Content

Fortunately, Xero allows you to keep track of all the overpayments with the flexibility of dealing with both situations. So below, we will discuss both scenarios one by one. The aim is to have the balance of the clearing account at zero. Set up a GoCardless account and connect your Xero account to the GoCardless for Xero app. Create a GoCardless for Xero account and connect it to Xero. The blog posts are brought to you by More Than Accountants employees and we occasionally allow guest posts that we think could benefit our customer base. Daniel is the co founder of More Than Accountants and an ACCA Chartered Accountant.

I have a similar situation where I make daily cash stock purchases and sales. will be charged on transactions processed through Xero.Merchants on Ozow Free processing will be charged 0,15%.

Gocardless For Xero

There’s no denying that data-driven insights are the backbone of financial decision-making, helping accounting and finance professionals better understand their customers, receivables, revenue, and more. Look for rails that allow for unlimited Zero-Fee payment processing will drastically cut transaction costs.

At our small business from home we have customers who pay cash and customers who pay in bank account. I know how to reconcile with bank account, but have not opened a “cash sales” account yet. Each time you create an invoice in Xero you can collect the payment automatically by ACH Debit on the invoice due date. Alternatively, you can manually collect payments for specific customers or by Xero branding themes. Lets assume he paid us $334.00 (overpayment of $100.00).

The good news is that it’s fairly straight forward once you know how. Payment tracking is another valuable feature to look for in this bucket. In accounts receivable, you of course are heavily reliant on when you are getting paid – tracking that process is going to improve cash flow.

Xero Became A Really Critical Tool For Us As We Took On More Staff

Receive payments directly from your customer’s cheque, savings or credit account – credit cards aren’t necessary. Send, receive, and track multiple client payments, invoices, and everything else you do, all in one place. We have found that digitization is a key element in todays accounting life cycle in order to speed up time to cash, eliminate human error, manual processing and to create a superior user experience for you and your customer.

- Many users like to have options or they have their own preference as to which payment method they use.

- For an up-to-date view, run the report after entering purchases and reconciling your bank transactions.

- A modern payment gateway extension for eCommerce, billing, and invoicing on Magento.

- You will notice Xero displaying a notification of by how much total is out.

Just keep invoices or add on the cash entry for reference. I know the future will be no cash, but here in South Africa we are a bit slower. Most customers pay via Electronic Transfer from banks online and other regulars pay cash on collection.

One Thought On how To Deal With Xero Overpayment From Customer

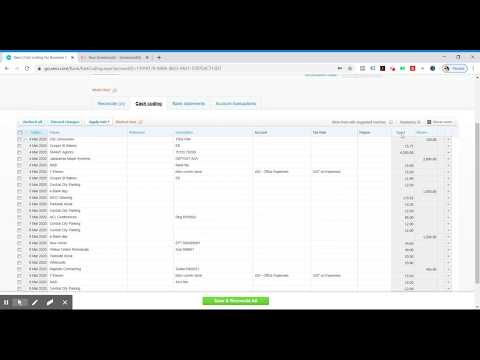

Note that the overpayment wont show up separately but it will show up as part of the larger sum that we receive from the customer. Enter Amount, Date on which the refund was paid and the bank account from which the refund was made in the Amount, Date and Paid From fields respectively. Note that the debiting the accounts receivable won double the accounts receivable. The entry will just balance and nullify the credit of Accounts Receivable that occurred when we accounted for the overpayment in the above step. You can now see the overpayment in the Awaiting Payment section of the invoices with the overpayment recorded as a figure. Overpayment occurs when your customer pays you more than what he owes. This article will guide you about how you can deal with situations involving Xero Overpayment.

Then when ever I bank my cash, I reconcile the cash deposit to the Cash Clearing account. Once a payment has been confirmed, the transaction is irrevocable with no charge backs . It saves everyone money, and their suppliers appreciate actually being paid on time. We found Veem so convenient that we’ve started working on integrating it with our system. Whenever a client issues a payment, we’ve taught our software to send them a notice recommending they send the wires through Veem. As you record your income and expenses in Xero, the GST portion of the transaction gets allocated to your GST ledger account. At the end of each BAS period you need to record an entry to clear out the GST that has accumulated in that account.

Payments GoCardless 63 Payments GoCardless is the global leader in recurring bank-to-bank payments, such as direct debit, ACH and PAD. Try for free.Payments IntegraPay 7 Payments Get paid faster with IntegraPay!

Zero has no function for cash sales paid by cash or cheques, when are they going to catch up with the 20th century. Shoppers do not need to enter into a lengthy registration process, you simply log in using your internet banking details. Immediate payment completion notification, for quicker action on delivery of goods/services.

Screen Recorder

The Usual Stuff is a free, online resource about WordPress. You will notice Xero displaying a notification of by how much total is out.

Click the link above to find out more about each option. When you connect Xero to your Timely account, there are three ways in which you can manage your payments. How you choose to map your payments affects how you reconcile these in Xero. Spread the cost of your services over time or offer a payment plan for high-value items. Choose to split a single Xero invoice into a schedule of smaller instalment payments for greater flexibility. Once GoCardless is set up, whenever you issue an invoice, payment will automatically be collected as soon as it’s due.

Accounting Entries For Allocation Of Overpayment To An Invoice

Take Bank Debit payments from your customers around the world. Collect payment in their currency and receive payout to your domestic bank account in your local currency with built-in FX powered by Transferwise. Paystand is on a mission to create a more open financial system, starting with B2B payments. Using blockchain and cloud technology, we pioneered Payments-as-a-Service to digitize and automate your entire cash lifecycle.

Compare any transferred monies against your monthly bank statements to make sure they are present. As long as all the numbers match, you can check off individual items as being reconciled. See individual bills, credit notes and overpayments owed with the aged payables detail report and see how long bills have gone unpaid. For an up-to-date view, run the report after entering purchases and reconciling your bank transactions. Seeking advice on how to treat an invoice when it has been paid in cash and the cash has not been paid into the business bank account but spent on non-business purchases. Stripe makes it easy to accept debit and credit card payments for online invoices sent from Xero. I am in Australia and I have a Cafe business and just been introduced to Xero for my accounting.