Commercial paper is usually issued at a discount from face value and reflects prevailing market interest rates, and is useful because these liabilities do not need to be registered with the SEC. That is to say, notes and loans are usually listed first, then accounts payable, and finally accrued liabilities and taxes. Typically, vendors provide terms of 15, 30, or 45 days for a customer to pay, meaning the buyer receives the supplies but can pay for them at a later date. These invoices are recorded in accounts payable and act as a short-term loan from a vendor. By allowing a company time to pay off an invoice, the company can generate revenue from the sale of the supplies and manage its cash needs more effectively. A number higher than one is ideal for both the current and quick ratios, since it demonstrates that there are more current assets to pay current short-term debts.

Current Portion of a Note Payable

However, during the company’s current operating period, any portion of the long-term note due that will be paid in the current period is considered a current portion of a note payable. The outstanding balance note payable during the current period remains a noncurrent note payable. On the balance sheet, the current portion of the noncurrent liability is separated from the remaining noncurrent liability.

How much will you need each month during retirement?

In most cases, you will see a list of types of current liabilities and the amount owed in each category. For example, assume the owner of a clothing boutique purchases hangers from a manufacturer on credit. The basics of shipping charges and credit terms were addressed in Merchandising Transactions if you would like to refresh yourself on the mechanics. Also, to review accounts payable, you can also return to Merchandising Transactions for detailed explanations. Current liabilities are obligations that must be paid within one year or the normal operating cycle, whichever is longer, while non-current liabilities are those obligations due in more than one year.

Short-Term and Current Long-Term Debt

A liability occurs when a company has undergone a transaction that has generated an expectation for a future outflow of cash or other economic resources. When a company determines that it received an economic benefit that must be paid within a year, it must immediately record a credit entry for a current liability. Depending on the nature of the received benefit, the company’s accountants classify it as either an asset or expense, which will receive the debit entry. Although the current and quick ratios show how well a company converts its current assets to pay current liabilities, it’s critical to compare the ratios to companies within the same industry. The current liability deferred revenues reports the amount of money a company received from a customer for future services or future shipments of goods.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

What is your current financial priority?

Businesses are always ordering new products or paying vendors for services or merchandise. A balance sheet will list all the types of short-term liabilities a business owes. The good news is that for a loan such as our car loan or even a home loan, the loan is typically what is called fully amortizing. For example, your last (sixtieth) payment would only incur $3.09 in interest, with the remaining payment covering the last of the principle owed.

- The most common is the accounts payable, which arise from a purchase that has not been fully paid off yet, or where the company has recurring credit terms with its suppliers.

- For example, as happens in many countries, taxes are levied on citizens and/or companies, and a firm may be required to collect tax on behalf of the taxing agency.

- On the other hand, on-time payment of the company’s payables is important as well.

- Current liabilities are used to calculate financial ratios which analyze a company’s ability to meet its short-term financial obligations.

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. Unearned revenue, also known as deferred revenue, is a customer’s advance payment for a product or service that has yet to be provided by the company. Some common unearned revenue situations include subscription services, gift cards, advance ticket sales, lawyer retainer fees, and deposits for services. Under accrual accounting, a company does not record revenue as earned until it has provided a product or service, thus adhering to the revenue recognition principle.

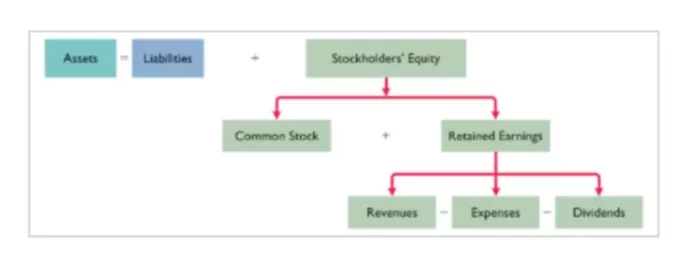

However, the claims of the liabilities come ahead of the stockholders’ claims. For example, as happens in many countries, taxes are levied on citizens and/or companies, and a firm may be required to collect tax on behalf of the taxing agency. No recognition is given to the fact that the present value of these future cash outlays is less. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Working Capital is calculated by subtracting current liabilities from the total current assets available. Not surprisingly, a current liability will show up on the liability side of the balance sheet. In fact, as the balance sheet is often arranged in ascending order of liquidity, the current liability section will almost inevitably appear at the very top of the liability side. Since no interest is payable on December 31, 2023, this balance sheet will not report a liability for interest on this loan. On the other hand, it’s great if the business has sufficient assets to cover its current liabilities, and even a little left over. In that case, it is in a strong position to weather unexpected changes over the next 12 months.

The option to borrow from the lender can be exercised at any time within the agreed time period. This liabilities account is used to track all outstanding payments due to outside vendors and stakeholders. If a company purchases a piece of machinery for $10,000 on short-term credit, to be paid within 30 days, the $10,000 is categorized among accounts payable. In those rare cases where the operating cycle of a business is longer than one year, a current liability is defined as being payable within the term of the operating cycle. The operating cycle is the time period required for a business to acquire inventory, sell it, and convert the sale into cash.

Current liabilities are listed on a company’s balance sheet below its current assets and are calculated as a sum of different accounting heads. Current liabilities are generally a result of operating expenses rather than longer-term investments and are typically paid for by a company’s current assets. Current liabilities are short-term financial obligations that are due either in one year or within the company’s operating cycle.

Suppliers will go so far as to offer companies discounts for paying on time or early. For example, a supplier might offer terms of “3%, 30, net 31,” which means a company gets a 3% discount for paying 30 days or before and owes the full amount 31 days or later. Below, we’ll provide a listing and examples of some of the most common current liabilities found on company balance sheets.

Companies should strive to keep their total amount of current liabilities as low as possible in order to remain profitable. These advance payments are called unearned revenues and include such items as subscriptions or dues received in advance, prepaid rent, and deposits. Short-term debt is typically the total of debt payments owed within the next year. The amount of short-term debt as compared to long-term debt is important when analyzing a company’s financial health. For example, let’s say that two companies in the same industry might have the same amount of total debt. The treatment of current liabilities for each company can vary based on the sector or industry.

Current liabilities are used by analysts, accountants, and investors to gauge how well a company can meet its short-term financial obligations. Current liabilities are used to calculate financial ratios which analyze a company’s ability to meet its short-term financial obligations. Current liabilities are critical for modeling working capital when building a financial model. Transitively, it becomes difficult to forecast a balance sheet and the operating section of the cash flow statement if historical information on the current liabilities of a company is missing. Current liabilities are financial obligations of a business entity that are due and payable within a year.