Content

These characteristics are especially valuable in today’s volatile job market. The availability of the online portals makes it easy for clients to access their account. You will need to complete a regionally accredited, four-year degree (bachelor’s) in accounting to be eligible to sit for the CPA exam in most states.

Graduates can pursue careers or go straight into UAF’s associate of applied science in applied accounting. The certificate also counts toward the education required to sit for the CPA exam. Upon graduation, learners should be able to process transactions, analyze financial statements, and perform payroll operations. Graduates can seek employment as bookkeepers, tax accountants, or payroll clerks. Degree-seekers who add another year of study may earn their associate degree in accounting. Created to help energetic, detail-oriented people enter the accounting profession, Southwest Tech’s diploma requires one year to complete.

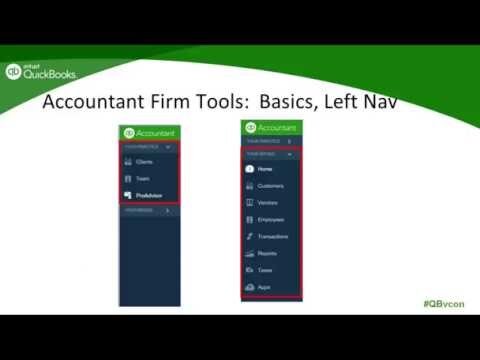

Try us for free—we’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. For business owners who need bookkeeping, tax filing, and tax advisory. To learn about Advanced, QuickBooks is offering webinars and trainings. To access self-paced learning modules and training webinars, accountants just need to login to QBOA, go to the ProAdvisor tab and select Training. They would have missed that opportunity without online accounting. There’s no way they could have waited a year to look at the numbers and spot that opportunity.

The school’s distinctive mascot, Chauncey T. Beaver, first appeared in 1960. It takes about 10 minutes to complete the online application and send the $40 application fee. Applicants must then send high school transcripts or GED certificate scores along with test scores, college transcripts, and proof of residence if applicable. SPC’s online accounting certificate prepares learners to pursue jobs in financial recordkeeping and reporting.

The curriculum consists of 34 credits, including courses in accounting, software, and general education. Coursework includes taxes 1, Microsoft PowerPoint, Sage 50, and career planning in business. SCC offers four accounting and finance certificates to prepare students for employment and growth in the industry. In addition to a general certificate, learners can choose a program in bookkeeping, tax, or payroll. Courses in the program include individual income taxes, principles of managerial accounting, and accounting software applications.

Not every school offers well-funded athletic programs, Greek life, or diverse student organizations. If getting involved on campus matters to you, look for a school with extracurriculars that meet your interests. With a master’s, graduates can also pursue careers in advanced accounting positions like budget analyst, financial manager, or personal financial advisor.

Aicpa Cpexpress: Convenience Learning. Value.

She explains why cloud clients are so awesome for firm growth. Keeping everything organized in your business can be a hassle, and eat up your valuable time. With our service, you’ll get a bookkeeper to help organize your expense reports, balance sheets, and income statements. You’ll have access to our bookkeeping software to sync your bank accounts, send invoices, and more. We are a nationwide team of accountants, bookkeepers and tax experts, here to help small businesses navigate a changing world. Manage everything from one place with accountant-only features for greater efficiency and insight. So you can grow your clients’ business in more ways than ever.

QuickBooks Online Advanced was built to help accountants grow their firm, scale processes and magnify the impact of their work for clients. If you are looking for a blend of personal service and expertise, you have come to the right place!

Membership benefits include networking, professional development, and referral listings. In the accounting field, students can also pursue a unique five-year program to earn both a bachelor’s and master’s in a shorter time frame. This format is especially ideal for aspiring CPAs who need to fulfill a 150-credit requirement to obtain certification. The perks for CPAs who fulfill these requirements include better pay, advanced job opportunities, and increased job security. Compared to the median $41,230 brought home by entry-level bookkeeping, auditing, and accounting clerks, accountants earn a median $71,550 salary. CPAs frequently earn more than uncertified accountants because companies value their advanced knowledge and abilities. From its five campuses in northwest Iowa, WITCC serves almost 7,000 full-time and part-time learners.

Founded in 1912, WITC now serves one in 16 people in the community. The school offers more than 100 programs, and approximately 92% of WITC graduates secure employment within six months of graduation.

You need to take them through accounting concepts so they know what they’re looking at. So when I started Soaring Falcon, I exclusively offered online accounting. Most of the clients we’ve won have followed the same trajectory – from accounting novice to excited participant to confident business thinker. And they become more profitable to my business as they move along that spectrum. You can meet initial CPA certification requirements by taking accounting classes online, but your education does not stop after graduation. Accountants must commit to lifelong learning to stay up to date with best practices.

Prospective students complete the free online application on WITCC’s website. Once admitted, new enrollees receive a login to the student portal. There, they can apply for financial aid and register for classes.

Common options include a master’s in accounting, a post-baccalaureate certificate specifically designed for CPA preparation, and other types of online accounting courses. Intuit Online Payroll for Accounting Professionals is offered exclusively to accounting professionals interested in offering payroll services to non-QuickBooks clients. The product can be used as a stand-alone application, but is better suited to firms already using other Intuit/QuickBooks applications. Public accountants understand tax implications of business decisions. Some give advice on overall company spending, including employee salaries and benefits. Others audit financial statements and prepare reports for investors. These latter accountants are often known as external auditors, and many have their own businesses or work for public accounting firms.

News And Resources On Tax Filing, Cares Act, Association Activities, And More

Learners who are unfamiliar with computers should also take introduction to computers before beginning the program. Students must earn a grade of C or better in all required online accounting courses in order to graduate.

Access a variety of self-paced and live training options to become a more trusted advisor. Hone your craft, prep for QuickBooks Certification, and earn CPE credits. Track all your clients and work from one place, and jumpstart projects with templates and team-wide notifications. Attract clients through our Find-a-ProAdvisor network, and train to expand your expertise and versatility. Intuit Marketing Hub Ready-to-use resources to market and grow your practice. Core products built to meet your and your clients’ unique needs. When you sign up with KPMG Spark, you get a dedicated bookkeeper and manager on your team, and who are your point people.

We believe having your taxes prepared should be an engaging experience with a true professional. We know how to prepare your tax returns quickly and efficiently delivering a high level of service with reasonable fees. Whether you’re searching for you or your client, find cloud, desktop, and mobile solutions to tackle every task. Now take it to the next level by growing your client list and expertise. We’ll walk you through how to get your practice up and running with QuickBooks.

Serving Your Business

You must fulfill all eligibility requirements to be listed on the Find-a-ProAdvisor online directory, including but not limited to certification and identity verification. For more information on eligibility requirements see the ProAdvisor Program Agreement. Total leads determined by the number of new leads in the period between August 1, 2017 and July 31, 2018 worldwide. You don’t have to sacrifice your day to clean up your clients’ books.

- KPMG Spark also offers tax preparation, invoicing and payments, expense tracking and payroll services.

- GNTC’s occupational courses include payroll accounting, spreadsheet applications, computerized accounting, and individual tax accounting.

- With a master’s, graduates can also pursue careers in advanced accounting positions like budget analyst, financial manager, or personal financial advisor.

- In the face of COVID-19, thousands of students are turning to online options as a way to continue their education with fewer risks.

- On desktop or your iPhone, professional support and essential insights are just a few swipes, taps, or clicks away.

Factors impacting cost include type of school (public vs. private, in-state vs. out-of-state), desired degree level, and length of enrollment. Although CPA certification typically requires some in-person components, like a certification exam, aspiring professionals can complete their accounting classes online. A growing number of colleges offer academic opportunities to distance learners. For entry-level accounting professionals looking to advance in the workplace, becoming a CPA can be a great choice. CPAs enjoy excellent job security and tend to earn higher salaries than accountants without CPA certification.

We empower our forward thinking clients to realize their vision. Online Accountants can assist with your personal and your business tax matters, in a responsive and accurate manner. QuickBooks Online Accountant isn’t just a portal to your client’s books—it’s the one place to grow and manage your entire practice, at your pace. Turn your practice into a well-oiled machine with innovative training and time-saving solutions. Based on the number of QuickBooks Online clients who have connected to QuickBooks Online Accountant between August 1, 2017 and July 31, 2018 worldwide.

The organization produces education programs, awards scholarships, and offers membership benefits including networking opportunities and exclusive discounts. For years, negative stigma about distance learning providing students with the same quality education as in-class instruction was ubiquitous. These days, online college courses and degrees are gaining increased acceptance, success, and prevalence. Many of the nation’s top schools now offer remote learning options.

Internal auditors evaluate their firms’ financial systems, maintain accurate records and check for mismanagement and fraud. They also make sure that the company complies with government regulations, and ensure that accounting technology and computer systems are secure and reliable. Get a direct line to your bookkeeper and fast access to essential business info. On desktop or your iPhone, professional support and essential insights are just a few swipes, taps, or clicks away. Tax bookkeeping and a year end package with everything you need to file comes standard with Bench. Bundle it with Bench Tax, and cross even more off your to-do list. With Bench Tax, you get expert tax prep, filing, and year-round tax advisory support.

Accounting Technician Certificate

Coursework also covers application of the principles of internal control to basic business processes. Graduates should know how to support data-driven management in the companies where they serve. Founded in 1964, MCCC serves more than 12,000 students in a variety of academic and career preparation programs. The school maintains a municipal police academy and a culinary arts institute along with many traditional educational divisions.

By accessing and using this page you agree to the Terms and Conditions. Easily reference shared notes, documents, and client information in your client list. Reply to client reviews directly to shape your brand and leave a lasting impression.

Each client has access via a unique user name and password, just like your bank. A client who knows these things can get paid, keep creditors happy, and stay compliant. I’ve found that a lot of the stumbling blocks are the same so I’m making a video that addresses them. I’m going to send it to clients and hopefully I won’t have to keep answering the same questions personally. No matter whether you’re paying a bunch of employees, or just yourself – our expert can help you set up and process your payroll with ease. You get access to our payroll system to keep track of everything, make sure you stay IRS compliant, and all your forms are up to date. You get transparency, and the confidence of knowing that our experts have your back.