While you might be able to do this yourself to start as a small business owner, it’s best to make the investment in a qualified, professional bookkeeper to ensure your success in the long term. Bookkeeping is one of the most important tasks that a business owner will delegate over the life of a business. Without it, it’s nearly impossible to produce an accurate record of financial activities that affect everything, from profit to equity to payroll, and more.

You can use the following software solutions to set up all your business accounts. Whether you’re an established or new business owner, here are seven bookkeeping processes to follow. This account tracks the purchase of any raw materials and finished products for the business.

Depending on the type of accounting system used by the business, each financial transaction is recorded based on supporting documentation. That documentation may be a receipt, an invoice, a purchase order, or some similar type of financial record showing that the transaction took place. From balance sheets to income statements, there’s no denying that there are new terms and phrases you’ll come across. In practice, they’re quite easy to understand once the terms are broken down into much simpler definitions. If your business is a side project with a limited budget, you can probably get by going the DIY route.

The best part is that you will not require any prior knowledge or an accounting degree to get started. Let’s say you want to write off some office furniture on your taxes. You’ll also need to save those receipts in case you ever get audited. Most bookkeeping software has a place to scan and store receipts. So, it’s been getting really painless to save all of your supporting docs.

Overview: What is bookkeeping?

Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook. Businesses that have more complex financial transactions usually choose to use the double-entry accounting process. Our bookkeepers here at Bench can do your books for you entirely online. We’ll also give you simple software to produce financial statements, keep track of your daily expenses, and help make tax time a breeze. Under single-entry, journal entries are recorded once, as either an expense or income.

- If you’re a busy small business owner with a million things to do, it’s easy to let bookkeeping fall by the wayside.

- Lenders and investors want a clear idea of your business’ financial state before giving you money.

- It will help you physically run a periodic stock check to confirm that the inventory products match the record on the books.

- When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor.

Professional bookkeepers and accounting professionals are available to manage, track, and report on financial activities. For a small business, this can be a great way to get the benefits of having a dedicated bookkeeper and accountant without the need to build out your own accounting and bookkeeping department. Business accounting software and modern technology make it easier than ever to balance the books.

Owners equity account

Liabilities are claims based on what you owe vendors and lenders. Owners of the business have claims against the remaining assets (equity). Equity is the investment a business owner, and any other investors, have in the firm.

If you look you look at the format of a balance sheet, you will see the asset accounts listed in the order of their liquidity. Asset accounts start with the cash account since cash is perfectly liquid. After the cash account, there is the inventory, receivables, and fixed assets accounts. Firms also have intangible assets such as customer goodwill that may be listed on the balance sheet. At the end of the appropriate time period, the accountant takes over and analyzes, reviews, interprets and reports financial information for the business firm.

Missing out on any payments — even if they’re ten cents — will cause issues when you try to reconcile your books. Know that you must record each and every debit and credit financial transaction, no matter how small it might be. All these accounts may sound too much to handle in the beginning. However, once you get the hang of the bookkeeping basics, you’ll be able to effectively use the data from these accounts to make informed business decisions.

The equity accounts include all the claims the owners have against the company. The business owner has an investment, and it may be the only investment in the firm. If the firm has taken on other investors, that is reflected here. Most software that’s designed for sole proprietors and small businesses will include a default chart of accounts, so you won’t have to create one from scratch. Diamonds may be forever, but the ink on your expense receipts is not. Since the IRS accepts digital records, it’s smart to use a cloud-based system like Dropbox, Evernote, or Google Drive so you never have to deal with smudged receipts.

Liabilities are what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books. The liability accounts on a balance sheet include both current and long-term liabilities. Current liabilities are usually accounts payable and accruals. Accounts payable are usually what the business owes to its suppliers, credit cards, and bank loans.

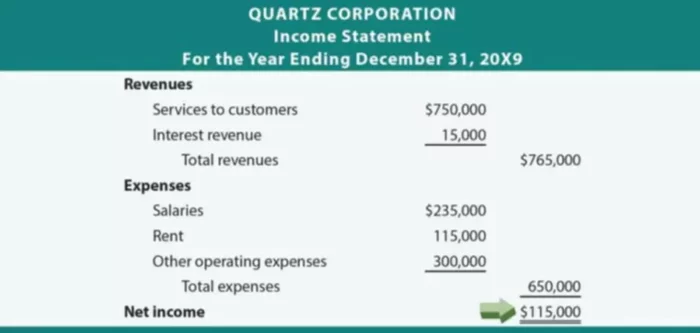

Preparing your financial reports

One of the most important bookkeeping basics is to stay consistent and stick to the schedule you’ve established for your business. You must record all financial transactions — ideally once a week. These include all incoming invoices, outgoing bill payments, purchases, and sales.

Use that day to enter any missing transactions, reconcile bank statements, review your financial statements from the last month and make any major changes to your accounting or bookkeeping. Finally, if you want someone else to do your bookkeeping for you, you could sign up for a cloud-based bookkeeping service like Bench. We’ll do your bookkeeping for you, prepare monthly financial statements, give you expense reports with actionable financial insights, and we’ll even file your taxes for you when the time comes. Under cash accounting, you record transactions only once money has exchanged hands. If you bill a customer today, those dollars don’t enter your ledger until the money hits your bank account. If you wait until the end of the year to reconcile or get your financial transactions in order, you won’t know if you or your bank made a mistake until you’re buried in paperwork at tax time.

How to Budget for Bookkeeping Services

Since good record keeping relies on accurate expense tracking, it’s important to monitor all transactions, keep receipts, and watch business credit card activity. Many bookkeeping software options automate the tracking process to eliminate errors. You can hire a full-charge bookkeeper, a virtual bookkeeper, or use software to keep financial records.

(Liabilities are essentially claims in which you owe lenders and other vendors.) This is also known as “net assets.” This account deals with the money that your business owes to vendors, contractors, and other parties. An accounts payable account gives you a clear and simplified view of when your payments are due and helps you avoid duplicate payments. Here are 1o types of bookkeeping accounts for a small-to-medium sized business.

- While the job of bookkeeper may appear similar (or the same) as an accountant, they are only similar on the surface.

- If you just started your own business, DIY with spreadsheets or invest in bookkeeping software like Bench, Freshbooks, or Xero.

- Bookkeeping is not something you can pick and do when it suits you.

If your company is larger and more complex, you need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account. One of the first decisions you have to make when setting up your bookkeeping system is whether or not to use a cash or accrual accounting system. If you are operating a small, one-person business from home or even a larger consulting practice from a one-person office, you might want to stick with cash accounting.

Now that you’ve mastered the basics of bookkeeping, let’s move on to the best practices. By the end of this section, you’ll learn how to smoothly manage the business side of things without spending a fortune. This can be from new client work or even interest from your business bank account. Next, calculate the total amount and put it under Total Revenue.

Block a date in your calendar every month and commit to it. If you’re expanding your business and you require more complex statements, or you’re looking to delegate so you can free up time for more projects, hire a bookkeeper and accountant. Look at your books and start canceling those subscriptions. Did you know that you can deduct tax from the software you bought for your business?

If you need to borrow money from someone other than friends and family, you’ll need to have your books together. Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. You must always ensure secure storage of your bookkeeping records. Following the bookkeeping basics above will make the process easier and help you to stay compliant with industry standards. Balancing your accounts is the most crucial sep of bookkeeping basics.