Content

To calculate funnel drop-off, start by finding the number of visits for a particular conversion step in the funnel. Then, subtract the number of visits that occurred during the first step. Divide the value from the specific conversation step by the visits that took place during the first step to find the number of customers that you lost along the way. No business can achieve success if it’s paying out more to suppliers than it’s netting in sales. Gross profit margin as a percentage of sales demonstrates total profits compared to revenue. While there are many more important business metrics that companies can and should measure, these 12 will give you a quick overview of the current state of your business.

Because the goals in these examples are measurable and actionable, business owners should have an easier time filling out their KPI dashboard. A good KPI is one that will allow you to track the critical success factors related to the goal. In our first goal, the company will want to focus on financial metrics related to revenues from the XYZ product line and operating costs. In the second example, the firm will want to track social media spending and customer acquisition. However, there are a few common financial metrics that all companies need to keep an eye on. They need to have a firm grasp of total revenue, expenses, assets and liabilities and how each shifts over time. The cost of customer acquisition and how long those customers stick around, a.k.a. churn rate, are other metrics important to many young companies.

- KPIs allow you to track performance in various areas of your business.

- Tracking relevant KPIs can assist in decision-making, help you set strategic objectives, and allow you to evaluate your business process in real-time.

- Financial KPIs allow business owners to assess their company’s progress.

- Regardless of the area of business they are in, each leader should agree on the right KPIs for the business overall.

We chose to put this metric first as it can tell a lot of things about your company. Month-over-month sales results show whether people are interested in buying your product/service, are your marketing efforts paying off, are you still in the competition, and much more. Tracking irrelevant KPIs will distract you from focusing on the things that truly matter. This way, you’ll end up stressing about the numbers that have no actual impact on your company’s development. So it is highly important that you not only track business metrics but also choose the right ones to perceive.

Short titles with keywords, a few bullet points, a nice visual, and—most importantly—a short form that encourages rather than discourages your potential lead. This metric tells you how many unique visitors are reaching your site. You can add up visits for periods of time, such as a week or a month. It’s important to monitor your website performance from one period to the next to see how it is trending. It’s also valuable to identify any major dips or blips and be able to point to internal events or occurrences that caused them.

Revenue Growth Rate = ((period 2 Revenue

These discussions should include employees from all key departments to ensure goals are relevant to the entire company. Small-business executives should choose their critical KPIs early on and establish a clear understanding of what numbers will indicate success, or raise warning flags. For example, average customer account size could be a manufacturing KPI to watch if a company wants to increase revenue by 10% this year. If that manufacturer is looking to increase productivity at its plant, another KPI could be the number of products produced per day. Financial metrics and KPIs help small businesses understand if they have the cash on hand to fund big capital investments—or are on the fast track to insolvency. These numbers are obviously important to business owners, but lenders and investors will also want to review them before they sign any contract with a company.

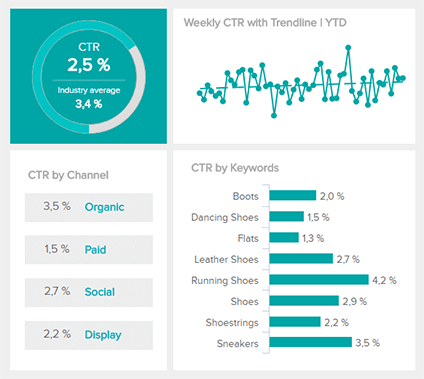

The remaining four metrics in this category give you insights about visitor acquisition from the perspective of advertising efficiency. These apply to channels such as Search Engine Marketing, , social media, and banners you place on other websites to promote your brand. Many of them can be managed with Google Search Console, KeyWord planner, and other similar tools. These first seven KPIs all have to do with visitor acquisition and traffic generation. The first three can help you determine whether your marketing activities are doing their job to bring more traffic to your website. They also give you more insights into where your traffic is coming from. If you only review your visitor acquisition metrics, for example, you might notice a significant increase in traffic but make the mistake of thinking that the campaign is doing the job.

The Net Profit Margin is a good way to predict long-term business growth, and see whether your income exceeds the costs of running the business. The most obvious way to grow your sales revenue is to increase the number of sales. This can be done by expanding your marketing endeavours, hiring new salespeople, or making discount offers that are hard to resist. Growing your sales revenue should be a long-term strategy rather than a quick boost in sales.

Sales revenue is calculated by summing up all the income from client purchases, minus the cost associated with returned or undeliverable products. The right marketing KPIs will open your eyes to where you need more work, where to invest, and where to cut back. They will also inform, focus, and motivate your marketing team and provide you with the data you need to impress customers or CEOs with the value of your work. ROI points to what digital activities are driving revenue and where there is room for improvement. To calculate it, you start with the total amount of revenue generated by your campaign leads and then deduct the total cost of your campaign. It may be relevant to also look at the revenue generated by each acquisition source. A high bounce rate tells you that your landing page has poor content quality or layout.

Customer satisfaction is an important metric to keep track of because if your customers aren’t satisfied, they won’t keep coming back. Sudden drops or downtrends in customer satisfaction are red flags that something needs to be changed. For example, one of the most popular customer satisfaction KPIs is the CSAT, aka the customer satisfaction score. The CSAT is calculated by asking your customers to rate their satisfaction through a survey and then averaging all the responses. So, your flagship product makes up 25% of your entire business’s revenue. Revenue by product is a KPI that tells you what percentage of your total revenue a specific product or service makes up. This can help you keep track of which products are your best sellers, and which ones aren’t doing so hot.

Let go of clients who are decreasing your net profit and difficult to convert, and focus on the most rewarding audience. Calculating the CLV depends on your product specifics – are you selling on a monthly basis, is it a big one-time transaction, or do people return to make repeat purchases? Here’s a great infographic by Kissmetrics, explaining the CLV in-depth. The Cost of Customer Acquisition should always be measured together with the Customer Lifetime Value. If a new client is worth the average of $1400 to you, acquiring them for $200 is a reasonable deal.

Average Time On Page Or Site

As a business owner, you must keep track of your KPIs, as they affect your company’s progress. One way to measure customer satisfaction is through administering a survey. Have customers rate their satisfaction on a numerical scale from great to bad. Tracking scores over time can help you see whether your customers are happy with your product or service . Your customer acquisition cost is your total sales and marketing expenses ÷ the number of new customers. The most successful businesses use KPIs in some form or fashion to help them measure company success. As a small business owner, you should work to implement KPIs into your business strategy.

How do you know if you’re meeting your client and customer needs? Measuring customer satisfaction can be a great indicator of how you’re doing and what you can expect for the future of your business. If your business relies on social media to generate business, social media engagement is a great KPI to track. Measuring likes, comments and shares will help you see what type of posts contribute to boosting your business. For example, say that during January you had $50,000 in credit sales (sales where the customer didn’t pay immediately).

Get your free guide, business plan template, and cash flow forecast template to help you run your business and achieve your goals. CAC is often calculated alongside lifetime value , which refers to the total revenue a business can expect from a single customer. LTV is a strategic KPI to determine which customer segments are most valuable to a business. While MRR might seem straightforward, there are different aspects of MRR to analyze. You’ll want to measure new MRR (i.e. new customers), expansion MRR , and churn MRR . Other important KPIs within revenue are revenue per employee and revenue growth rates.

KPIs allow you to track performance in various areas of your business. KPIs or Key Performance Indicators let you determine how well your company has reached its business goals. Once you have surveyed your customers you take the percentage which are promoters and subtract from the percentage of detractors to reach your net promoter score. You can use this information to see how happy your clients are with your business in general. You can also reach out to individual Promoters and remind them to refer new business to you or reach out to Detractors and see what you can do to make them happier. A ten-point scale rates the answer and helps make your sort list.

If more money is coming in than going out, a business has positive cash flow, and if it’s paying out more money than it’s receiving, it has negative cash flow. Net Income Net income or net profit is the money left over after subtracting all expenses and taxes from revenue.

Not only does this help with tax preparation, but it can help you find areas of cash surpluses. For example, if purchasing a new office desk is on your radar, you can add the cost to your forecast. Adding this new statistic will tell you if purchasing this new office equipment will affect your cash flow . Many small business owners who are starting out may neglect this aspect, as they operate without a full understanding of their financial picture. It’s also important to note that looking at a single business KPI only tells a small part of the story of your business.

Invoice Templates: Get Paid Faster And Maintain Cash Flow

Customer Retention Rate is the percentage of the customers that your business has managed to keep during a particular period of time. Normally, the business should be interested in keeping the CRR as high as possible. Growth KPIs focus on measuring change in numbers or percents over time. It can be related to just about anything, from your overall revenue to the number of new customers on your website.

This metric can give a business a sense of how much cash it can spend in the immediate future and whether it should reduce spending. OCF can also reveal issues like customers taking too long to pay their bills or not paying them at all. As a business grows, it often starts tracking more metrics, including ones specific to certain initiatives or departments. It’s critical that small-business leaders understand the financial health of their organizations, and financial metrics and key performance indicators inform that understanding.

Set up various project milestones and keep track of whether they’re met in time. Use a free marketing tool such as Google Analytics to track your monthly website traffic as well as the traffic sources, to understand how people find your site. One of the best indicators of your company’s reputation in the monthly website traffic. The more people hear about your product, the more likely they are to check out your web page. To calculate the Lead-to-Conversion KPI, divide the number of monthly new leads with the number of monthly new customers. Provide the very best customer service and deliver high-quality service. Offer benefits and information that your customers didn’t even expect to receive to make their user experience as good as possible.

Accounts Payable Rate

It’s a helpful signal to know whether your business is poised to grow organically. Or whether there are some service issues that you should address. Respondents are asked, “How likely are you to recommend our company to friends or colleagues? Zero means they are extremely unlikely to and ten means they are very likely to. Like with website traffic, no complex calculations are needed here. Watching and monitoring trends over time will help you focus your efforts. Consequently, you’ll be able to concentrate on creating the right posts and content that drive business growth.

Examples of conversion could be a shopping cart, subscriptions, and more. Once you identify where customers are dropping out, make strategies to boost your sales. In this technology age, many businesses rely on the internet as a sales tool, due to which, funnel drop off rate has become a key performance indicator to track. Business Strategy Set your business up for success, then make moves that maximize opportunities. Commerce Make your ecommerce operation profitable and your customer experience engaging.

Cash Flow (

A KPI for small business can keep you on track and let you know whether your efforts are paying off. You probably know that to help your business grow and thrive, it’s important to monitor different key aspects of your business. But when you’re a small business owner there are a lot of details. Sitting down to look at important metrics can fall off your priority list. First, find your business’s gross profit margin by dividing your gross profit amount by your sales. Divide that value by your sales amount to find out how much of your GPM makes up your overall sales.

While there will always be more urgent needs, carving out time to review the health of your business and make proactive changes is critically important. Adding multiple KPIs to your list of things to monitor—without creating an easy way to do so—is setting you up for a lot of frustration. Once you’ve picked the right KPIs to track for your business, you’ll want to set up your KPI tracking the right way. To calculate this, let’s say you started the year with 20 employees. By the end of the year, 16 of those employees are still working at your company. That’s the number of employees retained ÷ the number of employees at the beginning of the year multiplied by 100 to get a percentage. The longer a good employee stays with your company, the better the return on investment you’ll get from the money and time you spent hiring and training.