Content

Micro-lenders make money by charging people interest on their loans. You may lend out $500 at a 20% interest rate, meaning the debtor will owe $600 by the time all is said and done. If you’re hoping to make money on your loan, you may want to consider lending to young go-getters who lack the credit history they need to get a conventional loan.

“It’s Match.com for money. A key difference is in borrower risk assessment.” “Strategic funding acts like venture capital in that it is usually an equity sale , though sometimes it can be royalty-based, where the partner gets a piece of every product sale,” she added. For instance, personal or family medical issues and job losses can all negatively impact a borrower’s accounting, but those can all be explained. Also, CDFI lenders do not need nearly as much collateral as a traditional bank would. Other things can compensate for a lack of assets to be used as collateral. Factoring is an alternative funding option that can alleviate cash-flow problems and generally doesn’t require a good credit score.

How To Open Business Bank Accounts

When considering starting a micro finance bank, the legal entity you choose will go a long way to determine how big the business can grow. You have the option of either choosing a general partnership or Limited Liability Company which is commonly called an LLC for a business such as a micro finance bank. When it comes to starting a business of this nature, it will pay you to buy the franchise of a successful micro finance bank as against starting from the scratch. Even though it is relatively expensive buying the franchise of a micro finance bank, but it will definitely pay you in the long run. Some micro finance banks may also operate on the internet; that is, people can access their micro loans without physically residing within the locations where the micro finance bank is located. So, if you have done the required feasibility studies and market research, then you might want to venture into this business. If you have been tinkering with starting your own micro finance bank, but do not know how to go about it, then you should consider going through this article; it will sure give you the needed guide and direction.

Micro-lending has done well in Latin American countries and third-world nations because there are a limited amount of ways to obtain conventional funding. If you wish to open a for-profit business, you may want to concentrate on these areas as opposed to lending within the US. Having some type of formal education in how finances work around the world will help, as will an in-depth knowledge of current law for both the country you operate out of and the country of those you’ll be lending to. The best way to promote and market your business is to understand the need you’re filling in any given area. For example, if you’re only targeting small family farmers, then you need to determine how they learn about financial opportunities in their area.

Trying to find financing for your startup can easily turn into a full-time job. From building a network of investors to connecting with other founders, financing is at the heart of any business’s success, but it can turn into a serious time commitment. “Every time the merchant processes a credit or debit card sale, the provider takes a small cut of the sale until the advance is paid back.” It is important to read the fine print of different equity crowdfunding platforms before choosing one to use. Some platforms have payment-processing fees or require businesses to raise their full financial goal to keep any of the money raised. Crowdfunding on platforms such as Kickstarter and Indiegogo can give a financial boost to small businesses.

A Limited Liability Company is the most common form of organizational structure for nw finance companies due to the protection from liability and tax advantages. Like any loan, the Small Business Administration’s help will extend only as much as you are able to offer appropriate collateral and credit. Consider obtaining credit reports to show how financially responsible a candidate is.

Advantages Of Debt Financing

To learn more about how sales tax will affect your business, read our article, Sales Tax for Small Businesses. It also builds your company’s credit history, which can be useful to raise money and investment later on.

- Product and service reviews are conducted independently by our editorial team, but we sometimes make money when you click on links.

- However, due to our unique relationships with these lenders, they have agreed to approve you for lending as soon as you walk out our doors.

- Anyone who wants to take mortgage applications or negotiate terms for a mortgage between consumers and mortgage companies in California, for example, requires a state mortgage loan originator license.

- It is very needful that you analyze the existing micro finance banks in and outside of your area.

- In addition, any new finance company must comply with strict state and federal regulations and meet initial funding requirements.

Initial startup costs will be used for meeting reserve requirements and the building or rental of office spaces. From there, much of the company’s operating capital will be lent out to customers.Be aware of Federal and State laws regulating the private solicitation of investors. Adherence to securities laws regarding the information provided to potential investors and the qualifications of the investor will apply in most circumstances. Determine how much money you need to start your finance company. Indicate how you plan to finance your company with leverage , where these loans are coming from, and how the loans will be used in the business. Finance companies provide loans to individual and commercial customers for a variety of reasons. Commercial customers can include retail stores, small businesses or large firms.

You will need to specify exactly what type of financial institution you are opening, such as an investment company or a licensed lender. Explain the types of financial products and loans you provide. Emphasize the benefits your products offer to your target customers.

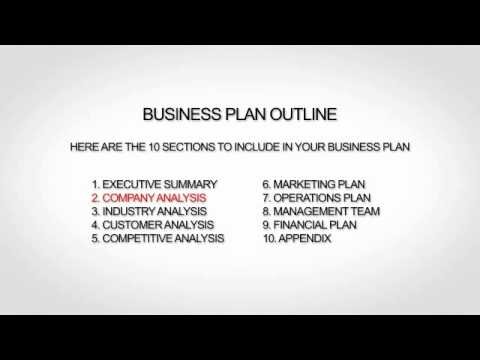

Begin writing your business plan by including all of the required sections and leaving room to fill them in. The steps in this part should serve as your sections, starting with the business description. What are the likely fixed costs to operate the business – office space, equipment, utilities, salaries, and wages? What business processes are necessary for day-to-day operations – marketing, loan officers, underwriters, clerks and accountants? Will potential clients visit a physical office, communicate online, or both?

Start A Financial Product Business

This will keep the company safe from clients that might wish to take advantage of them. There are other, specific, downsides to forming a corporation.

“This article is so helpful to me for promoting a finance company.” “The whole thing helped. Although, I am fully aware of the legal obligations in setting up a finance company.” You have explained so well and it was detailed, how a person should start, as well as financing your business and legal liability.”

With decades of experience and hundreds of success stories under our belts, we know that when budding entrepreneurs use our Global Financial Training Program, the only thing that can impede their success is them selves. to get the greatest companion to starting and growing your business. My name is Gregory Elfrink and I’m the director of marketing with Empire Flippers. We’re a three-time winner of the INC 5,000 award for being one of the fastest growing companies in America and we help people buy and sell online businesses. Building a new financial services company, or any company, is challenging. The potential upside is worthwhile – particularly within financial services – but the roadblocks make success difficult to attain.

Decide if you are going to offer revolving or fixed-amount types of credit. Think about your target customers and what kinds of loans they would need. Homeowners and individuals may seek mortgages, auto loans, student loans or personal loans. Consolidated loans may help customers who are struggling to manage their finances.

The sponsoring company often overcapitalizes the SPV in order to make it look attractive should the SPV need a loan to service the debt. What if you were applying for a new home mortgage and discovered a way to create a legal entity that takes your student loan, credit card, and automobile debt off your credit report? The coupon or interest is often higher, as the lender views the company as high risk. Mezzanine capital provided to a business that already has debt or equity obligations is often subordinate to those obligations, increasing the risk that the lender will not be repaid. Because of the high risk, the lender may want to see a 20% to 30% return. However, a newer business may not have that much data to supply. By adding an option to take an ownership stake in the company, the bank has more of a safety net, making it easier to get the loan.

These are significant barriers to entry that require substantial time, capital resources and persistence to overcome. Helping people accomplish their financial goals is different than helping them connect to friends, play games or share photos on their phones. There is a higher standard for security, reliability and trust, as there should be. Your challenge as an entrepreneur is to meet that higher standard while solving a real problem for real people. PayPal is an example of a massive success in the financial services industry that wouldn’t have been possible without sufficient capital resources and investor support. At a time when the nascent team was focused on solving important issues like fraud, capital helped them survive and reach profitability.

Years later, major corporations and banks began crowding out true P2P lenders with their increased activity. In countries with better-developed financial industries, the term “marketplace lending” is more commonly used.

For example, it is easier for someone to get a car loan with a FICO score of 480 than to get a mortgage. To open a loan company, you need to define the types of loans you want to offer and obtain the correct licensing for them. It is primarily a way to keep large purchases off a company’s balance sheet, making it look stronger and less debt-laden.

Get out and network in your community for other business owners or local investors. “Raising money from people is a very difficult thing,” he said. “You just have to sort of roll with it and be aware that there a lot of companies that were initially rejected that became generation-defining companies.” One of the biggest variables throughout this process is motivation. Staying motivated during trying times can be difficult, but it will be the backbone of your business’s success. “The warm introduction goes a lot further than really any other potential avenue,” he said. “Any professionals that are surrounding the company should absolutely be the first stop and the first location a company goes to try to have access to venture capital and a warm introduction.”

In every industry, there are always brands who perform better or are better regarded by customers and the general public than others. Some of these brands are those that have been in the industry for a long while and so are known for that, while others are best known for how they conduct their businesses and the results they have achieved over the years. Most startups begin with early seed funding from friends and family, angel investors or accelerators. If you’re already through this step and are looking for longer-term funding, it’s important to approach venture capitalist firms the right way. Kisch said it’s crucial to find the right investor for the stage your business is in. There are thousands of VC firms out there, so think critically about your business and which investors make the most sense.

What Is Mezzanine Capital?

The industry is heavily regulated to guard against financial fraud, money laundry and criminality. Auto finance companies are some of the most lucrative in the lending business.

Similarly, lending laws vary by state in the US, as well as being dependant on the amount lent. Finding financing in any economic climate can be challenging, whether you’re looking for start-up funds, capital to expand or money to hold on through the tough times. But given our current state of affairs, securing funds is as tough as ever. To help you find the money you need, we’ve compiled a guide on 10 financing techniques and what you should know when pursuing them.

If you’re unemployed and thinking about starting your own business, those funds you’ve accumulated in your 401 over the years can look pretty tempting. And thanks to provisions in the tax code, you actually can tap into them without penalty if you follow the right steps. The steps are simple enough, but legally complex, so you’ll need someone with experience setting up a C corporation and the appropriate retirement plan to roll your retirement assets into. Remember that you’re investing your retirement funds, which means if things don’t pan out, not only do you lose your business, but your nest egg, too. The best thing you can do is learn how to screen your clients, and to create detailed contracts about each loan. You will get a lot of applications from hard-working, responsible people who will do everything possible to use the funds wisely and pay you back.

Wherever there are profits, there are regulation and government oversight. Financial services companies face a strict and complex regulatory landscape that is constantly changing. Get the advice you need to start, grow, and lead your business today. Your business may need to meet other criteria depending on the type of loan. In order to qualify as a small business, your firm needs to meet the government’s definition of a small business for your industry.