However, a company is said to be facing financial difficulty and is not in a position to pay off its debts when the value of net current assets is negative. In short, you can use your current assets to monitor your business’s finances and pinpoint problem areas to make adjustments and improvements. On the balance sheet, components of net current assets i.e., current assets and current liabilities appear on the asset side and liability side respectively. Any of your business’s outstanding debts or IOUs are considered accounts receivable.

- The calculation of net current assets turnover is similar to the total assets turnover ratio.

- A current asset—sometimes called a liquid asset—is a short-term asset that a company expects to use up, convert into cash, or sell within one fiscal year or operating cycle.

- Get the scoop on how to calculate current assets for your business and how to use them to evaluate your company’s finances.

- Report these on your company’s income statement over the period the payment covers.

Current assets are short-term assets that can be used up or converted to cash within one year or one operating cycle. Non-current assets are long-term assets that a company expects to use for more than one year or operating cycle. The best way to evaluate your current assets is to compare them to your current liabilities. Generally, having more current assets than current liabilities is a positive sign because it shows good short-term liquidity. However, having too many current assets isn’t always a good thing. A “good” amount of current assets can also vary by industry and your business’s goals.

Download our FREE whitepaper, Use Financial Statements to Assess the Health of Your Business, to learn about the financial statements you need to gather for your calculations. Suppose company ABC has a working capital of Rs 50 Crores, whereas its net sales for a year is Rs 200 Crores.

Another way current assets can be used on your balance sheet is for calculating liquidity ratios. Once having the value for net current assets, you can now analyze whether the company appears to be in good or poor financial health. If your calculation results in a positive number, you know that the company has a positive working capital and should be able to meet its short-term debt obligations.

Characteristics of Net Current Assets Turnover Calculation

However, for a better decision-making process, these ratios should be used simultaneously. No one ratio is self-sufficient in nature while measuring the performance of a company. Current Assets are used to calculate NWC by subtracting current liabilities from total assets on a balance sheet or income statement. This calculation helps investors assess the ability of a company to finance its operations and pay off debt obligations shortly. Net working capital refers to the difference between a company’s total current assets minus its total current liabilities. Therefore, net working capital is not itself a current asset, but a representation of the value of the difference.

Report these on your company’s income statement over the period the payment covers. In your case, having more current assets than current liabilities shows that you have a healthy amount of current assets. Yes, calculating current assets is as easy as doing a little addition. Current assets are directly proportional to net current assets whereas current liabilities are inversely proportional to net current assets. Before you can dive into how to find current assets, you need to learn what current assets are.

Calculating Net Current Assets in Excel

The net current assets turnover ratio expresses the ability of a company’s working capital in promoting the sales of the company. The ratio shows to what extent the day-to-day expenses fuel the net sales of a company. In other words, the ratio is an expression of net sales that occur per unit of net current assets. The Net Current Assets can have a positive or a negative value, wherein the two are an indicator of the well-being of a business.

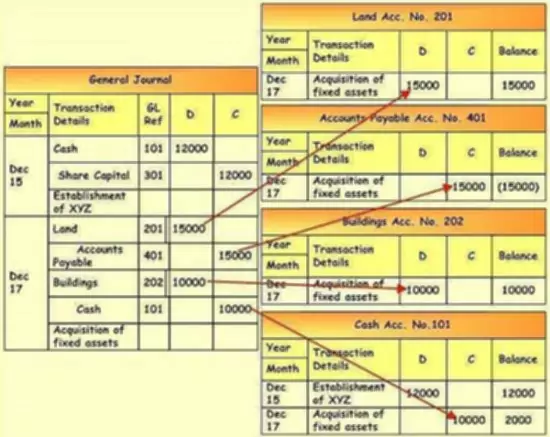

It’s the money that clients or customers still owe you for services already rendered or goods already delivered. Liquid assets are assets that you can quickly turn into cash, like stocks. To enter current liabilities in Excel for the purpose of calculating net current assets, you would enter “Current Liabilities” in cell A2. If you are working on a balance sheet in Microsoft Excel, you can calculate net current assets as outlined below. Prepaid expenses include anything you’ve paid for but expect to benefit from over time. If you’ve paid for a year-long lease or an extended insurance policy, you have prepaid expenses.

Yes, cash is a current asset, as are “cash equivalents” or things that can quickly be converted into cash, like short-term bonds and investments and foreign currency. While cash is the most obvious current asset, it’s not the only one. Here are the seven main types of current assets, listed in order of liquidity (which is how they should be listed on a balance sheet). Use your balance sheet to help find the amounts you need to compute total current assets.

Is Net Working Capital a Current Asset?

In simple terms, Net Current Assets refer to the total amount of current assets, excluding the total amount of current liabilities in a business. Supplies are tricky because they’re only considered current assets until they’re used, at which point they become an expense. If your company has a stock of unused supplies, list them under current assets on your balance sheet. Inventory covers the products you sell and is listed on your balance sheet as finished goods, works-in-progress, raw materials, and supplies.

A current asset is any asset that will provide an economic value for or within one year. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. In the meantime, start building your store with a free 3-day trial of Shopify. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Try Shopify for free, and explore all the tools and services you need to start, run, and grow your business.

Net Current Assets Vs Current Assets

It is a simple formula that can easily be calculated in Excel with information quickly received from a firm’s balance sheet. Current assets consist of assets that can quickly be converted to cash. They include cash, cash equivalents, accounts receivables, and marketable securities. They can and cannot include inventories, as inventory takes time to sell.

Net current assets is the aggregate amount of all current assets, minus the aggregate amount of all current liabilities. There should be a positive amount of net current assets on hand, since this implies that there are sufficient current assets to pay for all current obligations. If the net amount is negative, it could be an indicator that a business is having financial difficulties, and will need additional funding fairly soon.

In case the current assets are greater than the current liabilities, the company possesses sufficient assets to pay off its indebtedness and is operating efficiently. Think of current assets—also frequently (and aptly) referred to as liquid assets—as the glass of water your business can “drink” if it’s thirsty for cash. Your long-term assets, meanwhile, are that glass of ice—you can’t convert these assets to hard currency (i.e., water) as quickly. Even when your business is on track to succeed in the long-term, current assets can be helpful if you need extra money to cover short-term expenses.

- A current asset is any asset that will provide an economic value for or within one year.

- Marketable securities are investments that can be readily converted into cash and traded on public exchanges.

- It is, however, an important metric that sheds light on a company’s liquidity and ability to meet its short-term debt.

- This calculation helps investors assess the ability of a company to finance its operations and pay off debt obligations shortly.

When it comes to your business, keeping up with your finances is a must. And to know where you stand financially, understand how to calculate certain figures, like current assets. Get the scoop on how to calculate current assets for your business and how to use them to evaluate your company’s finances. Marketable securities are investments that can be readily converted into cash and traded on public exchanges. This applies to cryptocurrency, for example, and other more standard marketable securities and short-term investments that are easy to sell. As the name implies, current assets refer to short-term assets that will be used, sold or converted to cash within one year by a company.

Current assets FAQ

Get up and running with free payroll setup, and enjoy free expert support. We can easily see that the net sales and net current working capital is mentioned in this case. Therefore, we may calculate the value of Net Current Assets Turnover. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

What is Net Current Assets Turnover Ratio?

If the calculation results in a negative number, whereby current liabilities exceed current assets, the company may run into problems paying back creditors in the short term. Current liabilities consist of a company’s financial obligations that are due within a year. Current liabilities include short-term debt, accounts payable, dividends payable, and taxes due within a year. Similarly to current assets, current liabilities is a standalone line item on a balance sheet. Some examples of current assets include cash, cash equivalents, short-term investments, accounts receivable, inventory, supplies, and prepaid expenses. It is, however, an important metric that sheds light on a company’s liquidity and ability to meet its short-term debt.

If current assets are greater, then it indicates that the company has enough assets to pay for its obligations. By showing it has positive net current assets, a company underlines the fact that it is liquid and operating efficiently, signifying that it can invest, grow, and take on more debt if need be. Having negative net current assets would indicate that a company is in financial difficulty and would have a hard time meeting its obligations. To calculate net current assets, subtract current liabilities from current assets.