Content

A tight job market means job rejection is part of the job search process. Find out how to handle job rejection and move forward with your job search. This document/information does not constitute, and should not be considered a substitute for, legal or financial advice. Each financial situation is different, the advice provided is intended to be general. Please contact your financial or legal advisors for information specific to your situation.

Provides a detailed summary of all your accounts payable related finances from invoice management to balance sheet details to get an accurate picture of your AP in real time. QuickBooks Desktop Enterprise is an accounting software for small businesses which provides users with real-time access to customer, employee, and vendor information. The software includes tools for managing inventory, shipping, sales orders, pricing, tasks, invoicing, reporting, and more. Thus, business needs to think of some favorable terms and conditions it can offer to such customers. This is because such customers would otherwise prefer buying goods and services from competitors on attractive credit terms. Thus, business needs to carefully manage its accounts receivables as considerable amount is tied up in such accounts.

Let’s Hear It Directly From Our Customers

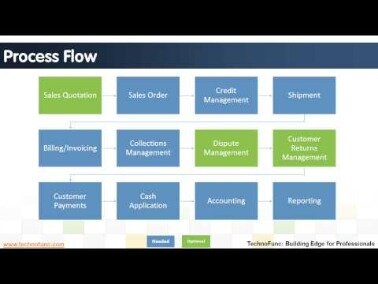

Then, develop either a physical or digital invoice system so you can send invoices to your customers requesting payment. To help you keep track of your accounts receivable, use an automated management system like Quickbooks, or manually track everything in Excel. A crucial part of optimizing accounts receivable processes is to start the process early. All too often, businesses are so intent on making sales that they treat accounts receivable as an afterthought. Starting the process early means discussing things like payment terms in the early stages of the customer relationship. Getting a new customer on board with electronic payments early in the process is another example of taking a proactive approach to the situation.

The worst part of all is that many of the problems are easily avoidable. If your company offers goods or services without prepayment, the unpaid money is classified as receivables .

In a manual process, companies use spreadsheets to record when they send the invoices, and when they receive payments. Small companies also may not have enough staff to appoint an AR Officer, in which the company may hire a professional accountant to fulfill this function.

Tipalti Ap Automation

If you’ve ever had an overdue medical bill or credit card debt, chances are you’ve received a host of annoying calls. No one enjoys those—you don’t know who the voice on the other end is and you’re not exactly ecstatic to pay. Agree on a date and send all invoices electronically to keep better documentation.

- Key features include approval workflow management, quotations, purchase requisitions, invoicing, issue tracking, cash flow monitoring, order generation, and analytics.

- This is because the total value of unpaid accounts increases when sales are made on credit.

- The customer might have charged the money to a specific account that they allocated to a certain department, for example.

- Statements are generated for the purpose of simplifying billing for the customer.

- Planning ahead and sticking to your plan by documenting your process allows your employees to be more efficient and consistent when handling collections.

- Be sure to develop a credit approval process for your business.

It’s important for business owners to manage their accounts receivable properly, from initial credit application to collection of the accounts receivable balance. If you’re concerned about how quickly your customers are paying, calculating your accounts receivable turnover ratio can provide some insight.

So, the amount to be received from Singhania and Sons would be an asset for Kapoor Pvt Ltd. This is because the payment for such goods would be received on a future date. Hence, this is recorded in books of accounts as bills receivable, book debts or debtors. The designated accountant must keep a proper record of the dates on which such bills become due. This is done to ensure that payments against bills receivable are received on time from the customers. Once the invoice is generated, the next step is to keep track of payments received or payments due from customers. Further, the details with regards to the payment method and the date of receipt of payment are required to be recorded in the customer’s ledger account.

Accounts Receivable Job Description

Add flat rate shipping charges unless the order is marked as prepaid or is picked up by the customer. Thanks to all authors for creating a page that has been read 181,003 times.

Company #1, on the other hand, is expecting payment on the bill, and thus records it in its account receivables ledger. As you can see, you don’t have to start over from scratch to improve and optimize your accounts receivable. You can choose to take on one area at a time, or you can plunge full steam ahead and revamp it all at once. Either way, any steps that you take toward optimizing your accounts receivable will pay off handsomely in the long run. Like many business owners, you may not immediately see the benefits of proactively optimizing your accounts receivable processes. As mentioned above, doing so can drastically improve many aspects of your business.

Overview: What Is Accounts Receivable?

However, smaller businesses sell goods on a shorter credit period due to less capital availability and lower cash flows. Accounts receivables are one of the current assets that can be easily converted into cash. Not only that, it is also one of the major current assets of a business including inventories. Since current assets can be converted into cash within 12 months, accounts receivables help in maintaining liquidity.

Also, make a journal entry of a credit in the same amount to the allowance for bad debts account on the balance sheet. If you do not accrue bad debt expense and simply wait to record the bad debt expense when a customer doesn’t pay, this violates the matching principle. For example, suppose you made a sales transaction of $10,000 in which you sold $7,000 of merchandise to the customer. For accounts that continue to go unpaid, a system to identify, followup and collect on delinquent accounts should be developed and in place.

Beginner’s Guides Our comprehensive guides serve as an introduction to basic concepts that you can incorporate into your larger business strategy. Alternatives Looking for a different set of features or lower price point? Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. Applicant Tracking Zoho Recruit Zoho Recruit combines a robust feature set with an intuitive user interface and affordable pricing to speed up and simplify the recruitment process. Cash flow management helps you forecast your monetary requirements based on your current expenditures and savings.

Patriot Accounting

The first step in formulating accounts receivable process is arriving at a credit application process. Such a process is put in place to determine whether the applicant customer has the desired credit worthiness for purchasing goods on credit. The business may choose to sell goods on credit either to individuals or to other business units. Therefore, it is important for a business to sell goods or services on favorable credit terms in order to retain and attract such customers. Thus, we can say credit sales create receivables that help in boosting overall sales of the business. A business sells goods on credit to its customer when it does not receive the payment for the same immediately.

You may be comfortable with an offline, manual entry system using Excel. However, if your business is growing, you may choose to automate your process with accounts receivable management software like QuickBooks.

An invoice is a document the buyer receives from the seller at the time of sale. It details the products and services that have been provided and the cost of these products or services, as well as the date by which payment is expected. Prepare a document that explains your requirements and the customer’s obligations. For example, you may state that payment is due within 30 days of purchase. Stipulate that the customer will be responsible for payment of returned check fees or debt collection fees.