Content

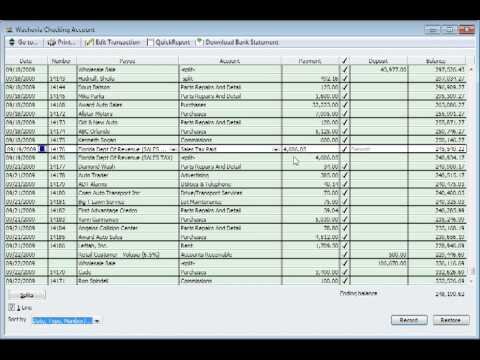

Transactions entered into a bank account in Xero but not reconciled will be spend and receive money, transfer money, and payments entered directly on invoices and expense claims. Are your statement balance and the balance in Xero still different?

Now go through the transactions for that day and compare the Xero bank statement report against the actual bank statement. You are looking for transactions on one side that are not on the other, or transactions where the amounts differ . If it is on the bank statement but not in Xero – check to see if it is in the transaction list . If it is there with a different date and is manually reconciled you may want to change the date so that it matches up with the bank statement. If there and not reconciled you should mark it as reconciled.

A Bit About Your Business!

If it did, we need to go back to the account transaction screen and do a remove and redo of the unreconciled payment or receipt. We will either go back to the invoice or bill and record the payment to the correct bank account or go to the correct bank account and match the bank transaction directly to the invoice and bill.

If not, the two most common problems are conversion balances and manually reconciled items . If your balance is still out then you should get a expert Xero Advisor to look into it for you – it should take less than an hour to solve but is worth getting it sorted. EG if you manually uploaded OFX/QIF or CSV, there won’t be an imported balance. Also I’ve found that some banks upgrade their feeds to Xero, and originally they don’t send over a balance and now they do. I thought it would be useful to set out how you can quickly and easily check the balance agrees. Jack runs a profit and loss report for November which shows a profit of $25,000 for the month which is much higher than his usual profit of $15,000.

Is the bank balance in Xero – this includes all transactions posted to your accounts in Xero. Deleted Bank Statement Lines – users can too easily delete a bank statement line from the reconciliation screen and thereby throw your reconciliation out of balance. The easiest place to see if this has happened is by looking on the Statement Exceptions page of the Reconciliation Report. I have previously written about the most common bank reconciliation errors in Xero, which is a good primer for understanding the items listed on your Reconciliation Report. This article is specifically dealing with the scenario where your “Statement Balance” in Xero does not agree with your actual bank statement. I’ll warn you now – this can be technical and complicated. Novice users should not play around in most of these areas.

Xero Balance Different From Bank Statement

These will be transactions which you haven’t allocated to an account code or transactions where you have added a payment or receipt to an invoice and that money hasn’t gone out of or come into the bank. Or it may have come in or gone out but you have recorded it as a payment or receipt rather than finding and matching with the transaction you have already done. If Jack’s bookkeeper had compared the bank balance in Xero to the bank statement balance they would have identified there were transactions missing in Xero. Jack runs a digital marketing agency and uses Xero to keep track of his accounts. The bank feed didn’t import transactions between 3-10 November correctly and there are 30 missing bank statement lines.

We can also utilize the efficient bank rules features that allows us to speed up the bank reconciliation process and provide greater accuracy to our financial reports. Above are 3 reasons your Xero bank account balance doesn’t match your statement balance.

If the statement balance in Xero does not agree to the bank statement, then we know we do not have every transaction in Xero from the bank. Before we start digging into individual transactions, run this test back each month prior until the Xero statement balance and the bank statement balance agree. That will pinpoint which month the discrepancies first started. One thing to keep in mind is that the bank balance in Xero does not necessarily mean the actual bank balance as Xero does not download the “balances” from the bank but the transactions. So the bank balance in Xero is Xero’s own calculations of the transactions downloaded which it then compares to what you’ve actually reconciled.

- There is no way to change the assigned bank account, so you need to “Remove and Redo” the incorrect transaction and do it again.

- Moreover, I also manage a blog sharing informative articles about Xero and other topics.

- Imported Statement Balance – this is the statement balance provided to Xero by a direct bank feed or through an OFX file import or similar.

- Not sure what you mean by a “detailed Reconciliation Report” – the Reconciliation Report in Xero is a detailed one – it lists all transactions that have not been reconciled.

- Don’t start fixing them until you’ve worked through the following steps – it could be correct to keep your deleted or manual statement lines.

transactions that appear on the statement that have not yet been entered into Xero. Now that you have a safe starting point, jump forward one week at a time until you find the point that they are no longer in balance. Go back daily until you find the last day where it balanced. You have now identified the day where there is a problem. You may then want to run Bank Reconciliation Summary reports for several dates in March so you can further narrow down the date an error happened.

If it agrees then your conversion balance is correct and you can move onto the next one. If this balance does not match your bank statement – we will need to investigate why.

Directly Email The Statement

If you identify that you have problems PLEASE get a Xero Certified Advisor to help you fix it. We offer paid support and can quickly address most problems. Delete the bank statementif you created it by mistake by marking a transaction as reconciled. If you have a lot of statement lines you may want to export both your bank statements in Xero and your actual bank statements to an Excel spreadsheet. This could make it easier to compare your two sets of statement lines. View imported bank statementsto compare start and end dates for statements and bank feeds imported into this organization. However, it’s not OK to have outstanding transactions you think you’ve already reconciled.

However, what you need to make sure is that the money going out of your account has been downloaded in the “spent” column and the money coming in is in “Received” column. Some times the columns are changed for some reason which cause the discrepancy. Shows changes in the equity of your business for a set time period. In other words, changes in how much money your business keeps . Shows changes to the cash coming into and out of your business over a period of time.

Export list of transactions in excel and start marking them if they are correct when compared from the bank statement. This way it will be easier to figure out the problematic transactions. Financial management starts with recording all the money your business earns and spends. Accountants then prepare reports that help owners understand the financial health of their business. These include profit and loss statements, balance sheets, cash flow statements and budgets. You need to compare your bank statement with Xero bank transactions. Compare the date of the conversion balance with the balance on your bank statement.

Don’t start fixing them until you’ve worked through the following steps – it could be correct to keep your deleted or manual statement lines. Check conversion balance, and correct it if you need to.

First, check the actual bank balance in your conversion balances is correct and entered. It’s OK to have outstanding transactions on the Bank Reconciliation Summary or unreconciled transactions under Account transactions if they haven’t come through on an imported statement line for you to reconcile.

The other issue could be that we recorded a bill payment or invoice receipt to the wrong bank account. To diagnose this issue, we would go through the same steps as the first issue above by looking at the account transactions tab. If we don’t see a duplicate entry in there, we will then check the other bank accounts to see if this transaction came through a different bank feed.

Sounds like you have identified the problem already and can re-import or create the missing transactions and it should all work. If you reconciliation balances to the actual bank statement then I would just accept it and move on. Kim, you should check the “Statement Balance” in Xero against the actual balance on the statement from the bank.

If it doesn’t match, this video tutorial can show you how to find out what could be causing the issue. A bank reconciliation is a comparison between your bank account balance in Xero and your bank statement balance.

Compare the opening statement balance in the Xero report to the opening statement balance on your bank statement. If they are not the same go back one month at a time until you find a period where they agree. If this never happens, you probably have a conversion balance problem – see above, then seek professional help. Missing Bank Statement Lines – before bank feed starts – when you set up a bank account in Xero the bank feed data might be missing the first few weeks. You can tell when your feeds started by looking at the Bank Statements tab in the bank account screen and sorting on start date . The easiest way to solve this tis to import the missing data from your bank account and then reconcile these transactions. If you have already manually reconciled then you should check that you have done it correctly.

If a statement balance is not available for that ending date Xero does not display this line on the Reconciliation Report. You now need to manually compare your actual bank statement lines against your bank statement lines in Xero. That is, go through your actual bank statement line by line and find where it differs to your statement lines in Xero.