Content

The balance sheet is a very important financial statement that summarizes a company’s assets and liabilities . A balance sheet is used to gain insight into the financial strength of a company. You can also see how the company resources are distributed and compare the information with similar companies.

Thus, getting an online free balance sheet template can be best choice to serve the purpose in a more sophisticated and professional manner. Once you’ve read the assets, it’s important that you focus on the liabilities.

In addition to this, the document further describes how each asset is financed either through debt or equity. Put in simple terms; a balance sheet is summarizes everything that a company owns and owes and the amount invested by shareholders. Plus, they provide useful information that can help you make sound investment decisions. Save time, protect financial assets, and increase accuracy with free bank reconciliation templates.

For instance, an investor can start a company and fund it with $5 million. Retainer income is the amount of net income a company decides to keep and pay it out as dividends.

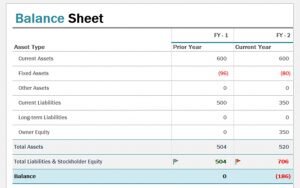

One way to add more insight to such an analysis is to test the proportions of each balance sheet line item over time to show trends, outliers, or potential errors. When rows are added or deleted, the dynamic summationsshould automatically update to include all items within an individual section of the balance sheet regardless of where the item was added or removed.

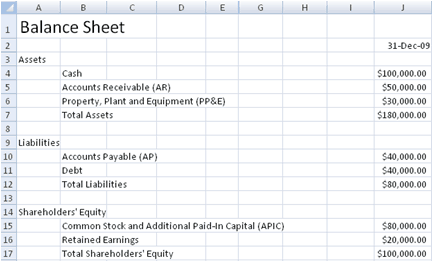

Basic Balance Sheet Template

Balance sheet templates, such as the Investment Property Balance Sheet allow you to easily factor in details such as property costs, expenses, rental and taxable income, selling costs, and capital gains. Similarly, the Trucking Company Balance Sheet allows you to keep track of profitability on a truck-by-truck basis, so that all pertinent details can be added to each of our individual balance sheet templates. Track your month-by-month and quarterly financial position by entering each month’s assets and liabilities, resulting in monthly and quarterly perspectives of your owner’s equity. Monthly columns provide you with assets, liabilities and equity tallies, and also reflect three-month figures for each quarter. This is the perfect template for short-term analysis of fiscal health, and can also be used for year-over-year monthly and quarterly comparisons. Designed with secondary or investment properties in mind, this comprehensive balance sheet template allows you to factor in all details relating to your investment property’s growth in value. You can easily factor in property costs, expenses, rental and taxable income, selling costs, and capital gains.

Be sure to enter it as a negative number so the spreadsheet will subtract it from Total Fixed Assets. Most business owners don’t dive into entrepreneurship because they are excited about the accounting process, but a basic understanding of accounting sets a successful business apart from those that struggle. Fortunately, many places and people are willing to help you learn, including your accountant, your bookkeeper (if you employ one and don’t do the books yourself), as well as the resources at SCORE. 6- Financial investors and share holders both are very keen while investing. They gather information for every possible way to know and learn actual financial position.

- Able to satisfy your requirements.Get with a solitary click.Equipped with astounding contents.Easily printable and powerful template.

- Long-term– Assets and liabilities not meeting the definition of current should be reflected as long-term (i.e., outside of the current classification).

- This process is typically performed monthly for efficiency and to prevent errors from carrying over from one month or year to the next.

- It can be looked at on its own, and in conjunction with other statements like the income statement and cash flow statement to get a full picture of a company’s health.

- This document provides all information about cash flow during any transactions and also referred as statement of financial position.

- You can conveniently mention other crucial details about accounts on a balance sheet to easily get information at the time of requirement.

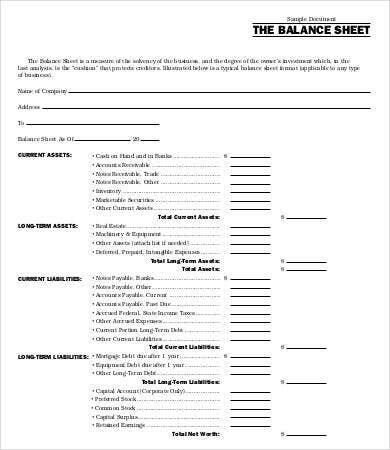

In financial terms, current assists include every item that a company owns and can be converted into liquid cash within a period of one year. These items include accounts receivables, inventories and cash and cash equivalents, marketable securities, and prepaid expenses, among others. Certain detailed balance sheet templates, such as the trucking balance sheet template, allow you to track equity on a truck-by-truck basis.

Real Estate Balance Sheet Template

Usually, companies preferred to prepare it on the 1st of every January each year to understand financial standing of the company. You can compare it with previous year’s pictures and then make promptly analysis of the financial progress. Core purpose of this document is to give readers an idea of the company’s financial condition by displaying what the company owns and what the company needs to pay in order to get rid of liabilities. General accountant is the responsible person for making of balance sheet for the business or company and a balance sheet template can be used to prepare it in a professional looking and correct format.

If you are finding ways of time saving then use our offered ready to use formats for conveniently preparing a balance sheet. This balance sheet is designed for your existing small businesses, or with projected data for your small business plan. Annual columns provide year-by-year comparisons of current and fixed assets and current/short-term as well as long-term liabilities so that you can easily determine your company’s equity. This small business balance sheet template includes tallies of your net assets , and your working capital. This comparative balance sheettemplate is set up to show a two-year period along with a vertical analysis of each year. The vertical analysis is based on total assets– the most common denominator used in a vertical analysis of the balance sheet. The purpose of a vertical analysis is to perform a proportional analysisof each individual line item relative another line item.

Liabilities, in its simplest definition, refers to everything that a company owes other parties. Usually, they are categorized into two, i.e., current liabilities and long-term liabilities. Additionally, balance sheet templates allow you to enter projected figures, so that you can see what your quarterly figures must be in order to beat your previous year’s profits.

Accounting Balance Sheet Template

Tangible assets are physical assets such as machinery, buildings, computers, vehicles, to mention a few. Inventory refers to goods that your business/company is ready to sell at market price or lower cost. These refer to payments that your customers owe you and are due within a short duration. Smartsheet provides a better way to unify collaboration and automate workflows so you can spend more time on the work that matters. When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Get up and running fast with streamlined implementation and solution building to address your immediate business needs.

Reconciling an accounts payable account involves matching the general ledger balance with the AP subsidiary ledger . If not, the two ledgers need to be compared closely to identify errors such as missing or incorrect entries. , which outlines all of the company’s outstanding debt, the interest expense, and the principal repayment for every period. Property, Plant, and Equipment (also known as PP&E) capture the company’s tangible fixed assets. Some companies will class out their PP&E by the different types of assets, such as Land, Building, and various types of Equipment. Able to satisfy your requirements.Get with a solitary click.Equipped with astounding contents.Easily printable and powerful template.

You can customize all of the templates offered below for business use or for reconciling personal accounts. For more financial management tools, download cash flow and other accounting templates.

Save this template as a day-by-day, month-by-month, or year-over-year balance sheet — or enter projected figures — to see your financial position and how close you are to reaching your financial goals. A balance sheet represents a snapshot in time; unlike an income statement which is accumulates transactions over a time, the balance sheet presents information as of a specific date. For example, the line item cash is the amount of cash the company has on the date the balance sheet is presented. Many large scale industries, companies, organizations and foundations utilize balance sheet for getting knowledge about its current status. This document offers financial statements of any business consumed by accountants and business owners as a helpful material. The information obtain through balance sheet is relevant according to the time mention on the sheet. No balance sheet statement is complete without an income statement to go along with it.

How Is The Balance Sheet Used In Financial Modeling?

This simple template is unique in its inclusion of insurance considerations and other real estate-related information , and gives you a holistic picture of your property to appreciate year after year. This balance sheet template comes complete with common balance sheet line items.

3- A professional format will make sure you get accurate picture of your firm because only true figures can confirms whether you are getting profit or loss. 2- This format not only beneficial for yourself but also for management to take appropriate decisions. This is basically the amount left over when you subtract Total Liabilities from Total Assets. One of the most important things to note in this step is that intangibles which cannot be sold such as patents, trademarks and brands, they are not assets. With a well-balanced balance sheet, you can determine the average number of days taken to completely sell your inventories. Current liabilities – these are liabilities that are due within a period of one year. Remember, the majority of non-current assets are calculated at a decreasing rate due to depreciation.

Daily Balance Sheet Template

As you will see, it starts with current assets, then non-current assets and total assets. Below that is liabilities and stockholders’ equity which includes current liabilities, non-current liabilities, and finally shareholders’ equity. The balance sheet informs company owners about the net worth of the company at a specific point in time. This is done by subtracting the total liabilities from the total assets to calculate the owner’s equity, also known as shareholder’s equity or simply the net worth. The next thing on the list after liabilities is the shareholder’s equity. Also referred to as net worth or net asset, a shareholder’s equity refers to the total amount of money attributable to the company’s owner. Put in simple terms, is the amount that the shareholder invested in the company during its formation.

Also factor in assumptions, such as years you plan to stay invested in the property, and actual or projected value increase. You can also edit the template to include whatever details you need to provide for renting, refinancing, home-equity lines, and possible eventual sale of your investment property.

It’s simply easier to start with more than you need and delete the items not applicable to your business. To top it all off you can use this balance sheet template to perform a vertical analysis. Reconcile a business credit card account with transaction receipts, and create an expense report for documentation. This template can be used for travel, entertaining clients, or other authorized business expenses. Make sure that your credit card statement matches the transactions reported on the reconciliation template. Companies or individuals can use this general ledger reconciliation template for bank reconciliation.