Content

If an electing S corporation wishes to adopt a tax year other than a calendar year, it must request IRS approval using Form 2553, instead of filing Form 1128. For information about changing an S corporation’s tax year and information about ruling requests, see the Instructions for Form 1128. All S corporations, regardless of when they became an S corporation, must use a permitted tax year. The determination of the tax year under the least aggregate deferral rules must generally be made at the beginning of the partnership’s current tax year. However, the IRS can require the partnership to use another day or period that will more accurately reflect the ownership of the partnership.

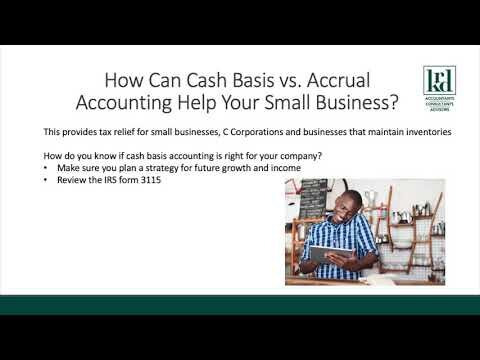

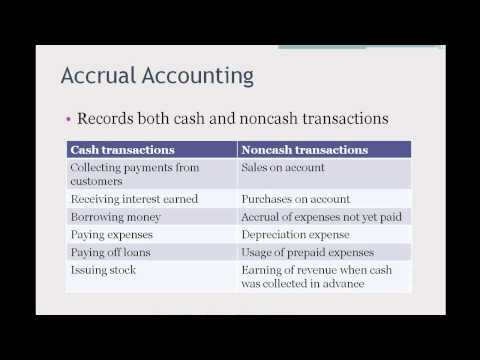

Given its ease of use, the cash basis is widely used in small businesses. However, the relatively random timing of cash receipts and expenditures means that reported results can vary between unusually high and low profits. The cash basis is also commonly used by individuals when tracking their personal financial situations. The timing difference between the two methods occurs because revenue recognition is delayed under the cash basis until customer payments arrive at the company. Similarly, the recognition of expenses under the cash basis can be delayed until such time as a supplier invoice is paid. Now imagine that the above example took place between November and December of 2017. One of the differences between cash and accrual accounting is that they affect which tax year income and expenses are recorded in.

If in doubt, check with your accountant as to which method you should use. You may ask why most businesses don’t use cash accounting and only use accrual accounting. Very recently, Biocepts transitioned from Cash Accounting to accrual accounting as they believed it is a more timely reflection of revenues associated with test volumes as well as revenues and expenses. Determine the relationship for this rule as of the end of the tax year for which the expense or interest would otherwise be deductible. You are a calendar year, accrual method taxpayer who accounts for advance payments under the alternative method.

Accrual accounting means revenue and expenses are recognized and recorded when they occur, while cash basis accounting means these line items aren’t documented until cash exchanges hands. Do you have questions about cash basis or accrual accounting, or have other questions about your tax or bookkeeping needs? Contact Silver Tax Group to speak with a tax services expert today. If you frequently deal with large projects with a large payout at the end, you may prefer to use the cash basis method. Electricians who only collect payout when they finish projects may want to use a cash basis accounting method to help calculate how much money they actually have on hand, for example. Cash method is barred to larger companies under certain accounting principles.As explained below, big businesses must use the accrual method to conform to accounting principles.

If your business has a predecessor entity, include the gross receipts of the predecessor entity from the 3 tax-year period when figuring average gross receipts. If your business had short tax years for any of the 3 tax-year period, annualize your business’ gross receipts for the short tax years that are part of the 3 tax-year period. An expense you pay in advance is deductible only in the year to which it applies, unless the expense qualifies for the 12-month rule.

How Accrual Accounting Works

The following are examples of changes in accounting method that require IRS approval. Qualified creative expenses paid or incurred as a free-lance (self-employed) writer, photographer, or artist that are otherwise deductible on your tax return. You claim a casualty or theft loss of inventory, including items you hold for sale to customers, through the increase in the cost of goods sold by properly reporting your opening and closing inventories.

Under the 12-month rule, a taxpayer is not required to capitalize amounts paid to create certain rights or benefits for the taxpayer that do not extend beyond the earlier of the following. An item considered material for financial statement purposes is also considered material for tax purposes. However, in certain situations an immaterial item for financial accounting purposes is treated as material for purposes of economic performance. Economic performance generally occurs as estimated income tax, property taxes, employment taxes, etc. are paid. However, you can elect to treat taxes as a recurring item, discussed later. You must report any advance payments you receive after the second year in the year received. These rules also apply to an agreement, such as a gift certificate, that can be satisfied with goods that cannot be identified in the tax year you receive an advance payment.

When a partnership changes its tax year, a short period return must be filed. The short period return covers the months between the end of the partnership’s prior tax year and the beginning of its new tax year. Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax forms, instructions, and publications. This publication explains some of the rules for accounting periods and accounting methods.

- A change in the depreciation or amortization method (except for certain permitted changes to the straight-line method).

- The partnership elects to use a week tax year that ends with reference to either its required tax year or a tax year elected under section 444.

- How you treat different types of income and expenses must be consistent for tax purposes.

- To change accounting methods, you need to file Form 3115 to get approval from the IRS.

- The accrual method is most commonly used by companies, particularly publicly-traded companies.

Knowing which method is right for your small business can help you avoid tax snarls and decrease your odds of facing an audit or, worse, tax evasion penalties. Cash basis method shows cash flow.Because the cash method follows the flow of income in and out of your business, it provides a more accurate picture of how much cash your business actually has on hand. In other words, monitoring cash flow parallels your accounting method. Most small businesses and individuals operate on a cash basis and prepare their income taxes using this method. Every business must have an accounting method, which governs how and when to report revenue and expenses. The accounting method you choose can help guide financial decisions for business activities, impact your taxes, and even affect the ability to obtain a commercial loan.

The most commonly used accounting methods are the cash method and the accrual method. Accrual accounting also conforms to GAAP and is required by all companies that make more than $25 million annually. While $25 million is a lofty goal for small businesses, choosing the accrual method means that you won’t have to change your accounting method in the future due to expansion. Accrual accounting is also required by some banks regardless of business income.

Cash Vs Accrual Accounting

You have received a substantial advance payment on the agreement . If you perform services for a basic rate specified in a contract, you must accrue the income at the basic rate, even if you agree to receive payments at a reduced rate. Continue this procedure until you complete the services, then account for the difference. Generally, you include an amount in gross income for the tax year in which all events that fix your right to receive the income have occurred and you can determine the amount with reasonable accuracy. Under this rule, you report an amount in your gross income on the earliest of the following dates. Income is constructively received when an amount is credited to your account or made available to you without restriction.

Figure the annualized alternative minimum taxable income for the short tax period by completing the following steps. You can use a relief procedure to figure the tax for the short tax year. Under this procedure, the tax is figured by two separate methods. If the tax figured under both methods is less than the tax figured under the general rule, you can file a claim for a refund of part of the tax you paid. For more information, see section 443 of the Internal Revenue Code and the related Regulations. The corporation’s final return will cover the short period from January 1 through July 23. Even if a taxable entity was not in existence for the entire year, a tax return is required for the time it was in existence.

For tax purposes, you will need to make this decision for your business before you file your first business tax return, using one of two accounting methods – cash or accrual. The accrual basis is used by all larger companies, for several reasons. First, its use is required for tax reporting when sales exceed $5 million. Also, a company’s financial statements can only be audited if they have been prepared using the accrual basis. However, unless a statement of cash flows is included in the financial statements, this approach does not reveal the ability of a business to generate cash.

How To Choose The Correct Method

If no market exists, or if quotations are nominal because of an inactive market, you must use the best available evidence of fair market price on the date or dates nearest your inventory date. Under ordinary circumstances for normal goods, market value means the usual bid price on the date of inventory. This price is based on the volume of merchandise you usually buy. For example, if you buy items in small lots at $10 an item and a competitor buys identical items in larger lots at $8.50 an item, your usual market price will be higher than your competitor’s. The basic elements of cost of goods being manufactured and finished goods on hand. For merchandise produced during the year, cost means all direct and indirect costs that have to be capitalized under the uniform capitalization rules.

If your SSN has been lost or stolen or you suspect you’re a victim of tax-related identity theft, visit IRS.gov/IdentityTheft to learn what steps you should take. Go to IRS.gov/SecureAccess to review the required identity authentication process.

However, if you have plans to expand in the near future, want to bring investors into your business, or apply for bank financing, your best bet is to use the accrual accounting method. Check out the two income (Profit & Loss) statements below to see how each accounting method affects your business. First, cash basis accounting is much easier than its accrual basis counterpart, partially because cash basis accounting eliminates the need to track accounts payable or accounts receivable. To further complicate the situation, once you choose, and file taxes using your chosen method, you will need to request approval from the IRS to change the accounting method that your business uses. Meanwhile, the advantage of the accrual method is that it includes accounts receivables and payables and, as a result, is a more accurate picture of the profitability of a company, particularly in the long term. The reason for this is that the accrual method records all revenues when they are earned and all expenses when they are incurred. The key advantage of the cash method is its simplicity—it only accounts for cash paid or received.

If no such goods are on hand, then estimate the cost necessary to satisfy the contract. You must also deduct in that second year all actual or estimated costs for the goods required to satisfy the agreement. If you estimated the cost, you must take into account any difference between the estimate and the actual cost when the goods are delivered.

A required tax year is a tax year that is required under the Internal Revenue Code and Income Tax Regulations. The entity does not have to use the required tax year if it receives IRS approval to use another permitted tax year or makes an election under section 444 of the Internal Revenue Code . The following discussions provide the rules for partnerships, S corporations, and PSCs. If the IRS approves a change in your tax year or if you are required to change your tax year, you must figure the tax and file your return for the short tax period. The short tax period begins on the first day after the close of your old tax year and ends on the day before the first day of your new tax year. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year.

Under the cash method, expenses are recorded when paid to vendors for purchases of products or services. If you pay early, say the 28thof the previous month, that’s when you record the payment. If you pay late, such as the 5thof the month that the rent is due, that’s the day the expense is recorded. Using the cash method of accounting, record income and expenditures according to actual cash flow.

If you must adopt the uniform capitalization rules, revalue the items or costs included in beginning inventory for the year of change as if the capitalization rules had been in effect for all prior periods. When revaluing inventory costs, the capitalization rules apply to all inventory costs accumulated in prior periods. It is the difference between the original value of the inventory and the revalued inventory. You can figure the cost of goods on hand by either a perpetual or book inventory if inventory is kept by following sound accounting practices. Inventory accounts must be charged with the actual cost of goods purchased or produced and credited with the value of goods used, transferred, or sold.

Accrual Accounting Vs Cash Basis Accounting Example

Whether you’re using cash basis or accrual basis accounting, the best way to keep track of your revenues and expenses and eliminate the need to process closing entries manually is to use accounting software. It provides you and any outside parties with a much more accurate financial picture. Keep in mind that using the accrual method of accounting will require you to keep a closer eye on cash flow, which can be obscured when using accrual accounting. Using accrual accounting provides a much more accurate summary of your business. The downside is that you will need to pay taxes on your net sales, prior to receiving a payment from your customers, which can be an issue for small businesses operating on limited cash flow. Modified accrual accounting is a bookkeeping method commonly used by government agencies that combines accrual basis accounting with cash basis accounting.

Keep in mind that the choice to use cash basis or accrual basis accounting will impact your business for the foreseeable future. Your business size can be the determining factor in deciding which accounting method to use. Sole proprietors and freelancers almost always decide in favor of the cash basis because it’s simple and more accurately tracks cash flow. An accounting method is based on rules that your business must follow when reporting revenues and expenses. Whether you’re using financial accounting, managerial accounting, or another type of accounting, the rules for accounting methods remain the same.