Content

The formula for the weighted average cost method is a per unit calculation. Divide the total cost of goods available for sale by the units available for each inventory item. The four main ways to account for inventory are the specific identification, first in first out, last in first out, and weighted average methods. As background, inventory includes the raw materials, work-in-process, and finished goods that a company has on hand for its own production processes or for sale to customers. Inventory is considered an asset, so the accountant must consistently use a valid method for assigning costs to inventory in order to record it as an asset.

This article provides general information, not tax or legal advice. Talk to your CPA and tax advisor and get opinions on your specific business situation before you attempt to make a change. The decision to use LIFO vs. FIFO is complicated, and each business situation is different. You must conform to IRS regulations and U.S. and international accounting standards. Get help from your tax professional before you decide on an inventory valuation method.

It is usually used for large items that can be easily identified and have widely different features and costs associated with these features. Inventory valuation is the monetary amount associated with the goods in the inventory at the end of an accounting period. The valuation is based on the costs incurred to acquire the inventory and get it ready for sale. The decision to change inventory methods or to change back is complicated and has many tax and accounting implications.

Under FIFO technique, cost of inventory is related to the cost of latest purchases, that is Rs.70. The theory is based on the logic of selling those inventories which are first purchased. Therefore, companies issue materials and utilize the goods that are set at higher price first. If businesses plan to expand globally, LIFO is definitely not the right choice for valuing company’s current assets or financial accounting. LIFO calculations are more complicated, especially when current costs keeps fluctuating. It might also cause a problem if there is an unusual increase in prices.

Global warming has resulted in poor yields of coconut oil and palm oil and thus steadily increasing costs for her. Let’s illustrate the different effect of these three methods with a completely fictitious example. Finally, if you deal in physical goods, inventory is easily the largest current asset on the balance sheet. And, as a current asset, you are motivated to sell and turn over the inventory in the next 12 months. It’s important to note that companies in the US operate under the generally accepted accounting principles , while most other countries adhere to the International Financial Reporting Standards . The national accounting standards organization, the Financial Accounting Standards Board , in its Generally Accepted Accounting Procedures, allows both FIFO and LIFO accounting.

Inventory Valuation

Your unit cost is simply the total cost for a given product, divided by the total number of units you have. Lastly, if the prices of the products you buy hardly change then you can use an even easier method called Weighted Average Costing. Accounting Learn about accounting tools, methods, regulations and best practices. The variance—whether a credit or a debit—is to the Materials Price Variance account. The Pacific Bead Company sells handcrafted beads from local island crafters to retail markets and customers out of its warehouse. From the company’s accounting software, the following is its reporting period information.

Different inventory costing methods are best suited to different situations and financial goals, and no single method is inherently better than any other. Small business owners should understand the different types of inventory costing methods and the advantages of each to select the best method for their accounting system. FIFO shifts the higher costs to ending inventory during periods of rising prices, while LIFO shifts the higher costs to cost of goods sold during the same period. The average cost method generally settles somewhere in between the two other inventory methods. If inflation were nonexistent, then all three of the inventory valuation methods would produce the same exact results. Inflation is a measure of the rate of price increases in an economy. When prices are stable, our bakery example from earlier would be able to produce all of its bread loaves at $1, and LIFO, FIFO, and average cost would give us a cost of $1 per loaf.

Lifo Under Perpetual Inventory Procedure

The FIFO method assumes that the first unit in inventory is the first until sold. On Monday the items cost is $5 per unit to make, on Tuesday it is a $5.50 per unit. When the item is sold on Wednesday FIFO records the cost of goods sold for those items as $5. So, the balance sheet has the cost of goods sold at $1 and the balance sheet retains the remaining inventory at $5.50. Without inflation all three inventory valuation methods would produce the same results. However, prices do tend to rise over the years, and the company’s method costing method affects the valuation ratios.

The FIFO method is the standard inventory method for most companies. FIFO gives a lower-cost inventory because of inflation; lower-cost items are usually older. Some types of products can be valued individually and a specific value assigned.

Yes, inFlow does have an Inventory Details Report that shows the amount of stock at each location, and also the value of that stock. To be competitive, you may want to offer a lower price than your competition, but don’t go too low or consumers might wonder why your price is so low. Kaye Morris has over four years of technical writing experience as a curriculum design specialist and is a published fiction author. She has over 20 years of real estate development experience and received her Bachelor of Science in accounting from McNeese State University along with minors in programming and English. Melissa sells handicrafts from Mauritius at various festivals and fairs in Hawaii.

Why Would A Company Have To Pick Lifo Or Fifo?

For example, antiques, collectibles, artwork, jewelry, and furs, can be appraised and a value assigned. The cost of these items is typically the cost to purchase, so the profit can easily be determined. You must keep inventory so you can calculate the cost of the products you sell during the year. Cash accounting and accrual accounting are different methods for determining when income and expenses are counted for financial accounting purposes. Under the Tax Cuts and Jobs Act, effective in 2018, your small business with less than $25 million gross receipts can treat inventory as “non-incidental materials and supplies” . You must also use an accounting method that clearly reflects income.

The net realizable value for Bob’s General Store inventory was $88,500. It also recorded income from the deadstock as $88,500 and a loss of $71,500 for the period. Fearing the product demand would continue to go down, in October, Bob’s General Store received a bid to sell the remainder of the fidget spinner stock for $90,000.

In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. FIFO is the most logical choice since companies typically use their oldest inventory first in the production of their goods. Because LIFO results in a higher Costs of Goods Sold , the method may help rein in tax liabilities. Still, it’s always important to check the exact impacts of LIFO with your accountant or tax advisor. In fact, it can only be used in the United States under the Generally Accepted Accounting Principles . Elsewhere, this method is not allowed by the International Financial Reporting Standards . For many businesses, it’s a system that is just too complex to justify using.

In most inventory-control software packages, you can add these non-vendor costs to any purchase order as a dollar amount or as a percentage. The method you use to value your inventory and the way you look at costing can have a significant impact on your small business. Net realizable value declares that inventory should be valued at their estimated selling price less the expenses involved in disposing of them. This method is used when goods are so damaged or obsolete that they can only be sold below their cost price. Commodities such as oil are physically indistinguishable and easily substituted. Crude oil bought earlier isn’t all that different from oil bought today. Thus, they are priced using the average of the cost of all goods in the inventory.

Section 472 of the Internal Revenue Code directs how LIFO may be used. We write only in-depth, original content with an intention to help business owners grow.

- In the LIFO system, the weighted average system, and the perpetual system, each sale moves the weighted average, so it is a moving weighted average for each sale.

- With this, the average unit cost is multiplied by the number of soap bars sold and the balance inventory.

- The average cost method takes a weighted average of all units available for sale during the accounting period and then uses that average cost to determine the value of COGS and ending inventory.

- Consider gravel yards, for example, which dump new loads of gravel on top of a pile consisting of several older loads.

- On the income statement, a company using periodic inventory procedure takes a physical inventory to determine the cost of goods sold.

The generally accepted accounting principles in the States allow all three to be used. However, the International Financial Reporting Standards does not permit LIFO to be used for reasons we shall see later. The GAAP accepts the three most common inventory valuation methods – FIFO, LIFO, and WAC – while the IFRS doesn’t accept the LIFO method. This means if your business is based anywhere other than the US, it’s likely you won’t be using the LIFO valuation method outlined above. To help you pinpoint the right technique for your business, we’ve created a guide to the different inventory valuation methods along with examples. Different inventory valuation methods – such as FIFO, LIFO, and WAC – can affect your bottom line in different ways, so it’s important to choose the right method for your business.

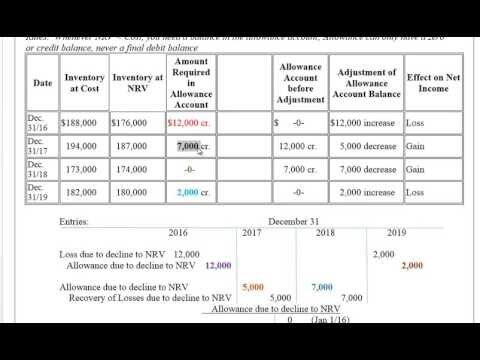

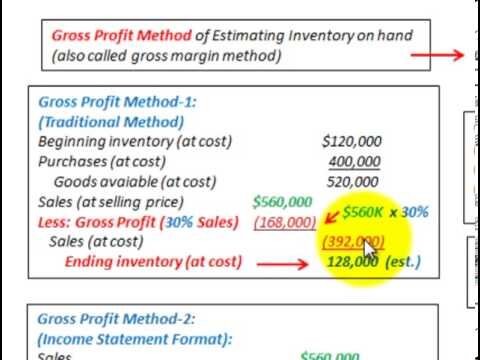

A company can manipulate income under the weighted-average costing method by buying or failing to buy goods near year-end. However, the averaging process reduces the effects of buying or not buying. The gross profit method uses the previous year’s average gross profit margin (i.e. sales minus cost of goods sold divided by sales) to calculate the value of the inventory. Keep in mind the gross profit method assumes that gross profit ratio remains stable during the period. LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first. The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the “LIFO reserve. ” This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method.

This approach requires a massive amount of data tracking, so it is only usable for very high-cost, unique items, such as automobiles or works of art. Because a company using FIFO assumes the older units are sold first and the newer units are still on hand, the ending inventory consists of the most recent purchases. When using periodic inventory procedure to determine the cost of the ending inventory at the end of the period under FIFO, you would begin by listing the cost of the most recent purchase. If the ending inventory contains more units than acquired in the most recent purchase, it also includes units from the next-to-the-latest purchase at the unit cost incurred, and so on. You would list these units from the latest purchases until that number agrees with the units in the ending inventory. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases , and various other accounting purposes.

It becomes tough for the ledger clerks to ensure the accurate price to be charged. Since closing stock comprises of more recent purchases, therefore closing stock of materials are valued at market price. This gives an idea that gross margin doesn’t essentially reflect on matching the cost and revenue numbers.