Content

The position generally requires the CPA credential and several years of experience to guarantee in depth accounting skills.Those who wish to become fraud examiners must also earn their Certified Fraud Examiner designation. Although there are many ways to launch your accounting career path, many successful professionals in the field have advanced degrees and specialized training. A graduate degree, such as Rider’s online Master of Accountancy, can help you advance your career and open the door to unique opportunities in the industry. Accountants perform many crucial financial and administrative tasks in a wide range of organizations, from small businesses and startups to large corporations and nonprofits.

Either way, accountants can enjoy long and successful careers, whether they choose a career path in public accounting or private accounting. Similarly, private accountants normally start their careers in entry-level staff accountant positions and typically move up into managerial roles over the years. The CFO is the top of the ladder in private accounting, though that career path can be even more challenging than becoming a partner in a CPA firm. Changing industries as a corporate accountant can also be formidable, but it can be done.

Compliance Analyst

Hard skills are learned abilities that are acquired through practice and education. An accountant is a certified financial professional who performs functions such as audits or financial statement analysis according to prescribed methods. Tax- As a tax accountant, corporate and personal income tax statements are prepared. They provide guidance and assistance on how to handle mergers, acquisitions, tax issues, how to properly record expenses that will have tax implications and more. Prestige -Being able to say you are an accountant holds a certain prestige and notoriety. There are many people who have majored in this field who have gone on to do other great things.

By working through the steps below you’ll end up with an effective plan for having the career you really want — one rooted in your key strengths and personal values, giving you a sense of purpose and fulfilment. Step by step approach to developing a personal career plan, by CABA in partnership with Renovo, the career coaching experts. Certified fraud examiners are a subgroup of forensic accounting; they gather evidence to judge whether or not fraud was committed and use the CPA skill set to do so.

Pursuing a CPA career path and taking the CPA Exam is well worth the time and effort, especially after spending the time and money to acquire an accounting degree. With so many different avenues for career options after the CPA exam, accounting careers are not only lucrative, but can be personally rewarding. They have a number of rules and tax implications that affect the way they do business. These grants have certain financial stipulations and must be carried out to the letter. The accountants on staff at a non-profit organization make sure every dollar is properly accounted for and the financials are in order.

Forensic accounting combines knowledge of accounting, law, investigative techniques, data collection and analysis, and accounting technology. It’s a complex field that requires a lot of education and experience, and forensic accountants tend to be well-compensated. Forensic accountants may work for corporations, nonprofits, or government agencies such as the FBI.

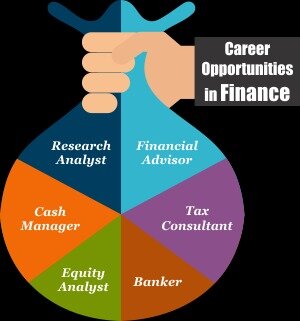

While you may reach that position with a bachelor’s degree, any major bank or financial firm is going to expect a master’s degree from applicants, especially one with a specialization in finance law, forensics, or a similar concentration. To become a Credit Analysis Manager, you’ll need at least a bachelor’s degree and a solid few years of experience in leadership. However, a master’s degree, especially one with a specialization in business law, forensics accounting, or management, will provide a stronger foundation and more job-market opportunity than just a bachelor’s degree. With the high level of expertise, and the wide range of multi-disciplinary knowledge required, Forensic Accountants need a high level of education. While you may start your career in an entry-level position with a bachelor’s degree in forensic accounting, a forensic accounting master’s degree is definitely going to be preferred. Forensic Accountants specialize in areas like fraud, auditing, and white-collar crime, and as the government cracks down on financial wrongdoing, forensic accountants are in more high demand than ever.

They’re the sergeant in the trenches keeping the soldiers on task while the higher-ups make plans, and without a good controller maintaining their day-to-day financial integrity, many a company would sink. Chief Financial Officer – the CFO – is one of the highest levels of authority and responsibility an accountant can aspire to.

It will take at least a bachelor’s degree to get to a position as a Cost Estimator, but much of the expertise you’ll need, you’ll learn with experience, as you get to know the industry. However, Cost Estimators need a wide-ranging set of skills, and a graduate degree in engineering, construction management, or a similar field will drastically improve your professional options. The professionals who are being managed by the Cost Accounting Manager (#6 above) are the Cost Accountants, who do the analytical and research work of figuring out the costs of production.

Planning Equals Accounting Career Progression Efficiency

Because accountants often work with complex budgets and complete extensive calculations, they need a strong foundation in mathematics. Mathematics is a cornerstone of any bachelor’s degree in accounting and related disciplines.

- The job of the Finance VP is to lead and coordinate company financial planning, debt financing, and budget management, while reporting back to the upper levels.

- As a payroll specialist, you will deal with payroll and benefits in companies of all sizes.

- If your serious about trying to break into this industry, you might also want to consider pursuing the CFA charter.

- Developing Technical Skills – Professionals in accounting value technical proficiency, meaning that to rise up the ranks in any organization you will require extra technical skills.

The job of the Finance VP is to lead and coordinate company financial planning, debt financing, and budget management, while reporting back to the upper levels. Finance professionals usually work their way into their job from the management level; it’s not usually necessary to have a master’s degree, but having an MBA or MAcc in finance can distinguish the ambitious from the merely competent. Consulting firm – CPA careers and accounting positions in consulting firms vary.

The Role Of Accounting In Managing Cybersecurity Risk

Most large accounting firms will either pay for your CPA Review course or reimburse your expenses for using a high-quality prep provider like Surgent. These are just two examples of the path your career could take, but there are countless variations and alternative accounting careers. The important thing to remember is to set short- and long-term career goals and know exactly what you need to do to meet them. For even more insights into the accounting and finance industry, view our up to date accounting and finance salary guide. Once you have gained 10 years of experience in the field and have an advanced degree, you will be ready to move into a Finance Director role. As part of the Finance Director job description, you will be responsible for directing and aiding financial analysis, evaluation and report generation of current and proposed financial plans.

They are looking for ways to cut costs, increase efficiency, and create channels for new growth. In terms of education, you should earn your bachelor’s degree in accounting, finance or business to work in either public or private accounting. For CPA jobs, you need to pass one of the most rigorous professional credential examinations in the business.

Promotions -Accountants get promoted on a regular basis and take on larger leadership roles within the organization. It is commonplace to have an accountant become a CFO, and later on the CEO of a company. Depending on the type of accounting you do, your work environment can vary significantly.

Their primary duties are to review the finances of a company and make recommendations for how a company can lower costs and improve its financial situation. A senior financial analyst is the leader of a group of financial analysts who work with the money the company they work for is spending and making in all areas of the business. The modern accounting field is defined by its seemingly endless specializations; as business becomes more complex, it takes more specialized professionals to keep track of it all.

Although accountants are used as if they are working in public accounting firms, their roles are slightly different. These firms handle forecasts, proposals and other financial issues that help guide companies in the right strategic direction.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. But according to the 2020 Robert Half Salary Guide for Accounting and Finance Professionals, a lack of work-life balance is prompting some workers to leave even if they’ve been at the firm for less than a year. By clicking any link on this page, you are giving your consent for us to use cookies. When we see legislative developments affecting the accounting profession, we speak up with a collective voice and advocate on your behalf. Our advocacy partners are state CPA societies and other professional organizations, as we inform and educate federal, state and local policymakers regarding key issues.

These professionals work as a high-level accounting executives in a large and small organizations or agencies. One of their jobs may be to find professionals in the accounting field to join the company and support their development.

As a clerk, you will perform basic accounting jobs and data entry that will help your accounting firm or company track transactions. The ones who love numbers often gravitate to the tax side, where they help clients navigate the morass of complex tax laws and, hopefully, minimize tax liability. Highly extroverted public accountants frequently end up in management consulting; these professionals audit clients’ business operations but for an entirely different reason than compliance.

Cost accountants measure the cost of producing products or providing services by determining the fixed and variable expenses necessary for production. These costs include research and development, equipment, marketing and human resources.