Content

As noted in my post above these transactions follow the same number sequence. I am the auditor and one of the first places I looked was on the Assurance Dashboard. Still, I was unable to find the missing invoices.

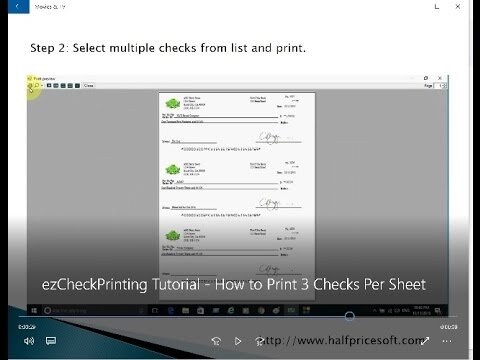

- You can now print top, middle or bottom checks with vouchers.

- Hi everyone, Come on over to the new discussions in Xero Central.

- One way that a deleted invoice can fail to appear in the Customer Invoice Report is if the invoice was deleted when it was in “Awaiting Approval” status.

- To keep track of users, you can run the History & Notes activity report from the Advisor tab to see a summary of what you’re users have been doing in the organisation.

If you can’t see this and there are definitely files attached, touch base with Support. I feel it would be useful when reviewing the Account Transactions to see at a glance whether the bill for a purchase ledger payment has a file attached and then be able to access this. At present you can only view attached files for direct payments. I would like a report that shows number of entries processed and the number of invoices attached.

I have this same issue with an invoice sent only a week ago. I only found out now, when the customer has paid the invoice, but there is no invoice to book the payment against. There are other invoices sent since that particular invoice, and they are still there. Over time, your list of customers, suppliers and contacts will grow. To keep things organised, your accounting software can become the central hub for all your business connections.

For accounting and bookkeeping partners who store and print checks for multiple clients, blank stock also reduces the costs of storing and managing unique check inventories. We are going to add WFM to Xero and need to be able to allocate job numbers to invoices, purchases etc. When posting transactions, whether these are supplier invoices, customer invoices, journals or bank transactions, you can then enter the job number from a drop down list.

Can I Map Products Or Product Categories To Different Xero Account Codes? Back To Top

Right now i have to send our accountant 3 different overviews and pray that he understands the different formats. To keep track of users, you can run the History & Notes activity report from the Advisor tab to see a summary of what you’re users have been doing in the organisation. You may also find info in the Users screen helpful. I would also like to know the number of hours each user is loged into xero.

When preparing an Income Tax Return, I would like to have the option of having the Tax File Number displayed at all times whilst preparing the tax return. Within the next few weeks, we will be concealing the TFN from the Clients Details screen once again. However we will also introduce a preference within Staff settings that will let admins within Tax and Practice Manager specify which users have the ability to view sensitive tax information. An in-app notification will go live prior to release. Can I suggest having “TFN show on hover” as privilege that can be set for appropriate staff in staff settings? From a privacy perspective, that’s no material difference to being able to see it when editing a tax client.

Select from multiple print layouts–including 3-up checks–so you can print on almost any type of check stock. I don’t want to be using a third party software, or spreadsheets. I want my accounting software to manage all of my costs in one place. Try pasting the error into the search bar above, to find an article relating to your sync error. If the errors persist, please contact Customer Support. While you can sync manually at any time, the sync automatically runs approximately 24 hours after the most recent sync. You can leave the sync screen at any time and continue to work in Bill.com.

Why Didnt My Contact’s Address Or Phone Number Sync To Bill Com?

It would make auditing quicker and easier and it seems a waste of potential. 2) Work out which invoices do not have attachments – e.g. the invoice has been created but the attachment hasn’t been uploaded for some reason – maybe human error. I’d love to be able to do an audit for a certain period and see a report of all “spent” transactions that don’t have an attachment loaded against the record. For the workaround, I note that I can’t see a file icon so I’ll raise a support request as you’ve suggested above. Hi Paul, check out this screenshot which is of the Account Transactions tab of a bank account in our Demo Company. You’ll see the file icon in the far right hand column.

I think it would be great to have the search feature to include “search whether transaction are tagged to a file”. Hi Peter, there’s no report that shows all your transactions and whether they have Files attached or not. However, you can look at the Account Transactions tab in each of the Bank Accounts to see which transactions have attachments.

We are no longer able to see the TFN on the client record. It was bad enough that there were spaces in the TFN which have to be removed every time we enter them into the ATO portal. But to now make us search for the TFN as well is a bit much.

If you can make it so that we can turn the feature on/off as we please, that would be most appreciated. We have a bit of discussion on this thread requesting multiple sequences, that’d allow the type of setup your describing. While it’s not in the cards right now, if there’s any movement towards a feature of this kind we’ll be sure to post there to let you all know.

I’ve checked the CN situation and this isn’t affecting the missing sequences. The TFN doesn’t print on reports in Draft mode, however it does when Completed. The option “Show TFN” becomes visible when printing. Please advise how I can restore this feature back onto my screen.

No sorry, I am meaning when you bring up a report of account transactions, i.e. all account transactions coded to repairs & maintenance or office expenses for example. Withing the account transactions report you have to drill into the individual transactions to see if any files are attached. Would be time saving and helpful to have a column in this report to show if files are attached. This basically means that i can not submit an overview of all our transactions to our accountant so he can check every single invoice. 1) Work out which payment transactions are linked to an invoice and which ones are not.

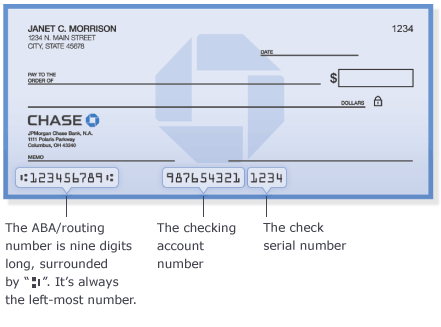

Once done, just save the information and you’ve just added a tracked inventory item. You can also add the purchase price, sales price while setting up the item. This only gives you the convenience of not entering the purchase or sales price on every bill or invoice respectively. In order to make them “Tracked”, you need to check mark a box, “I track this item”. That’s not all, there are certain other steps as well to follow. However, this feature is not allowed when you track your inventory in Xero as it simply does not let your inventory go in negative. When printing MICR encoded checks, we recommend using stock with built-in security features.

You can provide your phone number and ask us to contact you if needed. Just let us know the preferred time to call, and which country you’re in. But if you come across a customer support phone number on the web that claims to be the official Xero support number, it’s a scam, and they may try to charge you for help if you call it. Xero doesn’t have a support phone number and doesn’t charge customers for support.Find out how to keep your Xero account safe. Xero provides free and unlimited online support, 24 hours a day, seven days a week, as part of your Xero subscription. The first port of call for getting support with any of Xero’s business or practice products is Xero Central, where you’ll find online help, online learning, and discussions.

Print Micr Encoded Checks On Blank Stock (us)

The new functionality sounds great, but I think details are lacking. If you still have pre-printed check stock, the lack of precision when setting up the check is a huge inconvenience. With the old styles, I could specify the exact position of the elements.

I don’t want my bookkeeper creating transaction from the bank rec without attaching an invoice. I would like to see the completness of my accounts and records. The accountants and bookkeepers listed in the advisor directory all have at least eight clients on Xero and have staff members who are trained in Xero. Explore advisors by location to find an accountant or bookkeeper near you. There’s no charge for the support provided by the Xero support team, whether it’s online or over the phone. Your accountant or bookkeeper may also offer help as part of their services to you. But anyone or any website claiming to be the official Xero support channel and charging for support is acting fraudulently.

Small businesses, accountants and bookkeepers locally and across the world trust Xero with their numbers. Keep your practice a step ahead with Xero accounting software.

Right now, every invoice needs a unique invoice # in order to be saved. Sure, will change it manually when creating an invoice. Hi Danlu, there’s no way to stop the automatic sequencing of invoice numbers. However, you can change the prefix & sequence from the Invoice Settings, or manually adjust the # when entering an invoice. In case you need to know something else and feel that I’ve not been comprehensive enough, just let me know in the comments section.

Xero provides a pre-defined spreadsheet/CSV template using which you can add your items. This method is way quicker than the one explained above especially when you have bulk of items to be added.

Because of Xero’s unique bank account setup, bank accounts can only be created in Xero and then synced over to Bill.com. Only unpaid Bills and invoices will sync from Xero to Bill.com. We do not sync historical Paid bills and invoices. This is not yet an option in the Xero plugin, however, it is theoretically possible by creating a custom function that hooks into the woocommerce_xero_line_item_account_code filter. Your custom function would need to check the category ID or product ID and return an integer representing the Xero sales account code(must be a Revenue/Sales account type).

Once you have done this, whatever you have set in as your tax rate label in WooCommerce will match what is already existing in your Xero account. Yes, if you have a Xero account with multi-currency capability. Create a new WooCommerce 0% tax rate with a name that exactly matches your 0% rate in Xero.

Not The Answer You’re Looking For? Browse Other Questions Tagged C# Xero

Just go to the check style editor, select Paper Layout, and choose your preferred layout. When it comes to check layouts, we understand that one size doesn’t fit all.