Content

And, how do we not only preserve but also garner new business insights from the enormous IP storehouse that is our firm’s email history? Fee from refunds are quickly becoming a “must have” service for Accountants. Refund Manager® removes the angst by providing a fully automated fee from refund management system. Developed initially as an on-line solution for E-Lodge Taxation Services , Refund Manager® is now available to accountants Australia wide. Our session will explain how Refund Manager® will save users time and money whilst growing client fees.

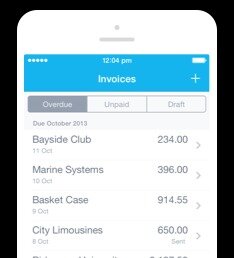

In this session Mark reviews data from a large number of SuperMate users. Utilising mobile technology sounds great in theory but quantifying the benefits to your small business clients can be hard. Come along and see a practical demonstration on how much time your small business clients can save on the go.

For other payroll systems, check with your system provider that it is SuperStream ready. To use SuperStream you may need to collect some additional information from your employees. New employees who choose their super fund will fill out a standard choice form, which will have all the information you need.

Use A Superannuation Clearing House

This may be the case if they were a lay person, had another source of income related to their professional training/skills, and the preaching was a very occasional activity. The leave balance on individual employee profile is immediately adjusted for all ‘approved’ leave requests, regardless of the leave date . There are accounting standards to be followed to ensure the that current accounts reflect the actual receiving and appropriation of monies in the current period, as well as utilising funds specified in prior periods. If you are planning to rent the property for less than 75% of the GST-inclusive market value of the accommodation, then the income & expenses relating to that property are GST Free.

- Thus the backbone of a successful smooth and seamless business is none other Xero Payroll.

- If you have 19 or fewer employees, or a turnover of less than $2 million a year, you can use the ATO freeSmall Business Super Clearing House.

- That view would be reinforced if the individual’s circumstances showed they were an itinerant preacher, ie they regularly preach at different churches.

- SuperStream – the standardisation of how employers make super contributions on behalf of their employees – involves employers sending all super payments and employee information electronically in a standard format.

- the GST amount payable – this can be shown separately or, if the GST amount is exactly one-eleventh of the total price, as a statement such as ‘total price includes GST.

- If your payments are not compliant with SuperStream by the cut-off date of 30 June 2016 you may be subject to ATO compliance penalties.

From what we have read on ATO’s guidelines and press releases, ALL (non-exempt) employers will need to use STP from 1st July 2019, even if they are considered “micro employers” with 4 or less employees. Single Touch Payroll will be mandatory for all employers from 1st July 2019 . If your business is a closely-held entity, then you do not need to start using STP until 1st July 2020. Security, Differences in cloud offerings, Microsoft licensing, IT planning and usage. Unlocking accounting system to make better Sales and Marketing decisions. We’ll discuss important risk issues of relying on data feeds, and an alternative audit methodology through the use of exceptions reports. Be the first to see a preview of a new SMSF audit software platform which has been designed by auditors, for auditors.

Australiansuper

If you’re not sure if your business is SuperStream compliant let us know and we can do an assessment for you. We can also help you implement Xero, an online accounting software, into your business so you can easily make SuperStream compliant superannuation payments for your employees. $5 /month for one user $5 /month for each additional active user/month. For your protection, Xero logs out when there’s no activity for more than 60 minutes. Share your Xero data directly with lenders during the application so you get a decision faster. The key component of SuperStream is that it is compulsory to make your superannuation contributions online with products that are SuperStream compliant. The easiest way to become SuperStream compliant is to use software in your business that enables electronic super payments.

Unless they address their structure, infrastructure, engagement and delivery models, nothing much will change. This session will address these four areas and outline how the right process and business/advisory platform will get your firm permanently on the right track. Out-of-the-box integration with PMS and DMS enables accounting professionals to easily collate and assemble multiple documents from multiples sources into a single, secure PDF document. In addition to preventing changes to the documents, users can easily redact private or confidential information as part of their digital workflow. pdfDocs from DocsCorp takes the heavy lifting out of creating digital work papers and tax returns. Learn how to apply simple benchmarking and auditing steps in your firm and begin your journey to a more productive business. Embrace new technology with a move to Nimbus CDM and go far beyond just saving on IT, infrastructure and removing risk.

If your business is a company, you will need one of the directors to register . If your business is not a closely-held entity, you need to be ready (more info about Closely-held entities here). It is a good idea to get it set up now so that you are compliant by 1st July. However, ATO has confirmed that they will be lenient toward small businesses during the initial transition to STP. It’s a truth that anyone working in a business knows all too well – email sucks, and there’s no escaping it. How do we meet complex legislative, retention and destruction responsibilities?

It’s about connecting a best-in-class ecosystem to maximise your future. Accounting firms say they want accelerated growth, yet a lack of vision and execution has seen most firms struggle for even single digit revenue growth. With most climbing on board the business advisory ‘train’, many are heading for a barren destination.

Topics covered by future include digital currencies, cyber security, offshoring and the future of work. In this 30 minute session, Ellen Brown will show you how Class makes it easy to support your clients with diversification through international exposure for both SMSFs and other investment portfolios.

Certainly if the person is an ordained minister then the presumption must be that the payment is in connection with the individual’s income-producing activities. That view would be reinforced if the individual’s circumstances showed they were an itinerant preacher, ie they regularly preach at different churches. The leave balance report only reflects ‘completed’ leave ie; leave which has been processed through a pay run. This entry can be done as each spending is entered and allocated, or it could be done monthly, or annually.

Once you have setup and populated your chosen platform with your details and employee information you are ready to start using SuperStream. Employers have options for meeting Super Stream which include using software that conforms to Super Stream; or using a service provider who can meet Super Stream on your behalf. Third parties may also place cookies through this website for advertising, tracking, and analytics purposes. These cookies enable us and third parties to track your Internet navigation behavior on our website and potentially off of our website.

You can forget about previous complexity, time costs, manual work and challenges of sourcing the right information. Bring your questions to participate in this lively debate with industry leaders who will discuss the important technology issues impacting accountants in practice. If the recipient provides such services for not more than 2 days in a quarter there is no requirement to withhold tax . Generally if the payment is made to the individual these people should be treated as employees .

What Is Superstream?

We value ongoing relationships and offer a comprehensive referral network to suit your needs. All calculations regarding pay, leave and other information are updated automatically into the accounts. This enables the employees to access their own account and view their pay disbursement history. From 1 July 2016, it will be compulsory for all employers to submit their super payments and the accompanying data electronically.

Emerging cloud software technology designs, are allowing accounting firms to access outsourcing services in new and innovative ways. See how AccSource provides supercharged, low-cost transaction matching and classification services using specially designed software. In this session we will show you how iPracticeApps has been busy building apps for accountants across Australian and how this has changed the Accountant-client relationship forever. We will sign a tax return, look at some of the 42 calculators, pay a bill, process a database change, see a set of financials delivered in virtual reality, who said accounting wasn’t sexy. In this session you will experience 21 practical make my life better reasons your clients will use your App. We are proficient in Xero and can assist with Xero conversions, setup and training. Our Bookkeepers can also provide ongoing support including payroll processing and ensuring your business is super stream and single touch payroll compliant.

In addition, you can learn how to prepare your connected practice for the future, with a showcase of the latest enhancements in transaction processing, compliance and advisory. (All superannuation funds must have a USI number, an employees must have gender, phone number, email address, and superannuation member number recorded in their employee details. Xero is beautiful online accounting software for smaller businesses.

This means you do not charge GST and you can claim the GST that you pay. If you are planning to rent the property for more than 75% of the GST-inclusive market value of the accommodation, then the income & expenses relating to that property are Input Taxed. This means you do not charge GST and you cannot claim the GST that you pay.

By continuing your use of this website, you consent to this use of cookies and similar technologies. If you have any questions or need some help setting up for SuperStream please call our office on or make an appointment to come in and see us. You can also choose from several commercial options, or your super fund may have a clearing house you can use. If you have 19 or fewer employees, or a turnover of less than $2 million a year, you can use the ATO freeSmall Business Super Clearing House.