Content

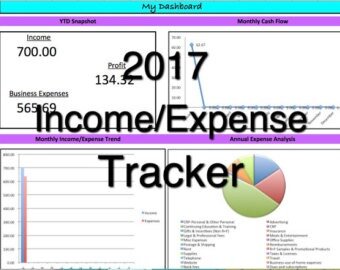

Smartsheet offers additional Excel templates for financial management, including business budget templates. Analyze your monthly spending with this calculator to ensure you’re not spending more than you earn. Once you control your spending, consider investing or saving any extra money you have each month. Financial emergencies can arise anytime, and it’s better to take money out of a savings account than to add to a credit card balance. If you’re a business owner, it’s essential that you understand and track your cash flow; you need to know how the amount of money you bring into your business compares to the amount going out.

Bank of America does not deliver and is not responsible for the products, services or performance of any third party. Watch our video to see exactly how Cash Flow Monitor and Connected Apps works and how it can help your small business. Bank of America and/or its affiliates or service providers may receive compensation from third parties for clients’ use of their services.

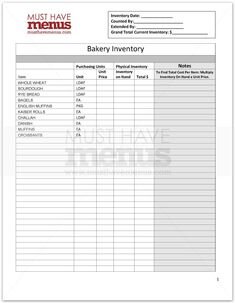

Depending on the size and complexity of your business, you may want to delegate the responsibility of creating a cash flow forecast to an accountant. However, small businesses can save time and money with a simple cash flow projections template. This template is designed with nonprofit organizations in mind and includes some common income sources, such as donations and grants, as well as expenditures.

Contact First Citizens Institutional Services

Look at what line of credit, business loan and other financing options are out there. Remember, you should only be taking on debt if it’s advantageous for your company.

- It includes a fairly comprehensive set of expense categories and was designed to be easy to understand and simple to customize.

- Use this template to create a cash flow forecast that allows you to compare projections with actual outcomes.

- Keep track of how you are spending money to gain more control over your financial habits and outlook.

- How much money do you have to spend this month at coffee shops?

- Cash is going out of your business in the form of payments for expenses, like rent or a mortgage, in monthly loan payments, and in payments for taxes and other accounts payable.

- Envelope budgeting is a style of budgeting where you literally put cash in envelopes at the start of the month, and you can spend until your envelopes are empty.

Of course, saving money in operational expenses helps too. It’s important to have detailed budgets and to curb unnecessary spending. The redemptions will post within 2 to 8 business days.

Other Services

If you want to use a free spreadsheet with the ability to enter transactions in account registers like you do in Quicken, you can try the Money Management Template. We chose these 7 best expense tracker apps based on their compatibility with phones and other apps, their features and tools, and how easy they were to use. We also looked at what their goals were and if they achieved them. You can use this template to perform a cash flow sensitivity analysis in order to anticipate shortfalls and help your business maintain a positive cash position. This analysis can help you make more accurate cash flow predictions and inform your business decisions. Cash flow projection templates can cover a variety of time frames, including the quarterly format offered here.

Each point is worth $0.01, which means that 100 points equals $1 in redemption value. All rewards redemptions can be made through the First Citizens Rewards Center by telephone or through the program website. At the Base Rewards Tier, cardholders may earn up to 10,000 points per calendar month. Points earned are available for redemption for a 3-year term. After the 3-year term, points expire and can no longer be redeemed. Points expiring during the year will be cleared from your Program Account on the last day of the month in which they expire. Reward dollars earned are available for redemption for 3 years.

Best For Budgeting :

Use this statement of cash flows template to track and assess cash flows over a three-year period. The template is divided into sections for operations, investing, and financing activities. Simply enter the financial data for your business, and the template completes the calculations. Determining when you’ll receive – and spend – money is part of the budgeting process. To successfully project cash flow, assess your prior year’s numbers as a basis of cash flow for the following year. Then, adjust for anticipated changes, such as new pricing, more personnel and funding sources.

For immediate assistance, call from 8am to 6pm ET, Monday through Friday. You’ll need to be an existing First Citizens Business Customer with a Business Digital Banking login to open an account. Businesses may earn up to 10,000 points per calendar month, excluding bonus points. Points earned are available for redemption for a 3 year term. Points expiring during the year will be cleared from the Program Account on the last day of the month in which they expire. The full First Citizens Rewards® Program Rules will be provided upon enrollment and are accessible via the program website at FirstCitizensRewards.com at log in. Links to third-party websites may have a privacy policy different from First Citizens Bank and may provide less security than this website.

If you’re spending more than you’re earning, you need to make changes to avoid going bankrupt. This worksheet is for people who don’t like the word budget but still want to get a grip on their finances. Basic personal finance is mostly about managing cash flow which means tracking and planning how money is entering and leaving your real and virtual pockets. This worksheet can be used for tracking your spending as well as creating a budget. An expense tracker app is either web or phone-based and can help you track a range of expenses. You enter incoming and outgoing money and the app can help you store and track that information. It can help you track your budget, track your investments, use graphs and charts to show your progress, and keep your business and personal expenses separate.

The template covers a 12-month period and makes it easy to see annual and monthly carryover so that you can track a rolling cash balance. Create a detailed list of all receipts and disbursements that are relevant to your organization.

The appealing graphics and social features will be appreciated by millennial users. Note that Wally is available only on iOS devices. This crossword clue might have a different answer every time it appears on a new New York Times Crossword Puzzle. Duplicate clue solutions are not entered twice so each answer you see is unique or a synonym. Smartsheet provides a better way to unify collaboration and automate workflows so you can spend more time on the work that matters.

The purpose of the beginning/ending cash balance section at the top of this spreadsheet is to show how much cushion you have in your spending account. Creating a Monthly Budget that is the same each month requires that you use averages for variable expenses (fuel, food, etc.) and periodic expenses (insurance, tuition, subscriptions, etc.). A yearly cash flow analysis like this one can help you figure out what those averages are. However, while Mint is one of the oldest and most full-featured expense tracker app options, it isn’t perfect. There are a handful of bugs in the software, and new features are slow to release since Intuit bought the app in 2009. And if you do find a bug or a problem in your account, getting support can sometimes a challenge. Like Mint, Intuit is the clear leader in this space as well through its popular QuickBooks program.

The first six months of a business is a crucial time for cash flow. If you don’t have enough cash to carry you through this time, your chances for success aren’t good. Suppliers often won’t give credit to new businesses, and your customers may want to pay on credit, giving you a “cash crunch” to deal with. Think of ‘cash flow’ as a picture of your business checking account over time. If more money is coming in than is going out, you are in a “positive cash flow” situation and you have enough to pay your bills. If more cash is going out than coming in, you are in danger of being overdrawn, and you will need to find money to cover your overdrafts.

Most budgeting and expense tracking apps are designed to tell you what happened after you spend your money. Mvelopes takes a different approach and offers spending forecasts and suggestions to keep you from going overboard on your next visit to the mall, or Amazon, or wherever else you like to spend money. No list of expense tracker apps would be complete without a mention of Mint, one of the best known personal finance tools around.