It is also important to put the plan and its terms in writing and have both parties sign it. Also make all future sales cash on delivery (COD) until the past-due amount is paid in full. Studies show that the longer receivables go uncollected, the less likely they are to ever be collected, either partially or in full. Issue dunning letters or e-mails when it appears that customers need a mildly-worded reminder. Some companies use a series of these communications, each one with progressively more strident wording.

You’re better off if you can work out an arrangement directly with the client and collect on the full payment. The defensive strategy is also a portion of your overall A/R collection procedure. It’s not designed to enhance A/R collection without the foundational and offensive strategy tiers in place. Establish a digital filing system for signed agreements to insulate your company from some (or all) receivables risk. Ensure that all contract documents are easily accessible and set your system up to receive e-signature documents as well as scans.

Whether new to BlackLine or a longtime customer, we curate events to guide you along every step of your modern accounting journey. World-class support so you can focus on what matters most.BlackLine provides global product support across geographies, languages, and time zones, 24 hours a day, 7 days a week, 365 days a year. We are here for you with industry-leading support whenever and wherever you need it. Automate invoice processing to reduce manual invoicing costs, maintain compliance with e-invoicing regulations, and increase efficiency across your invoice-to-pay process. Perform pre-consolidation, group-level analysis in real-time with efficient, end-to-end transparency and traceability. Reduce risk and save time by automating workflows to provide more timely insights.

- Accounts receivable collections management involves collecting balances on invoices.

- Collectors should be able to empathize and have polite conversations with clients.

- Set ambitious goals and actions for your A/R process, and periodically measure your performance to apply changes whenever and wherever necessary.

All in all, companies ought to also consider investing resources into an automated account receivable management system that can automatically send payment reminders to their customers. Overall, the accounts receivable collections process is a vital practice during business operations, and it is not surprising that one of the most crucial components in a company’s survival (let alone success) would be its cash flow health. As a result, devising a strong accounts receivable collection management policy to ensure a relatively seamless customer debt collection process is one of the most effective strategies to improve a company’s financial status. Not to mention, this inevitable reality ought to be highly apparent for small businesses, which should be well aware of how gaps in their accounts receivable collections can drastically impact their ability to serve many customers.

Final thoughts on accounts receivable collections

Centralize, streamline, and automate intercompany reconciliations and dispute management.Seamlessly integrate with all intercompany systems and data sources. Automatically identify intercompany exceptions and underlying transactions causing out-of-balances with rules-based solutions to resolve discrepancies quickly. Centralize, streamline, and automate end-to-end intercompany operations with global billing, payment, and automated reconciliation capabilities that provide speed and accuracy. Ignite staff efficiency and advance your business to more profitable growth. Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results. Accelerate dispute resolution with automated workflows and maintain customer relationships with operational reporting.

On that note, accounts receivable collections can be viewed as an approach to strengthen the company’s cash flow, and in the majority of cases, corporations would try to collect the customers’ payments within a 30- or 60-day timeframe. Through this approach, this thereby demonstrates that the days sales outstanding formula measures the average amount of time taken for a company to cash in on its total credit sales during the accounting period. In essence, the shorter the time taken, the better the business is at collecting debts and settling unpaid invoices. Though managing AR collections can be a complex process, many business strategies can help ensure your receivables get collected. You can manage receivable collections more efficiently by implementing a few different strategies, such as creating a receivable policy, sending out payment reminders and creating effective invoices. Customer analytics and automated AR solutions offer the best way to track, collect and invoice their customers.

How Do Businesses Measure Its Accounts Receivable Collections?

Monitor their financial health throughout the year, and get reimbursed in the event a covered customer fails to pay. The Billtrust Blog offers informative accounting insights, advice on automated AR best practices, tips and tricks, and strategies to optimize your AR processes. A great way to increase payment compliance is to make it easier for customers to pay.

As such, your accounts receivable collections process should involve more than just your AR team. Keep all client-facing teams, including sales and finance, in the loop to ensure consistent communication with clients and make sure you have a clear picture of the client’s experience with your product or service. Get your customer success team and sales team involved with cash collection as each stakeholder has a unique relationship with your client that they can leverage so you can be paid on time. On that note, accounts receivable collections is essentially a component of the accounts receivable management procedure, which involves collecting debts that are owed to a corporation.

- Simply sticking with ‘the way it’s always been done’ is a thing of the past.

- With Trade Credit Insurance, you get multiple benefits that enhance your A/R process.

- Managing receivable collections is a significant and delicate responsibility for any retail or retail-related company.

- Go beyond with end-to-end transformation.Powerful technology is only part of the story.

- Get your customer success team and sales team involved with cash collection as each stakeholder has a unique relationship with your client that they can leverage so you can be paid on time.

BlackLine’s glossary provides descriptions for industry words and phrases, answers to frequently asked questions, and links to additional resources. Accounts receivable software makes collections a less mundane and tedious activity. In fact, it enables you to make the right decisions around whom to talk to first, how to talk, and what to talk in collections calls. It is discomfiting to remind somebody about the payment they owe to you or your business. And it becomes even more discomfiting when you know that you’ll have to see them again for more sales.

Enhancing The Sales Process

If you have a few large clients who typically pay outside of a 30- or 45-day window, focus on acquiring additional smaller clients and ensuring they pay on time so you ensure healthy cash flow while you wait for the longer-term payments. Another helpful tool is a calculation of your company’s Accounts Receivable Turnover (ART) ratio, or the number of times per year that your business collects its average accounts receivables. This is done by creating an accounts receivable (A/R) aging report, which will track and measure the payment status of all your customers. Setting up early-payment discounts is one strategy, but better yet give discounts to customers who agree to do an upfront yearly payment instead of monthly payments.

Consider an AR workflow management software or adopt an AR automation solution. These will help you track balances and better monitor when customers need to pay their invoices, creating an optimal accounts receivable management system for your business. Effective accounts receivable management ensures that money owed by customers for goods delivered or services provided is paid to the company in a timely manner. Effective accounts receivable management enhances company cash flow by preventing nonpayment or late payment. Accounts receivable collections is a crucial component of the business world, and, as a business owner, you’re likely already aware that the most critical factor in your company’s success is its cash flow. Accounts receivable collections management involves collecting balances on invoices.

Offer a good customer experience

In our Billtrust webinar, “5 Steps to Increase your Collections Success,” learn how collections success is possible with automation, AI and more. For this reason, they are considered a “short-term asset,” which refers to any financial resource that can be converted to cash in one year or less. Stay up to date on the latest corporate and high-level product developments at BlackLine. Whether you’re new to F&A or an experienced professional, sometimes you need a refresher on common finance and accounting terms and their definitions.

Make sure your email is respectful, concise and specifically explains that you are writing about a past-due invoice. In bullet points, summarize the details of the past-due invoice, including invoice tracking number, the principal amount, any interest or fees and a description of what the original balance is for — including dates and locations. Reference our dummy accounts receivable collections letter template to help make this process easier.

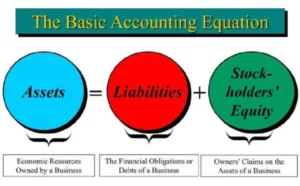

Accounts receivable is a balance sheet item because it is considered a current asset for the company. Thus, it will be listed under the assets section of this financial statement. Upflow acts like a CRM for your invoices, tracking the right KPIs, and sharing relevant information with your sales and finance teams through custom dashboards and tasks.

BlackLine is a high-growth, SaaS business that is transforming and modernizing the way finance and accounting departments operate. We empower companies of all sizes across all industries to improve the integrity of their financial reporting, achieve efficiencies and enhance real-time visibility into their operations. Accounts receivable collection is the process companies need to perform to safeguard the punctual debt collection from their customers/clients for the products and/or services that have been delivered prior to their payment. If you reach a point where you do have to use an agency, make the client aware of it before you transfer the debt. At this point, they’ve likely been unresponsive, but a notification of debt going into collections might motivate them to finally settle the debt with you directly.

Debt collection agencies can help you manage unpaid invoices through several methods, including phone calls, mailings and legal proceedings. While collecting on past due invoices is always a priority for most companies, it needs to be done strategically. Ignoring the accounts receivable (AR) process can significantly reduce your cash flow and hurt your company’s bottom line. Improving your accounts receivable collections is not just about getting more money in the bank but also about improving customer relations. Offensive accounts receivable collection procedures take a proactive stance, leveraging measures to insulate your organization from loss.

Consistent data collection and monitoring of financial health, as well as taking out a credit insurance policy, can work in tandem to help you evaluate customers and prospects who may pose a risk of nonpayment. The defensive strategy tier focuses on establishing terms that your clients would be responsible for should you need to move to debt collection for a past-due account. Accounts receivable, or AR, collections is the process of recovering debts owed to a company. The first step is to identify the debtor and then find a way to contact them and ask for payment. If this fails, collection agencies may be contacted to try and recover the debt.

In this white paper, learn the 10 best practices that your organization can use to help optimize your overall credit management process. A larger number is a good sign for the business, while a smaller number is a bad sign. In other words, a high turnover ratio means the business is converting a higher proportion of its credit sales into cash, and a lower turnover ratio means it is converting a smaller percentage of its credit sales into cash. The status of each group reflects the time that has elapsed since an invoice was issued to the customer. The aging report will help the business organize and evaluate the status of its accounts receivable.

This should include having your business development people in your postmortems on bankruptcy and non-payment situations so they can be learning what to look for when it comes to customer risk at the prospecting stage. Stay organized and know where every contract is in the agreement process and the status of every invoice. Contact management systems and accounts receivable management systems can help you process, review and access documents faster, and more easily track and report on status. Join our Billtrust webinar, “Increase your collections success and accelerate your cash flow” and learn about the power of collections management automation.

It is provided as a courtesy to the clients and friends of City National Bank (City National). Opinions expressed and estimates or projections given are those of the authors or persons quoted as of the date of the article with no obligation to update or notify of inaccuracy or change. This article may not be reproduced, distributed or further published by any person without the written consent of City National. This calculation allows for a faster evaluation of accounts receivable than the A/R Aging Report. Offer to take back goods for which it is apparent that payment will not be received.

The process usually begins with the accounts receivable professionals of the finance department having to identify the debtor, attempt to contact them to request for their payment, and in some instances, negotiate the payment terms. Should this effort be futile, the company may need to turn to collection agencies as a final resort to try and recover the unsettled debts. Accounts receivable collections is the process of collecting payment from customers who owe money to a business for goods or services provided on credit.