Like the first accounting year, the depreciation expense recorded in the last year also needs to be adjusted by the time factor to ensure that the asset is not depreciated above its depreciable cost or after its sale. There are a lot of reasons businesses choose to use the straight line depreciation method. Business owners use straight line depreciation to write off the expense of a fixed asset. The straight line method of depreciation gradually reduces the value of fixed or tangible assets by a set amount over a specific period of time. Only tangible assets, or assets you can touch, can be depreciated, with intangible assets amortized instead.

How is straight-line method of depreciation calculated?

So, the amount of depreciation declines over time, and continues until the salvage value is reached. The straight line method charges the same amount of depreciation in every accounting period that falls within an asset’s useful life. Depreciation expense in the year of acquiring an asset is the full year’s depreciation expense calculated using the straight line depreciation formula and multiplying that by the time factor. To calculate the straight line basis, take the purchase price of an asset and then subtract the salvage value, its estimated value when it is no longer expected to be needed. Then divide the resulting figure by the total number of years the asset is expected to be useful.

Part 2: Your Current Nest Egg

Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years. If you don’t expect the asset to be worth much at the end of its useful life, be sure to figure that into the calculation. Accumulated depreciation on 30 June 2020 will therefore be $2000 x 2.5 which is equal to $5000. For instance, let’s take an example of Acer Computer, which buys a $2,000 McAfee antivirus software that won’t be used for five years, and its estimated residual value is $500. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

How to Calculate Straight Line Depreciation

Straight line method is also convenient to use where no reliable estimate can be made regarding the pattern of economic benefits expected to be derived over an asset’s useful life. This depreciation method is appropriate where economic benefits from an asset are expected to be realized evenly over its useful life. Sally can now record straight line depreciation for her furniture each month for the next seven years. Sara runs a small nonprofit that recently purchased a copier for the office.

- The total cost of the furniture and fixtures, including tax and delivery, was $9,000.

- The straight-line depreciation method is one of the depreciation calculation techniques in which the value of the asset is depreciated/reduced evenly throughout its useful life.

- For instance, if you use the straight-line method to calculate depreciation expenses for your company’s assets each month, your total depreciation will be $300.

- Depreciation is an expense that should be adequately calculated and included in the financial statement.

- Most businesses prefer straight-line depreciation, although some use the double declining balancing method or sum of years digits for their books because it results in more write-offs at the beginning of an asset’s life.

The unit of production method is similar to straight-line depreciation, just that in the straight-line method, we measure depreciation using currency. When calculating an asset’s cost, ensure to add all related expenses, such as labor, materials, taxes, and more. The most important difference between this formula and other common depreciation formulas is the denominator. Other methods have a denominator of 1 or 1/2 depending on whether an asset was acquired during its first year or after it had been in use for 1 year. The denominator in straight-line depreciation is 1/ Estimated Useful Life, which has the effect of making 1/ Estimated Useful Life much larger than 1 or 1/2 when an asset is new.

Why should your small business calculate straight line depreciation?

In the last line of the chart, notice that 25% of $3,797 is $949, not the $797 that’s listed. However, the total depreciation allowed is equal to the initial cost minus the salvage value, which is $9,000. At the point where this amount is reached, no further depreciation is allowed. Calculating straight line depreciation is a five-step process, with a sixth step added if you’re expensing depreciation monthly. The last accounting year in which an asset is depreciated is either the one in which it is sold or the one in which its useful life expires.

The straight line calculation, as the name suggests, is a straight line drop in asset value. Note how the book value of the machine at the end of year 5 is the same as the salvage value. Over the useful life of an asset, the value of an asset should depreciate to its salvage value.

This $1,000 is expensed to a contra account called accumulated depreciation until $500 is left on the books as the value of the equipment. The final cost of the tractor, including tax and delivery, is $25,000, and the expected salvage value is $6,000. According to the table above, Jim can depreciate the tractor over a three-year period.

This method is mainly used for equipment and tools that wear out rather than over time, such as those that produce a certain number of units, travel a certain number of miles, or produce a certain amount of electricity. There are different methods of depreciation, such as Straight-Line Depreciation (SLD), which has been discussed, Double-Declining Balancing Method (DDB), Sum Years Digit Method (SYD), or Unit of Production Method (UPM). The residual value is how much you expect an asset to be worth after its useful life. From the above example, a monkey expects the peeling machine to cost $2000 at the end of its useful life. These kinds of accounts have a credit balance, which implies that they decrease the value of an asset as their balance increases. This method works best for equipment and tools that wear out with use—as they produce a certain number of units, travel a certain number of miles, produce a certain amount of electricity, etc.—rather than over time.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

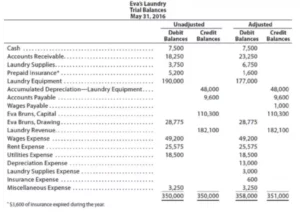

In finance, a straight-line basis is a method for calculating depreciation and amortization. It is calculated by subtracting an asset’s salvage value from its current value and dividing the result by the number of years until it reaches its salvage value. Recording depreciation affects both your income statement and your balance sheet. To record the purchase of the copier and the monthly depreciation expense, you’ll need to make the following journal entries. All accounting years other than the first and the last one are charged depreciation expense in full using the straight line depreciation formula above.

The initial cost of an asset will determine how much is depreciated each year. You would debit a depreciation expense account of $300 each month and credit an asset called an accumulated depreciation account. The straight-line method of depreciation can be used to depreciate almost any type of tangible assets such as property, furniture, computers, and equipment. You would also credit a special kind of asset account called an accumulated depreciation account. These accounts have credit balance (when an asset has a credit balance, it’s like it has a ‘negative’ balance) meaning that they decrease the value of your assets as they increase.

Remember to adjust the depreciation expense downwards when an asset has been acquired or disposed off during the accounting period to avoid charging depreciation for the time the asset was not available for use. With the straight line depreciation method, the value of an asset is reduced uniformly over each period until it reaches its salvage value. Straight line depreciation is the most commonly used and straightforward depreciation method for allocating the cost of a capital asset. It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. Many accountants use a simple, easy-to-use method called the straight-line basis.

Calculate depreciation expense for the years ending 30 June 2013 and 30 June 2014. Suppose an asset for a business cost $11,000, will have a life of 5 years and a salvage value of $1,000. One of the most obvious pitfalls of using this method is that the useful life calculation is often based on guesswork.

In case you’re confused at any step, read the explanation below the depreciation schedule. The straight-line depreciation method is one of the depreciation calculation techniques in which the value of the asset is depreciated/reduced evenly throughout its useful life. If you don’t expect your asset’s expenses to change greatly over its useful life, it may be the best choice for calculating depreciation. Straight-line depreciation is a simple method for calculating how much a particular fixed asset depreciates (loses value) over time.

Similarly, in the last accounting year, we need to reduce the depreciation expense to just 9 months because the asset will complete its useful life at the end of the ninth month of the year 2025. In the first accounting year, the asset is available only for 3 months, so we need to restrict the depreciation charge to only 3/12 of the annual expense. Using this amount, we can calculate the depreciation expense, accumulated depreciation, and carrying value of the asset for each year as follows.