Content

All businesses need accounting and audit, after all, and an application like this can offer them a centralized way to see and manage their balances and cashflows, even claim expenses, maintain inventory, and generate reports. There have been AP solutions for as long as computers have existed in the modern workplace. You would likely think of accounting software as slow behemoths installed on local computers. Like many B2B applications employing a SaaS model—which is hosted in the cloud and accessed either by a web browser or a mobile app—AP software can now be deployed anywhere. Setting it up takes minutes instead of hours, and it can give you a complete overview of your accounts payable in hours rather than days. In accounting and in other financial-related tasks, compliance is the norm.

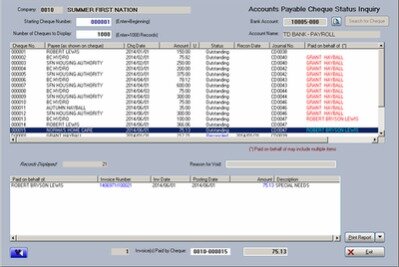

There’s considerable potential for enhancement, in particular, in accounts payable workflows. • Eliminate manual time consuming processes of routing, coding, matching, approving and keying of supplier invoices. While the ERP seems like a good idea on the surface, a company’s AP staff is still burdened by all of the manual aspects of processing the supplier invoices BEFORE an AP invoice even makes it to the ERP system. AP Automation adds significant value to Accounts Payable, including real-time visibility into performance and financial status, increased accuracy, and better compliance with tax laws and industry regulations.

- Templates Plug and play pre-built solutions based on Pipefy’s best practices.

- Since most people aren’t very good at calculat-ing numbers in their head your AP Staff most likely take out their calculator on every PO invoice to make sure the invoice due amount is within your allowable tolerance.

- This guide provides a practical how-to for selecting the right AP software to cut unnecessary costs and create efficiency in payables processing.

- Because of discrepancies in costs and pric-ing companies have developed internal allowable tolerances.

- Compare product reviews and features, and learn from our Finance Software Research.

Accounts payable automation systems drastically speed up the workflow and help reduce the occurrence of serious issues. An AP employee manually enters the payment info into the ERP system or accounting platform and may need to save a physical copy to meet auditing requirements. But most job descriptions include the same overarching steps aimed at delivering accurate, on-time payments to ensure smooth business flow. • All levels of corporate finance are able to make better business decision based on real-time KPI’s and financial data. Does the vendor have a growing customer base, and are they regularly updating the platform?

Esker Accounts Payable

Software Advice uses reviews from real software users to highlight the top-rated Accounts Payable Software products in North America. When reviewing a product, users are asked to asses the product’s overall quality, ease of use, features & functionality, customer support and value for money. Put another way; it can also save an hour a day so your accountants can do more tasks instead of filing paperwork. Get a free consultationfrom an independent accounts payable system expert. Members of IOFM have 24/7 access to an unmatched collection of resources for AP professionals including critical compiance webinars, exclusive benchmarking reports, white papers, expert answers, tools & templates, timely articles and much more. GEP NEXXE is a unified and comprehensive supply chain platform that provides end-to-end planning, visibility, execution and collaboration capabilities for today’s complex, global supply chains.

The functions of a typical AP software can help them nurture relationships with their clients and practice under the industry they’re currently employed in. Processing credit memos and invoices are not only demanding but very repetitive, and doing it by hand just opens professionals to human error. And if your figures don’t match, it means you won’t have a solid grasp of your financial condition and would make you prone to committing a grievous mistake. This post will introduce you to what accounts payable software is, what it can do, and provide some examples that can help you choose one that your company’s situation requires. Accommodating the payment of funds that may or may not actually be cashed, creates a unique accounting challenge. Certain accounts payable modules will provide specially developed tools to manage these transactions. The level of reporting functionality will vary greatly between different solutions.

Certify AP innovates the AP and finance functions with digital requisitioning, purchase orders, receiving, invoice management, vendor payment, and budget management workflows. Built-in controls adhere seamlessly to your organizations regulatory requirements and approvals processes to drive compliance and keep purchases within budget and policy. Business Payment Automation — When a payment is processed, ideally a transaction ID should be generated. The system should automatically capture and get mapped against the invoice so that three-way matching happens in real-time and the payment trail can be tracked at any instant. This yields to a better relationship with vendors by allowing them for preferred service and better deals. Automated emails can be set up to remind for the pending approval, processing payments and avoiding a delay.

Automated accounts payable systems can create a process that’s simpler, more accurate and highly efficient. It helps in reducing the business payment cycle, governs the financial policies, automates the approval mechanisms and stores the record in a digital archive — making the entire process paperless. It’s that strong and growing network of partnerships that makes the Yooz platform so powerful. But it’s the holistic approach of an end-to-end cloud platform will put it on the shortlist for anybody researching accounts payable automation best practices.

It has all everything include Purchase Orders, Purchase Requisition, Vendor Management, Purchase Invoicing, Analytics, and Integrations. They offer a global view of the state of their business, as well as a list view, which offers greater visibility on document statuses and next activities. Vendor Portals — A vendor portal enables your vendors to submit and track a quote instead of emailing, communicate instantly with the purchasing team and receive automated payments. Vendors can get discounts by setting up rate contracts and can track statuses of deliveries in a single workflow. An automated accounts payable system is a great way to overcome these issues and increase effective communication as well as employee productivity.

Popular Accounts Payable Software Comparisons

Automate Repetitive Tasks — Tasks, like approving purchase orders or making payments against invoices, are laborious and consume a lot of time for finance teams. A fully integrated and automated invoice processing solution like Applexus InSITE can handle the full-cycle accounts payable process without any human support.

Your accounts payable software should include controls to identify the authenticity of each payment. No one likes to think they’ve lost money through errors or fraud, but audits often turn up evidence this has happened.

• Gain complete visibility and control to corporate spending, financial condition and liabilities. This fundamental design assumption also leads to poor exception handling, because the assumption is that humans have already corrected the data as they entered it. In reality, error rates through manual human intervention are fairly high while visibility and productivity remain low and expensive. Assuming that the matching process goes well and there are no discrepancies it may take a few minutes to an hour or so to match a PO invoice, HOWEVER it is not often that a PO invoice matches exactly. Because of discrepancies in costs and pric-ing companies have developed internal allowable tolerances. What this means is that as long as the invoice due amount falls within an acceptable tolerance range of a few dollars or a percent or two, then the AP Staff should just pay it. Now let’s think about what it takes to figure out if an invoice is within your allowable tolerance.

Tipalti is an example of an accounting software deployed in a SaaS model. NetSuite ERP gives you total control over all your accounting needs—and more. Let’s talk about how your product can solve the business needs of our visitors. Progressive IT teams are much more in favor of cloud systems that do not require monitoring of a vast amount of physical hardware. Deployments become far simpler, and automatic updates allow you to have the most up to date solution possible.

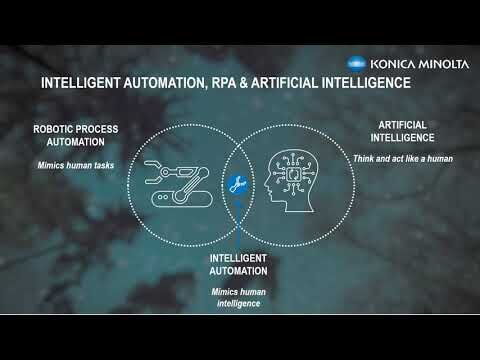

Individual best-of-breed applications often have a more extensive feature set, but lack the integrative capabilities of other applications. In contrast, integrated suites might lack features but come with the benefit of being totally integrated across all applications. While businesses can generally rest easy knowing that their financial data is secure in the cloud, some businesses that have particularly sensitive financial data might wish to host their accounting solution on their own servers. Be sure to consult with an IT security professional to decide what your organization should do. As such, accounts payable systems are almost always offered as a package with other core accounting modules. That said, some vendors may offer standalone accounts payable applications to help with more complex accounting situations. Artificial intelligence is set to revolutionize the way people do business, from retail to services.

By providing prompt and efficient service with an automated accounts payable system, you will build trust with your suppliers and partners. Having lasting relationships with them is just as important as the relationships with your clients or customers.

You’ll want to deploy a system that can scale with your business and your needs. One major consideration is whether a platform complies with various foreign or international accounting regulations. It is important to verify with prospective software vendors that they have other clients that are in your industry and are similar in size.

Square Payroll Review: Pricing, Pros, Cons & Features

Since most people aren’t very good at calculat-ing numbers in their head your AP Staff most likely take out their calculator on every PO invoice to make sure the invoice due amount is within your allowable tolerance. HOWEVER, there are probably some very good business reasons for considering or even implementing an AP Automation system or process in your organizations finance department. Most accounting platforms are considered to be “general purpose” and serve a range of industries. However, certain organizations in particular industry niches might have to seek out a more specialized platform. For example, a distribution company would want to use an accounting platform that can assist with something like international fuel tax compliance.

The crux of an accounts payable solution with self-learning capability is its machine learning algorithms. This algorithm analyzes the data flowing in from the invoices and leverage it to make the process faster and accurate. This tech-driven automation process is also dubbed a hyper-automation where AI, ML, RPA, and Data combine to work together. Electronic invoicing and real-time notifications are vital to improving your team’s performance.

That’s why they recommend organizations do their homework long before embarking on any accounts payable automation project. It includes compiling the main pain points, spelling out their key questions, and then doing a vendor survey. The focus should be on vendors with whom they can enter a partnership, including a lively information feedback loop with software providers that use their customers as a valuable resource to continuously improve their product. An example of how automation, data, and machine learning can work together inaccounts payable automationlies is3-way invoice matching. Given a set of rules in AI, the intelligent software system will successfully match invoices to receipts and purchase orders, freeing up plenty of AP team resources. There is more to learn about how accounts payable systems with self-learning capability transform the invoice payment processing cycle. Data capture is super easy with Pipefy because you can set up online forms and even service portals, to receive requests from employees and electronic invoices from suppliers, even if they are not Pipefy users.

CFOs who do not develop an effective control over their accounts payable strategy can severely limit their company’s liquidity, leaving them with insufficient cash on hand when they have narrow windows to seize fleeting opportunities. Spend Matters welcomes this guest post from Finly, a provider of business spend solutions. together deliver supply chain solutions of unprecedented scale, power and effectiveness. Our customers are the world’s best companies, including hundreds of Fortune 500 and Global 2000 industry leaders who rely on GEP to meet ambitious strategic, financial and operational goals.

Integration with the Purchase Order module is important as both Accounts Payable and Purchase Order processes benefit from mutual access to the master vendor list. Bank reconciliation capability functionality may also be contained in its own application. If this is the case, integration is critical to identify which payments have been made and to reconcile the Accounts Payable and bank records. Spendesk is the all-in-one spend management solution that delivers more control, visibility, and automation to today’s finance teams. Combine spend approvals, virtual cards, physical cards, expense reimbursements, and invoice management into one source of truth. Employees easily pay for what they need while finance keeps ultimate control. Trusted by over 1,500 companies, Spendesk is helping businesses everywhere spend smarter.

What Is Accounts Payable Software?

Static accounts payable solutions are not at all advanced to scale up as per the business requirements. As companies expand, taking care of vendor payments, employee reimbursements, and dozens of other outgoing costs often grows complicated, and the process becomes inefficient. The explosion of payment options has introduced system compatibility issues and similar risks that slow down business. For CFOs and AP teams to meet these challenges, they need to deeply understand theiraccounts payable processand go after innovative solutions to standardize, centralize, and automate it. A beautiful and innovative Procurement Software for small and midsized businesses that don’t require time for implementation and have flexible open pricing.

Over time, slow payments will drive vendors to more reliable new partners that are more efficient in their financial duties. This is because ERP’s don’t have the ability to support the multiple processes (receipt, review, approval, etc.) that are prevalent with each invoice transaction. ERP’s are simply not specialized enough in any one area to provide the best AP automation solution you can get. Finally, after all of the tedious manual back and forth to get approvals, the back and forth to deal with invoice exceptions now your AP Staff can finally key the invoice data into your financial system for payment processing. When the vendors call to inquire about the status of the payment of their invoice I would bet your AP Staff will happily talk with the vendor about where the invoices are at and when you’ll pay them. On the other hand, AP software can also be categorized by the business they’re targeting. In general, businesses that can see the most use for these applications are obviously accounting firms that look to boost revenue.