilities. For example, wages that have been earned but not yet disbursed would represent an accrued expense. Companies handle accrued expenses by making adjusting entries to the general journal.

Automated Prepayments And Accrual Schedule

This is just the first step for Holidays and it currently works with leave requests. When the request dates includes a holiday for the employee, the number of hours requested is automatically reduced by the number of holidays falling within the date range. For example, a request for 26–30 January 2015 will automatically calculate the 26th as public holiday in Australia, for Australia Day, and reduce the required number of hours requested. Managing leave requests where the dates include public holidays is a real chore.

Accounting can be done on a cash or accruals basis, and it is very important to understand the distinction. Check out this help doc to learn more about setting up PayPal accounts in Xero as part of your Xero Setup process.

- Make sure you set these up using the correct names so they are later coded accurately, to ensure you get a clear view of how your business is running.

- As Xero automatically matches your accounting record with statement lines, a lot of small business owners mistakenly think they can skip this particular step in both the initial step up and daily use.

- Unpaid expenses become and continue to be accruals on the Balance Sheet from accounting period to accounting period as long as the liability remains.

- Can someone please let me know how often the leave accrual is calculated?

- To join the flat rate scheme your turnover must be £150,000 or less , and you must apply to HMRC.

- In accrual accounting, the transaction has been recorded immediately or in the same period, even when the cash has not been paid or received.

However, if you don’t need the payroll function, then they are similar in pricing. All plans with Xero, including their starter plan, include payroll and can process 1099s. You can prevent this by using the ‘lock dates’ feature of Xero. Locking dates should become part of your process each time a reporting period is finalised . The cash sale allows them to stay on top of cash flow, but to work out whether their sales function is performing, the accrual report is more relevant. The bank reconciliation process is a key check to pick up missing transactions or duplicated transactions in Xero.

Because Xero automatically matches statement lines with the accounting record, a lot of people think they can skip this step. This is a crucial process and still needs to be done with Xero to make 100% sure that Xero has imported your bank statement lines properly. If you are using an external Payment Gateway like Stripe, these funds are transferred into your business bank account as daily batches rather than individual transactions. This means individual sales and processing fees aren’t accounted for fully.

Xero

Expenses are recorded on the Balance Sheet in the period they occur, even if not paid. Unpaid expenses become and continue to be accruals on the Balance Sheet from accounting period to accounting period as long as the liability remains. The implication of this principle is that you cannot always wait until cash changes hands to record an expense. Say, for example, a company has a biweekly payroll expense of $10,000, but the current pay period is split evenly in half between two accounting periods. That means half of those wages have already been earned at the end of the current accounting period. You must record half of the full amount—$5,000—during the current accounting period even if the employee paychecks won’t be written until the following accounting period. The accrual basis of accounting states that you must record revenues and expenses in the period in which they are incurred, not when cash is received or paid.

It’s more work because you have to watch invoices, not just your bank account. You have a much more accurate picture of business performance and finances. It’s doesn’t help when you’re making management decisions, as you only have a day-to-day view of finances. It’s an easier option for calculating tax, though not all businesses are allowed to use it. You’re right, a small adjustment is needed for the decimals to sum to the exact number. So expect ~30seconds to do such adjustment at the start or end of the period. The amount of time it would save across all XERO users would be incalculable.

I’m not sure if this would help others but it would be great for us if an employee could be assigned multiple holiday groups. Some of our employees have additional annual leave dates (eg. religious holidays) so it would great if we could assign all employees the State public holidays and set certain people to have an additional group of holidays. Some types of businesses use a hybrid accounting system. They may base big financial decisions and things like loan applications on accrual accounting but use cash-basis accounting to simplify some elements of their tax. There are lots of rules around who can and can’t do this. Speak to an accountant or tax professional to find out what applies to you.

Want Help With Your Xero Setup?

@Catherine – I would think that FA roles are the most likely to use account reconciliation functions. But, like with Cash Coding, I think that there are times when non-FAs would like this as well. I’ll need to get more details from the product team on thoughts or plans for reconciliation of other accounts. Would you expect it to be a financial advisor only task that would appear perhaps in the suite of reconciliation reports on the Advisor tab? Navigate to the Leave tab and click on Annual Leave balance.

Melissa enter sick leave the same way as fulltime employees and you can adjust the hours taken after you have entered the leave date. Alternatively average their hours and divide by 5 days. The reason why we use this method of entering the hours into a timesheet first is so that the payroll administrator is less likely to make errors. By entering the timesheets a day at a time and making sure that the total number of hours match for each day and each week, and that the hours are correctly allocated to each pay item, accuracy is increased. It’s easy to get confused when you’ve got a lot of different pay items and you’re relying on your brain power. If you’re having a bad day or working late at night, errors are just too easy to make.

Yah Cassandra I just logged on to comment on the same thing – New Years Day 2015 is in the 2014 year (& not where it should be in 2015) and Christmas Day & Boxing Day 2014 are missing all together!! Does this mean Christmas has passed us by again and I missed it… It would also be nice if they were actually in date order & you could add dates as required. Great initiative BUT it does not appear to contain the balance of Public Holidays for this year – specifically Xmas Dan and Boxing Day. Check out the help information on getting holidays setup correctly, click here if you’re in Australiaand here if you’re in the US.

Us Payroll Reports, Annual Forms And Electronic Filing

Not because the software is lacking, but an accountant is best placed to help advise on best use, translate your findings into actionable strategies, and, moreover, do all that boring reconciling for you. We won’t lie, there are parts of Xero that are tricky to get used to. Some users have stated they’ve found refunds and credit notes awkward to make, based solely upon the existing information on the Xero resources page. And if you choose to start using Xero halfway through the current tax year, it is a lengthy and for some, painful, process to reconcile all your existing data into the software. But a lot of the teething problems associated with the switch are just that, minor and fleeting issues. Our blog is made up from years of Kent accountancy experience built up from helping companies across the UK grow and succeed. Yes, I’d like to receive weekly tips to grow my business, resources and special offers from Bean Ninjas in my inbox.

It works for leave accrual, but not for leave deductions, meaning I have to manually override any leave entries to ensure they are deducting 7.6 hours x number of leave days requested. @Tom – The ‘Hours in a Monthly pay period’ will determine the amount that accrues each pay period, based on hours worked.

For example, if the current pay period is split in half, you’d record half of the payroll this period and half next time. Then, record the accrued expense by debiting your expense account and crediting the relevant payable account. Don’t forget to reverse the entry in your next accounting period so you don’t count the expense twice. Many accounting software packages have options to do this automatically. Once you have identified the accrued expenses, you must calculate the amount of the accrual by prorating the portion of the total expense that falls into the current accounting period. @Neil – It sounds like these leave accruals are set up to be a fixed amount per pay period.

From Payroll, select Employees and choose an existing employee. Hi there, I too am having trouble with the labour day public holiday. @James and David, we’ve picked up an issue that we’ll get fixed ASAP around removing and adding the holiday again. Love it that you are adding features like this – just adds to the ‘automated’ feel.