Content

Once file is processed and the data formatted for Xero, we are saving documents into Xero on your behalf. We save the documents one by one and closely monitor all the responses we receive from Xero, to ensure all your data is saved into Xero.

This program is fully tailored to your file format and it won’t be used by anybody else, but you. It means that we have the freedom to create a program which will completely meet all of your requirements. All your bank statement transactions will automatically appear in your Xero Accounting. However, if you can’t set up your bank feed, your alternative will be manual import.

You can directly upload PDF copies that you have scanned or received from vendors. If a vendor emails you an attachment, you can forward it to your own unique Hubdoc email. You could even set that as the default email with your vendor’s accounts payable department.

Xero Simply Omits The Tax Rate In My Invoices If Items Are Tax Exempt Back To Top

Now you have to select a Bank account or Credit Card account to import transactions into. Once your Xero compatible file (.CSV) is downloaded, go to your Xero account to import the invoice. Xero is a cloud-based accounting software platform that enables you to track your finances, manage invoices, and reconcile accounts. Once we receive an email with file from you, EntryRocket will automatically process them using custom program . In this step we will apply all the custom rules you requested during the setup process. Before we start, we’ll ask you for samples of files which you need to import into Xero, based on which we’ll create our custom program.

AutoEntry can also read data from bills and invoices to create transactions that can be imported into Xero. This means that individual users with access to the Hubdoc files won’t need direct access to bank and credit card accounts. Having everything in one easily accessible place saves time, and allows the business owners to keep control of sensitive account access. Look for the ‘Manually import a statement’ or click on ‘Manage Account’ and look for the link ‘Import a Statement’.

Create a new WooCommerce 0% tax rate with a name that exactly matches your 0% rate in Xero. Xero creates a 0% tax rate upon account setup named Tax Exempt so it’s recommended to copy the name exactly. View tax returns, letters, agreements, invoices, receipts, and other key documents wherever, whenever. You can import transactions into Xero from Excel, Text or IIF files. Follow these steps to understand the process involved and better understand the advantages and limitations. There are several ways to send specific items like receipts and bills received from vendors to Hubdoc.

Why Accountants Use Business Importer To Import Transactions Into Xero:

You can import a CSV file into Xero with your invoice details. Before you can do this, you’ll need to set up vintrace so that it can export the necessary invoice information for Xero. Once this set up is completed, you’ll be able to export the invoices from vintrace to a CSV file, the import that file into Xero.

Your client requires you to send documentation with your invoices. Individual documents can be used to create a new transaction within Xero Files. Being able to quickly access additional information contained in the transaction source documents can help you make better informed decisions quickly.

We use a combination of all three with most of our clients. Share a file with another app, or attach files directly to Xero invoices or receipts from file storage apps on your iOS mobile device.

So, this way you delete all those transactions you just imported. Then look for the account you want to import your transactions into and click ‘Manage Account’ – ‘Import a statement’. Many of our clients use other document storage systems such as Dropbox or the like. However, we still use Xero Files with these clients.

Our fully customized system will solve any problem you may have with importing any file in Xero. In 5 simple steps, we will speed up your workflow and import documents in any way you want. Step by step workflow on how EntryRocket simplifies the process of importing your files into Xero. Learn how easy it is to actually import files with EntryRocket. In case you have any additional questions, please don’t hesitate to contact us.

I Am Getting An Error Sending Invoices: taxtype Code xxx Cannot Be Used With Account Code yyy Back To Top

Select Xero and choose the company’s name you want to import entities to. Register at Business Importer and sign in to your account. It’s all online, so you can work when and where you want to.

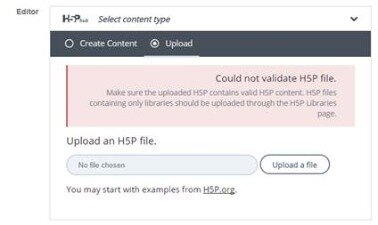

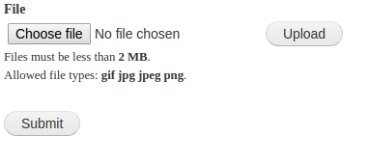

In your accounting software, look for “Upload a bank file” or similar links to upload the created CSV file. Data from the documents imported into Hubdoc can be read and converted into transactions.

Checks can be attached under the account transactions. Fixed Assets and Inventory items have to be approved by someone in an Advisor role before it will allow you to attach to it. The Advisor Journal requires the user to be configured as a Financial Advisor in General Settings. Reports need to be published first to attach to it. You can attach documents using the new SmartVault Toolbar for Xero. The list of supported entries to which you may attach documents is shown below. Documents attached to these transactions are uploaded to their respective folders in SmartVault.

Xero is an easy to use online accounting software that’s designed specifically for small businesses. As soon as an import is finished, you will be notified by email. Import transactions into Xero easily and without errors. Once the transactions are imported, you can review, categorize them under the account. Let’s say you realized, that it is incorrect imported QBO file or something wrong with a file, or you don’t want those transactions to be here. Hubdoc is one example of an app that can help with this. In Hubdoc, you provide your bank credentials so Hubdoc can automatically retrieve your bank and credit card statements.

“Files” is the first option within the Organization Menu. Within Xero Files, documents can be uploaded and used to create transactions or organized into folders. Many businesses trust online services like Dropbox, Microsoft OneDrive, and Google Drive to store and share documents digitally. This is useful as it prevents you from accidentally importing the same invoices multiple times. If any problems are found, they’ll be reported to you. The imported invoices will have a Draft status and will be ready for review and approval.

Exporting An Invoice To A Xero File

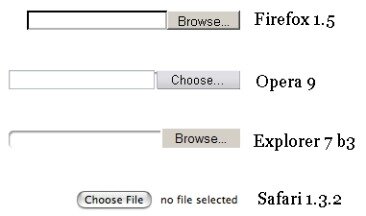

Your CSV file name will now appear next to the Browse button. In my example below, my CSV file name isBank Statement CSV file.csv. All other columns in your CSV file are Optional Columns. You may add in additional information to your CSV file for your reference when you do your bank reconciliation in Xero. Xero will only import your data if these 2 columns contains data.

- This will need to be either a Bank account type or a Revenue/Sales account type.

- App name – this is the name of your application, choose an easy to remember name.

- You can use Microsoft ExcelorGoogle Sheets to prepare your data.

- The Advisor Journal requires the user to be configured as a Financial Advisor in General Settings.

- Choose a plan depending on your needs or start a free 14-day trial to experience the amazing benefits Business Importer for Xero has to offer for your business.

Paddle provides all customer service inquiries and handles returns. Import transactions into Xero using Business Importer. What the benefits of using Business Importer are, read in our article.

Categorize transactions by selecting the account. And then transactions will be under your account. Names, like ‘Date’, ‘Amount’, ‘Payee’, ‘Description’, ‘Reference’, ‘Check number’ are from the CSV file. So when you create a CSV file with ProperSoft converter and you select the option ‘CSV Target’ as Xero, it will add the header column names to the CSV file. So it’s easier than to map it when you import into Xero. And another thing it will name the columns that Xero can understand automatically map.

If you integrate Hubdoc with Xero, you can also have Hubdoc push those statements right into Xero Files. When our bookkeepers go to work on one of our bookkeeping clients, all the needed bank and credit card statements are already in Xero Files. As soon as we begin working with a new client, we create new folders in Xero Files in order to organize and find stored documents later. We generally will create a folder for each bank and credit card account.

If you open your CSV file inNotepad to see its data, it will look intimidating to you (I know, it looks like programming codes, don’t you think?). Don’t worry, we are not going to type our data in aNotepad. CSV is the most common upload file used right now. In today’s blog post, you will learn how to prepare and upload a CSV file into Xero Accounting. The first step of bank reconciliation in Xero Accounting is to get your bank statement into Xero. There is 2 ways to do so, which is bank feed and manual import.