In accrual accounting, deferred revenue is essential for aligning revenue recognition with the period it is earned, rather than when the payment is received. The initial journal entry will be a debit to the cash account and credit to the unearned revenue account. If you’re using the cash accounting method, there’s no need to worry about revenue recognition since revenue is only recognized when cash is received. A country club collects annual dues from its customers totaling $240, which is charged immediately when a member signs up to join the club.

Deferred Revenue Vs. Accrued Revenue

Referring to the example above, on August 1, when the company’s net income is $0, it would see an increase in current liabilities of $1,200, which would result in cash from operating activities of $1,200. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. While most of your tenants pay their rent monthly, there is one tenant who pays the entire year’s rent in advance. You receive a check in the amount of $12,000 on August 15, which you deposit immediately even though their lease does not begin until September.

Create a free account to unlock this Template

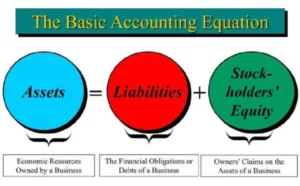

In accrual accounting, a liability is a future financial obligation of a company based on previous business activity. Liabilities are often oversimplified as the debt of a company that must be paid in the future. Long-term deferred revenue, such as multi-year contracts or subscriptions, introduces complexities in financial reporting and requires careful management to ensure compliance with accounting principles.

AccountingTools

As a small business owner, being paid in advance for goods and services can provide a needed boost to cash flow. But as welcome as those funds may be, they’ll need to be handled a little differently than standard revenue. For example, a contractor might use either the percentage-of-completion method or the completed contract method to recognize revenue. Under the percentage-of-completion method, the company would recognize revenue as certain milestones are met. Under the completed-contract method, the company would not recognize any profit until the entire contract, and its terms were fulfilled. As a result, the completed-contract method results in lower revenues and higher deferred revenue than the percentage-of-completion method.

What kinds of businesses deal with deferred revenue?

With a more secure, easy-to-use platform and an average Pro experience of 12 years, there’s no beating Taxfyle. You can connect with a licensed CPA or EA who can file your business tax returns. Free up time in your firm all year by contracting monthly bookkeeping tasks to our platform.

At the end of the first month into the membership, every member has “received” the benefit of having enjoyed the club for one month. Therefore, the country club has satisfied one month (1/12th) of its requirement to offer country club benefits for a full year. Let’s assume that a newspaper company in New York has $1,000 in deferred revenue for its newspaper delivery service. These rules can get complicated—and to top it off, the Financial Accounting Standards Board (FASB) recently overhauled them. For a detailed rundown of how to recognize revenue under the new GAAP rules, check out our guide to revenue recognition. Here, we’ll go over what exactly deferred revenue is, why it’s a liability, and how you can record it on your books.

Under accrual accounting, the timing of revenue recognition and when revenue is considered “earned” depends on when the product or service is delivered to the customer. The simple answer is that they are required to, due to the accounting principles of revenue recognition. In accrual accounting, they are considered liabilities, or a reverse prepaid expense, as the company owes either the cash paid or the goods/services ordered.

The payment is considered a liability because there is still the possibility that the good or service may not be delivered or the buyer might cancel the order. In either case, the company would repay the customer, unless other payment terms were explicitly stated in a signed contract. Distinguishing between deferred (unearned) and recognized (earned) revenue is crucial for transparent financial reporting and compliance with accounting standards. It provides upfront cash, which can be used for operations, even though this cash is only gradually recognized as revenue.

- One reason why small businesses like deferred revenue is because it provides an influx of cash which can help offset business expenses.

- As a result, the company owes the customer what was purchased, and funds can be reclaimed before delivery.

- On the balance sheet, cash would be unaffected, and the deferred revenue liability would be reduced by $100.

- Revenue is recognized even though the customer has not been billed or invoiced.

Deferred revenue, also known as unearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. The company that receives the prepayment records the amount as deferred revenue, a liability on its balance sheet. Accrued expenses refer to expenses that are recognized on the books before they have actually been paid.

Deferred revenue is a payment from a customer for goods or services that have not yet been provided by the seller. The seller records this payment as a liability, because it has not yet been earned. Once the goods or services related to the customer payment are delivered to the customer, the seller can eliminate the liability and instead record revenue. Deferred revenue is common among software and insurance providers, who require up-front payments in exchange for service periods that may last for many months. Although it’s more common for service businesses, other types of businesses also need to account for deferred revenue. Manufacturing businesses often accept deposits for large orders in advance of delivery.

Get $30 off a tax consultation with a licensed CPA or EA, and we’ll be sure to provide you with a robust, bespoke answer to whatever tax problems you may have. Access and download collection of free Templates to help power your productivity and performance. We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. Knowing the right forms and documents to claim each credit and deduction is daunting.

Deferred revenue is a short term liability account because it’s kind of like a debt however, instead of it being money you owe, it’s goods and services owed to customers. Gradually, as the product or service is delivered to the customers over time, the deferred revenue is recognized proportionally on the income statement. Accrual accounting records revenue for products or services that have been delivered before payment has been received. This is the opposite of deferred revenue in a way, that records revenue for services or products yet to be delivered.

On the other hand, revenue is money that the company has earned through its products or services. The opposite of deferred revenue is revenue that has been earned but has yet to be received. Companies must know their deferred revenue balance and properly account for it in their financial statements. This is crucial for accurately representing the company’s financial health and performance.

Suppose a manufacturing company receives $10,000 payment for services that have not yet been delivered. In total, the company collects the entire $1,000 in cash, but only $850 is recognized as revenue on the income statement. Deferred revenue can be set to automatically reverse in basic accounting information systems. Though a company will have to monitor the monthly activity, this frees up analysts time to scrub their financial reports.

This entry reduces the deferred revenue by the monthly fee of $1,250 while recognizing the revenue for January in the appropriate revenue account. This journal entry will need to be repeated for the next five months until the entire amount of deferred revenue has been properly recognized. When you receive the payment, it will need to be recorded in the deferred revenue account since you have yet to provide the services for which your client has paid. However, when your customer pays you for a year’s worth of services in advance, you’ll only recognize the first month of revenue as earned and record the balance as unearned revenue.

Understanding the differences between deferred and accrued revenue and deferred and accrued expenses is essential for sound financial management and reporting. Both concepts create liabilities on the balance sheet and involve the transfer of funds from one account to another when goods or services are provided or received. For the paper-producing company, $1000 is unearned/deferred revenue because it has received cash but has yet to deliver the product. Examples of deferred revenue are commonly seen in various industries, such as training services, delivery services, or newspaper subscriptions. In these cases, customers prepay for services or goods, and the company is obligated to deliver them.