Content

ACCA engaged with over 2,000 professional accountants and C-suite executives across the globe to identify the external factors that they expect to have the greatest impact over the next 3 to 10years. The findings showed 55% of those surveyed ranked the development of intelligent, automated accounting systems to have the highest impact. In the article, accountants were advised to educate themselves about what’s ahead for technology and specialize quickly, because entry level jobs will become vulnerable sooner than higher-level roles. Taking this one step further, industry professionals could also embrace AI technology in an effort to provide more value to clients. In the next 10 years, employers will expect accountants to have effective computer skills, including Microsoft applications and financial databases, and have the ability to pay close attention to detail. Knowledge of Net Suite and other accounting systems will also be required by many employers.

Accounting’s future is bright, with a projected 10% increase in accountant and auditor employment between 2016 and 2026, according to the U.S. Not only does the future of the accounting profession look promising, but the industry is also rapidly evolving with the rise of technology.

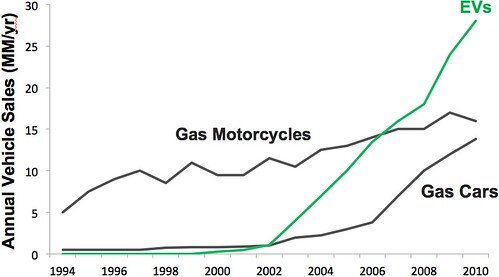

With advances taking place in artificial intelligence, technology is now able to start making predicting accuracy in various areas of accounting. You would leverage this ecosystem to run more complex automations in accounting. Today, this is a basic expectation when it comes to accounting automation. And while accounting automation does present a threat to some, it’s clear from the above chart that it presents an opportunity for many. So if you’re looking to improve your firm in 2021 and keep yourself on the cutting edge of accounting, you’ll love this new guide. This guide will cover trends that are happening at this very moment and specific strategies that you can use right now to better prepare you and your firm for the future. In the area of audit, big data analytical tools can analyse large volumes of data, apply a combination of statistical models and tests, and flag exceptions instantaneously for review.

Ey Employees Are Building A Better Working World One Colored Pencil At A Time

Some entry level jobs in accounting, such as accounting clerks and bookkeepers, only require a high school diploma or associate’s degree. However, the fastest growth in accounting jobs is expected to be in positions that require a master’s degree. Because of the increased number of audits and other corporate scandals, companies are hiring more employees to perform accounting and financial auditing services. They want to prevent any mistakes that weaken their brand and appearance of stability. The US Bureau of Labor Statistics reports that there will be a 14% increase in the job market for bookkeeping, accounting and auditing clerks. 1,898,300 individuals were employed in these occupations in 2010, and there will 2,157,300 jobs for accounting occupations by 2020.

The Institute of Management Accountants offers the Certified Management Accountant to applicants who complete a bachelor’s degree. Applicants must have work experience in management accounting, pass an exam, agree to meet continuing education requirements, and comply with standards of professional conduct. For accountants with a CPA, the AICPA offers the Accredited in Business Valuation , Certified Financial Forensics , Certified Information Technology Professional , and Personal Financial Specialist certifications. All of these credentials require experience in the related area, continuing education, and passing an exam. Most accountant and auditor positions require at least a bachelor’s degree in accounting or a related field. Some employers prefer to hire applicants who have a master’s degree, either in accounting or in business administration with a concentration in accounting.

Then make sure the direction of your business is consistent with them. They want easy & frictionless with everything at the push of a button. If you’re interested in reading about my proven formula for attracting clients through your blog, check my 15-Step Blogging Formula here. This is my all time favorite strategy for getting people to find you on Google. By doing so, you’re giving Google relevant information about your firm which helps improve your chance of ranking for popular local keywords. Search Engine Optimization is the process of optimizing your content/website to be more easily found on Google when people search for keywords relevant to your business.

The continued globalization of business may lead to increased demand for accounting expertise and services related to international trade and international mergers and acquisitions. Accountants and auditors must be able to listen to and discuss facts and concerns from clients, managers, and other stakeholders. They must also be able to discuss the results of their work both in meetings and in written reports. ISACA offers the Certified Information Systems Auditor to candidates who pass an exam and have work experience auditing information systems. Information systems experience, financial or operational auditing experience, or related college credit hours may be substituted for some of the experience required in information systems auditing, control, or security.

For example, “automation, minibots, machine learning, and adaptive intelligence are becoming part of the finance team at lightning speed” at consulting firm Accenture, as noted in Forbes. I believe artificial intelligence is about to transform the accounting industry. Automation, machine learning and big data are already impacting how accountants serve clients.

A) Onboard Technology Expertise

People have taken 9-to-5 jobs because that’s typically been the way to earn a living. Someone needs to properly communicate to clients and team members what the technology has done in order to guide them through complex situations.

As the accounting world continues to evolve, why not take advantage of the opportunity to grow with it? A career in advising gives you the skills accountants will need in 2040 today, exposing you to every part of the business and helping you grow your consulting and interpersonal skills. Data Will Take Center Stage–A lot of companies already invest heavily in big data and automation, while failing to realize that the people and processes are the things that are lacking. You can have the most robust data in the world but if you don’t have the right people to analyze it and the right processes in place to make sense of it, you’ll not reap the benefits of your data.

Accounting Job Outlook For The Next 10 Years

Meet regularly with your team and list problems and points of friction that still exist among your clients, rank them in terms of pain points and brainstorm ways on how you might solve them. By adding personal touches that improve the customer experience, you can sidestep some of the threats discussed in this section. There’s a lot of talk about automation, but today, and certainly in 2021, the personal human touch cannot be ignored. All of the above suggests that competition will increase and market share will erode due to new emerging business models. The online education market is exploding and is expected to hit $350B globally by 2025.

- Some work with financial managers on asset management, which involves planning and selecting financial investments such as stocks, bonds, and real estate.

- As markets opened up and investments started flowing across boundaries, the reporting needs of the organisation also grew.

- The future of accounting involves more complex automations that leverage the hundreds of third-party apps that can integrate into your accounting system.

- The accounting software market will experience a higher level of growth in the years ahead, according to a report by Fortune Business Insights.

Today, the first step in any consumer’s purchasing process is most likely through a Google search. This means that if your firm is not easily found on Google, you’re missing out. What this means is that during your discovery process you need to be learning about their current processes, in as much detail as possible, to understand how you’ll improve them. Part of what your clients are paying for when they offload bookkeeping, payroll, bill pay, etc., is for you to make the process more efficient and easier on them.

Join us as we offer our expert insights on five of the hottest future trends in the accounting profession for 2021. The most attractive workers have skills that cannot be replaced with computers – like advisory, consulting, and potential CFO duties. At Accounting Principals, we notice that skilled professionals are the most desirable talent for expanding accounting departments – while the need for admin roles has decreased significantly. Accountants will still need solid math and basic accounting skills to solve solutions that AI might misinterpret. It wasn’t long ago that most of us were jumping for joy at the sight of two line graphs crossing on our TI-83 calculators. Today IBM, General Electric, and other tech giants are helping businesses save money and improve accuracy through the use of robot automation for routine tasks. Here are four ways the accounting industry will change in the next 20 years.

What Accountants And Auditors Do

Another example is the use of robotic process automation to minimize processing times for audits and contracts down to weeks instead of months, according to the CPA Journal. As Forbes explains, larger firms using RPA AI integration have “increased efficiency and higher-level services,” compared with smaller, non-AI competitors. According to an ACCA Study, over 50% of C-level executives in the accounting industry expect the development of automated accounting systems. In the coming years, it will have the highest impact across several industries, allowing accountants to utilize data and optimize processes for both the best accounting software for small businesses and large enterprises. Accounting automation also seeks to guide businesses in arriving at data-driven decisions more quickly than ever before. I’ve been working on my own automation platform for businesses, and keeping tabs on other emerging technologies in the industry. From what I’ve seen, new technologies will create the need for accountants to adapt both their processes and skill sets.

It won’t be responsible for key client interactions, and it won’t get the final say on business-critical decisions. We’ll still need people for that—preferably, people who are good at talking to and working with our robot buddies. It’d be funny, sure, but about the fifth or sixth time he chugged a beer and burped fire across the conference table, the clients would run screaming for the hills. But again, tomorrow’s clients are going to want to see the faces behind those numbers.

Meanwhile, a growing number of firms are now prioritizing accountants who have extensive knowledge in analytics and data science. This shows that the accounting industry is shifting from its reactive nature to becoming more proactive. CPAs, backed by big data, can now focus more on planning, taking control, analyzing processes, and anticipating problems before they even happen. Just as big data plays a crucial role across many sectors, it fills the same significant role in the accounting industry. Big data supports companies and firms through expanded assessment methods, with accountants and finance experts working behind the scenes. Professionals identify which of the collected data are the most valuable and then turn them into actionable insights. This makes it crucial to understand what big data is in making business decisions.

Automating some routine tasks makes these workers more efficient by allowing them to focus on analysis and other high-level responsibilities. A bachelor’s degree in accounting or a related field is typically required to become an accountant or auditor. We believe in a collaborative approach to connect forward-thinking accountancy firms from across the world and share the latest industry updates. Our increasingly globalised world means it’s more important than ever to establish common goals and innovate as a united force for positive change. INAA is an International Association of Independent Accounting firms, established over 25 years ago to facilitate cross-border business. Additionally, as more and more accounting service providers compete to white label their offerings to larger firms, hiring outsourced support will become increasingly affordable. Outsourced accounting service providers is one of the fastest-growing areas of the accounting sector.

Accounting is moving to a future where the close is virtual, automated, and continuous. We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

They may use advanced math skills, such as calculus and statistical analysis, for these tasks. Some top executives and financial managers have a background in accounting, internal auditing, or finance. The Institute of Internal Auditors offers the Certified Internal Auditor credential to graduates from accredited colleges and universities who have work experience as internal auditors and have passed an exam. A few states allow a number of years of public accounting experience to substitute for a college degree. Accountants and auditors examine financial statements for accuracy and conformance with laws. As recent events trigger companies to rethink the way they operate, embracing remote collaboration platforms to facilitate an outsourced business model could pave the way for a new era of accounting. The sudden spike in remote working throughout COVID-19 will trigger some of the most radical accounting employment trends in recent history.