Content

Case Studies & Interviews Learn how real businesses are staying relevant and profitable in a world that faces new challenges every day. Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. All plans also include receipt capture, expert support, and out-of-the-box integrations. You can get started with QuickBooks Online from $25 per month as the lowest of three price plans.

Both QuickBooks and Xeroare great for e-commerce businesses with around ten thousand SKUs or less. You can track products and cost of goods, receive notifications when inventory is low, set up custom inventory reports, manage vendors, and create purchase orders. If you have a massive product catalog with tens or hundreds of thousands of active SKUs, you’ll likely need an enterprise solution.

There were several complaints about either slow responses or long phone support hold times with both Wave and QuickBooks. This could work well for a new or small startup or any DIYers who don’t have an extensive accounting background. Instead, they integrate with Gusto, a full-service payroll solution for $39 per month + $6 per month per person. While Xerodoesn’t charge an invoicing fee, their features are the most basic. If you need to send many invoices or make a lot of customizations, you may find it challenging to use. The key features you need will vary depending on the systems and processes of your business. What is the big deal about it, a flat chart of accounts and few non-customizable statements attached to them.

Scalability And Suitability For Different Business Sizes

However, when you look more closely Xero place a handful of restrictions on the lower level tier. QuickBooks Online, on the other hand, add access to certain software features as your business expands. At a glance, both pieces of software seem to offer broadly the same thing in terms of invoices, but there are a few noticeable differences that should be mentioned. Although both programs can send automatic payment reminders for invoices, Xero’s reminder settings are applied to all customers. This means every client will be sent a reminder once seven days have passed the due date. However, in QuickBooks Online you are able to select individuals to send the reminder to. You might see one of these as an advantage over the other; either way one of these features will be more advantageous to your business.

Initially, when you’ve input some data, look at your Balance Sheet, Profit And Loss, Aged Receivables, and Aged Payables. payroll overview is a comprehensive guide to take you through each step of the setup.

Forecast Your Cash With Accuracy And Make Business Decisions With Confidence

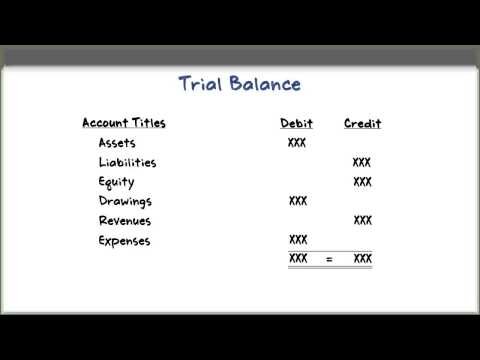

Enter the date range for the entire year, and check the box “Show YTD”. This will now give you the opening balance, debit, credit and net movement and closing balance. The only downside of this is that it is ordered alphabetically , not by account number). In a few hours, you will get an email asking you to take over the billing of your account. If you follow the steps above on how to convert Quickbooks online to Xero. Since Xero is converting your file for you, they don’t offer a trial or promotional price on your Xero account.

I agree with all comments about the inability to produce a TB that shows beginning and ending balances and activity. My auditors are asking for trial balance with details of opening balance, total debit and credit and the closing balance. I am however not able to generate the trial balance in this format. If you need further assistance or have additional questions, just know that I’m just right around the corner! Many companies, including ours, are utilizing mapped models in Excel to create financials.

There’s excellent core functionality for processing invoices and payments as well as add-ons for projects, time tracking and expenses. Xero offers basic inventory management for retail businesses to track what they have in stock, add inventory to quotes and invoices, and report on what product lines are trending. QuickBooks Online, the market-leading accounting software from Intuit, offers “Smarter business tools for the world’s hardest workers”. With their cloud-based system, businesses can streamline many of their repetitive tasks and processes by managing bills and invoices, tracking projects, and even tracking miles automatically with a smartphone.

Unlike QuickBooks Online, Xero also gives you an equity statement, which is useful if your business has several investors. It displays the owners’ investments and equity draws, as well as profits or losses kept in the business. If you’re concerned that one owner may be taking too much out of the business, it will quantify those concerns. Under “accounts,” “purchases” and “new,” you’ll find “repeating bill.” Xero automatically saves bills you input as recurring and lets you select the recurrence options. If you realize that a bill will recur often after inputting and saving it, there’s a box to click to make it repeat. Payment processing with Xero requires signing up for an external provider, such as Stripe or PayPal. While that gives you more options and could save you money on fees, it’s not as easy for customers to pay.

Xero Vs Quickbooks Online: Ease Of Use

Business Checking Accounts BlueVine Business Checking The BlueVine Business Checking account is an innovative small business bank account that could be a great choice for today’s small businesses. Enrich your accounting software with contact data from your CRM and other apps, while instantly sending contact data back to that app too.

- Along these lines, it’s also safe to say that Xero and Quickbooks Online are pretty evenly matched in terms of overall features, usability, and accessibility.

- Not only do all four of the QuickBooks Online plans include capabilities for managing sales tax, but they each also offer tools to maximize tax deductions as well as manage 1099 payments.

- One thing to keep in mind withWaveis that they charge a credit card processing fee of 2.9% + 30¢ per transaction.

- Only set up payment reminders when you get into the habit of reconciling receipts daily.

Additionally, Xero and QuickBooks both offer multiple plans for you to choose from, priced on a monthly subscription basis, with the software capabilities increasing with the higher-level plans. Moreover, Xero and QuickBooks each offer a free mobile app for you to manage your accounting on the go, as well as numerous integration options for third-party tools. The search for the right business accounting software can be extensive—deciding what features you need, what your budget looks like, and of course, comparing the different options on the market.

AClearing Accountis an account that you use to move money from one account to another account when you cannot move the money directly. This account normally has a balance of $0.00 because you always take out the same amount that you put in. Therefore, t will be up to you to decide how their differences will affect your business and which option will work best for you.

The Accounting category in Xero is where you’ll handle all of your banking transactions, as well as manage your chart of accounts and financial statements. The Projects category lets you manage any projects and record time spent using the time tracking feature. Perhaps you’ve read our accounting software reviews but remain confused about which of these two, popular accounting tools is right for you. Xero is an online accounting solution with apps for invoicing, expense management, inventory management, project management, and bill payment.

I have tried to use the General Ledger report for comparative figures but it only has the opening balances. Therefore only balance sheet items have comparative figures and no capabilities to compare profit & loss items. You can book a live remote Xero support session with me or self-paced Xero training for a very reasonable price. Your detailed conversion includes up to two years of financial history. All transactions are set up so you can pick up where you left off.

Xero caters to slightly more mid-market companies with employees than QuickBooks Online. Both QuickBooks and Xero are easy to set up and offer a huge range of banking integrations for many regions. There used to be a bit more friction with Xero here, but now it’s just as easy as QBO to sync your bank account. It has to be said that QuickBooks gives you a much deeper insight into your accounts than Xero does. With QuickBooks Online, you can find reports on profit and loss by customer and you can also compare estimates.

Cost Of Goods Sold A

Even though QuickBooks Online integrates payroll processing, it only provides reports on total wages and payroll taxes, worker’s compensation and employee details. Xero has far more reports, and they have built-in human resources functions, such as time-off balances and requests, wage garnishments and more. In addition to the core financial statements, basic accounts receivable and accounts payable aging reports track who owes you and what you owe by common past due buckets. QuickBooks Online delves deeper into accounts receivable than Xero. Collecting money is much more fun than paying it, but a strong accounting program will enable you to do both with ease. With most accounting software, paying bills is simpler than invoicing, but we find it to be more intuitive in Xero.