Content

Budgeting also helps to know about the financial health of a business. This totally depends on how management wants their budgeting to get updated. It consists of a rough estimate of expenses and revenues, cash flows that management is expecting, etc. On getting the actual results, at last, the budget is compared to it, to figure out the variances in the workflow. The budget is nothing but a representation of the results that management wants to achieve in the future. However, the forecast shows you how you are doing in chasing those goals.

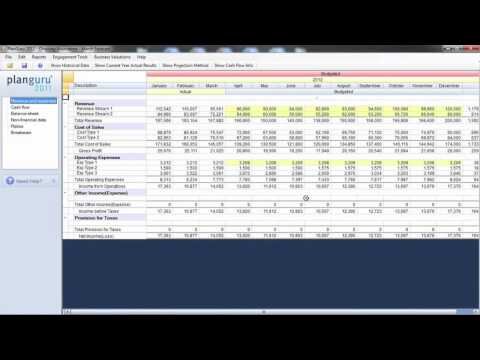

A budget that includes multiple forecasting scenarios helps you respond to opportunities and downturns more quickly. A forecast document does not use math formulas to provide an answer or guide for your income and spending. A forecast might simply include a list of possible income and expense scenarios. A budget, on the other hand, lists your income and expenses, subtracting one from the other to give you realistic numbers to guide your planning. For example, if your budget shows that your total expenses are greater than your total income, you must adjust your spending entries in your budget to try and gain the profit that you want. In the budget, you can calculate the variance by comparing your estimation with the actual results.

Whats The Difference Between A Budget Vs A Forecast?

A few years ago we as a company were searching for various terms and wanted to know the differences between them. Ever since then, we’ve been tearing up the trails and immersing ourselves in this wonderful hobby of writing about the differences and comparisons. We’ve learned from on-the-ground experience about these terms specially the product comparisons.

Confident budgeting and forecasting is a whole lot harder without them. The 2020 Pulse of Performance Management Survey revealed that 82% of finance teams still use offline Excel spreadsheets for budgeting, forecasting and other core FP&A activities.

- Gather your latest actuals and input them into your forecast template.

- Budget vs forecast are not mutually exclusive since they serve different purposes.

- That‘s better than waiting until you have the time to get it just right.

- Budgeting is when a company estimates the revenues and expenses that are going to happen once the budgeted period gets started.

- A forecast also helps you be reactive to change in a way that a budget does not.

- Unlike your budget and financial, which is an annual projection of revenue vs. expenditure, cash flow forecasts usually only project a few weeks ahead.

Financial forecasting will help you to model various scenarios and evaluate whether your company will meet your strategic growth plan. Companies use financial forecasting to determine how they should allocate their budgets for a future period. Unlike budgeting, financial forecasting does not analyze the variance between financial forecasts and actual performance. It gets prepared maybe only for one accounting period.It gets prepared for projections which are short term i.e., a quarter, or long term i.e., several years.NatureStatic. Whether your business is big or small, it’s important to have an accurate forecastandbudget. That’s because both of them work together, helping you reach your ultimate goal—financial prosperity.

You can even map your existing Excel templates back to the database, enabling a much smoother transition for you and all your colleagues. Identify KPIs and other performance ratios to see how the budgeted results stack up against previous years or anticipated changes in market conditions. Forecasting reveals business trends that help you determine if you need to adjust course. Forecasting is performed regularly after financial statements are released, usually right after a month-end or quarter-end close cycle.

A forecast is based on business drivers, like unit sales, hours billed, or memberships sold. Those drivers, once revealed and documented, can be tracked and measured, which allows the business owner to stay on top of very practical targets month by month. These budgeting protocols take into account how much an organization should allocate to cover their operational needs by setting do-not-exceed limits on expense line items. In this sense, a budget is a useful tool to manage short-term goals, like month-to-month operations and profit—tactical things. Incremental budgeting is the more prevalent approach, where last year’s budget is amended to increase or decrease each line item for the next budget period.

Periodic forecasts are beneficial, but they usually only project out to the end of the current fiscal year. Rolling forecasts, on the other hand, are even more useful because they extend beyond that timeline. Prepare financial statements—balance sheet, income statement and cash flow—using your budgeted numbers.

You forecast what your income will be using sales and revenue history, as well as anecdotal evidence and guesstimates based on what is happening in your marketplace. Forecasting might rely on government economic data or industry research reports. You might create both conservative and optimistic income projections to give you each scenario. Forecasting is a tool that projects what you want to happen, while budgeting helps you manage what will happen. You can forecast, or project, what you think your sales and expenses might be using research and estimates. You can create a budget that only spends what you make by using your current cash position and current sales and expenses to guide you. Think of forecasting as an educated guess and budgeting as a goal.

In short, both the tools are beneficial to the business; a budget defines the company’s goals. On the contrary, a forecast shows the expectations of a company for a period. Moreover, to make your business a successful one and long-running, you have to monitor your financial requirements. For this, budgeting can prove to be a good tool, which is used to plan for the future. You can effectively predict and upgrade your budgeting and forecasting as and when your business requirements fall.

What Is Financial Forecasting?

The main aim of a forecast is to quantify where the organization is headed over a specified period of time. As a public accountant, you are probably much more familiar with budgeting, and likely do it within your accounting software. I encourage you to practice forecasting until you become comfortable with it, and then use it as a tool to help your strategic advisory clients plan for growth. Complete planning solutions don’t usually require any maintenance or management from your IT department. They are truly “finance owned,” allowing you to organize budgeting and forecasting in a way that makes sense for your business. According to this report from Deloitte, emerging technologies are reimagining the future of finance—and the teams that don’t embrace this evolution risk falling behind the eight ball. For budgeting and forecasting in particular, a complete planning solution can help you get ahead by making your processes faster, easier and more reliable.

When reasonable stretch goals are set and recorded, they become the plan of action. The combination of forecasting and budgeting will always remain in the business. Your data related to forecasting and budgeting will be under full security, and there will be a proper workflow to be followed. Where budgeting sets the revenue expectations, forecasting determines the revenue that can be achieved. Your budgets, forecasts and actuals can be viewed from the same template so you can more easily spot variances and identify emerging trends. Rolling forecasts use real-time data so they stay relevant all the time. You can tweak your forecasts on demand with up-to-the-minute numbers, which is helpful in fast-paced business environments where you might need to pivot on the fly.

No Workflows, Audit Trails Or Data Validation Measures

Forecasts illustrate how your business is performing against your budgeted targets. You can drill down into transaction-level details right from your budget and forecast templates. According to the 2020 Vena Industry Benchmark Report, data silos are a challenge for 57% of finance teams. If you’re spending too much time wrangling numbers from your ERP, CRM, HRIS and other data sources, you won’t be able to analyze the story those numbers are telling you. Apply those trend calculations to your real-time numbers to come up with forecasted results.

Automations certainly help with usability, but your software still won’t get used if it’s clunky and difficult to manage. In order to keep cross-functional stakeholders involved in your budgeting and forecasting processes, you need to choose a solution that’s flexible and accessible for everyone. A complete planning solution leverages both relational and OLAP cube database structures so you can bring all your financial information into one source of truth in the cloud. By integrating directly with your ERP, CRM, HRIS and other source systems, you won’t have to input numbers manually while building budgets or generating forecasts. Instead, the cells in your templates would be mapped right back to your data sources so the values just flow in automatically whenever you need to refresh them.

There could also be forecasts of cash flows for several years helping management in several aspects like determining the optimal capital structure. A budget is a detailed statement of expected revenues and expenditure which quantifies the tactical plans of the management to reach a desired goal for the company during a specified period.

If you can accurately forecast when you will receive your income, you can match it against your payables to make sure that you have enough money in the bank to meet your obligations. A cash flow budget does not show the monthly average amount of your expenses, but the exact expense amounts each month when they come due. This allows you to budget lower payments for discretionary spending in the months when you have high payables. Setting a budget to guide your spending looks at fixed and variable expenses. Fixed expenses don’t change, such as your rent, insurance premiums and equipment leases. Variable expenses change each month, such as payroll, utilities, phone bills and commissions. Forecasting estimates what your fixed and variable expenses will be based on different sales and revenue scenarios.

It is the process used to compose a plan or create an estimate during a prior year or at the beginning of a current year to help manage and control the income and expenditures of the company for that year. Some have even defined a budget to be a road map or financial guide that recognizes the income of the company, while detailing the expense allowances with a not-to-exceed expectation for that given year.

However, if you don’t have the ability to level-up your processes as you grow, you’ll have a hard time adapting to the ever-changing needs of your organization. According to the 2020 Pulse of Performance management survey, ease of use is the most important feature for a budgeting and forecasting solution to have.

Forecasts are prepared for sales, production, cost, procurement of material, and financial need of the business. The forecast has some flexibility, whereas the budget having a fixed target. Hence, while the budget provides management’s insight on what they want the company to attain, the forecast shows whether the company is able to achieve its budget or not. Forecasting of sales and expenses from past performance or peer performance provides a guide to developing an effective budget. A budget is an outline of the direction management wants to take the company. A financial forecast is a report illustrating whether the company is reaching its budget goals and where the company is heading in the future. Financial forecasting can help a management team make adjustments to production and inventory levels.

Expenses are then layered in, beginning with direct costs and finally adding indirect expenses to meet desired net profit. Assumptions about cash receipts and payments are added to forecast cash flow. Forecasting is the process of analyzing historical trends in order to predict future business results based on your company’s most up-to-date actuals. Done over a compressed time frame, forecasting typically focuses on major expenses and revenue line items. Budgeting allows you to chart your organization’s path and assist your management team with strategic business planning.

With any change in business plan or workflow, it needs to be revised. The forecast is based on changes to the business in the prior quarter and more accurately projects what you think you should be doing. Its important to have that static budget, so you can see how to improve your budgeting for future years, but focus on the variance vs forecast to see how your business is really doing. If your clients are asking for help with budgeting, they may not appreciate the difference between an operational budget and a strategic forecast for long term growth.

But while equally important, forecasts and budgets are actually two very different financial animals. A budget is a plan built to determine how you want to grow your company.

It may lead to structural changes such as R&D upgrades or CAPex changes.Forecasting is a short term measure, and therefore it doesn’t lead to drastic changes. Though the purpose and approach are the same in both the statements, the use may differ. Financial forecasting is based on historical data, business drivers and assumptions of the situational factors expected to affect the company during the forecasted period. As a company manager, you would like to know where your company is actually going. Financial forecasting serves as an input for making budget allocations and helps management to develop its strategic plan. There could be quarterly revenue forecasts based on business drivers and past data.