Content

A KPI dashboard is also available in Xero Practice Manager, providing users with a good overview on business performance including WIP Days, Debtor Days, Average Hourly Rate, Write Offs, and Revenue per Fee Earner. All reports can be saved in Xero Practice Manager as a PDF, printed, emailed directly to a client, or exported to Microsoft Excel or in a CSV file format. Staff members have several options available for entering time, including the option to enter time directly from the dashboard. Time can also be entered using the timesheet option, or by entering time directly against a client, with date, the job, and the task performed the only information needed. Users can also indicate on the timesheet whether the time is billable. Xero Practice Manager also supports flat rate costs for those who need to bill clients a flat rate rather than an hourly rate.

- Almost everything on the dashboard is a link that can take you to related pages and actions.

- With this low cost, Xero accounting Early is certainly one of the most affordable accounting options out there, but does, of course, have its restrictions.

- Xero has been working with machine learning and artificial intelligence to add more automated processes to the site, as well as better connectivity with related financial websites.

- These include Squarespace for eCommerce, Stich Labs for eCommerce and inventory, Deputy for payroll and HR, and WorkflowMax for invoicing, jobs and time tracking.

We are an excellent fit for any size business currently on or thinking about using the Salesforce CRM. We also function as a stand-alone product. Remember clear that when there was some technical problem the take no accountability. The ease of creating a quote, changing it to an invoice once the client has accepted it, is a great add on. The ability to add inventory items on the fly is very welcoming. Hi everyone, Come on over to the new discussions in Xero Central. It’s a more intuitive way to connect and chat all things business with one another. The service was amazing, they were quick and able to assist as well as correct and finalise the query I had.

When linked with your bank account, your transactions appear in your Xero account daily and can be reconciled at the click of a button. Xero boasts accounting inventory management that monitors the worth of your business deals and boosts stock control. Modern business has gone mobile and Xero has not been left behind. You can download Xero Touch and manage reconciliation, receipts, invoices, expenses and other aspects of your business wherever you are.

Benefits Of Xero

Moreover, you’ll be able to create fixed price, progress payments, or time and details invoices, all of which can be uploaded automatically. Plus, Xero Projects will link to your contacts and allow you to set basic user permissions for your team. Xero accounting is cloud-based accounting software, meaning it’s accessible from any device, anywhere you have internet. With Xero accounting software, you can automate and streamline your core bookkeeping and accounting tasks, as well as related business processes such as inventory tracking, project management, and payroll. In this Xero accounting software review, we’ll explore Xero’s features, three unique plan offerings, and pricing—everything that you need to know to decide if Xero accounting can fulfill your business’s needs.

It is overly complex, not intuitive or easy to use and uses accounting terminology rather than plain language. XERO is designed for accountants who get benefits for sucking users into using it. There are no direct support phone calls, you have to send a message and wait until someone on the other side of the world wakes up and replies. XERO also make it very difficult to export all your data to another application when you have finally had enough. Xero reporting options continue to improve with each new release with new report options added regularly.

Mobile technology has evolved with time and Xero ensures that you can continue with normal accounting activities through your mobile devices while at home or on the go. The status of your accounts and bank reconciliations are on your palm because all you have to do is use the Xero mobile app. As a Xero user, you also benefit from seamless payroll software and internet-based accounting.

Unemployment benefits may be a new and unfamiliar tax topic for many. We handle the reporting on your tax returns and provide guidance on tax withholdings and estimated tax payments. If you want to avoid a surprise tax balance due when you file your returns, consider adjusting your tax withholdings or making estimated tax payments. The economic impact of the pandemic has been challenging, with millions receiving unemployment. If you recently became a US citizen, are a citizen of multiple countries or work in the US under a visa, our team will analyze your scenario to assist and file the appropriate US returns. As your income rises, you may be surprised to see how your tax filings change. EY TaxChat™ can help with the new tax reporting requirements on your annual tax returns.

All you have to do is integrate Evernote with Zapier and Xero to generate invoices from new notes. This is the easiest strategy for developing entirely customizable purchase orders, sending them by email to the supplier and – when payment time arrives – posting them to a bill. re-enter everything into a new file, I guarantee it won’t be Xero file. Other than that program is fairly easy to use however all the add ons get really expensive.

Honest, Objective Reviews

There’s more you should do before you start entering transactions, like creating records for contact and items/services and visiting the company’s settings pages, but this initial screen is a great place to start. If you’re using another accounting solution , you may have created a lot of accounting data online already. Xero makes it easy to import records, transactions, and some other data from QuickBooks Online using its direct-conversion tool. If you have files already set up in CSV or TXT format , you can import those into Xero, too.

Moreover, Xero has a marketplace full of add-on business applications to synchronize with your accounting system to manage data efficiently. For example, there are customized programs for invoicing, inventory management and time-tracking to name a few features. These include Squarespace for eCommerce, Stich Labs for eCommerce and inventory, Deputy for payroll and HR, and WorkflowMax for invoicing, jobs and time tracking. At Fundera, Randa specializes in reviewing small business products, software, and services. Randa has written hundreds of reviews across a wide swath of business topics including ecommerce, merchant services, accounting, credit cards, bank accounts, loan products, and payroll and human resources solutions.

I lost my business to fire in feb 2018, and cancelled the subscription back in July 2018. They still keep taking money from my account, and then sending an invoice. Their support consists of forums and circular, automated emails telling you to go back to the forum to read about why you can’t login all over again. It is beyond reason that a company this size doesn’t offer human support. Xero tax returns integrate nice and easily with the ledger software .

Manage Accounts And Tax

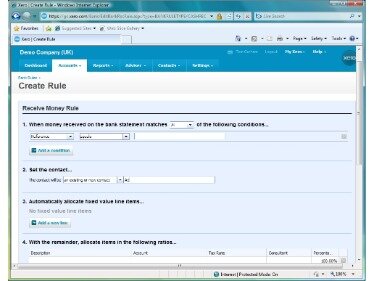

Xero offers dashboard functionality, with the application providing a summary view of total cash in and out, bank account balances, new and outstanding invoices, and sales and spending activity. Users can easily access all Xero features from the dashboard interface, and all data entry screens are easily navigatable with excellent search capability. Xero has put a lot of effort into developing Xero Tax and recently added more features and functionality into the package to help with the evolving state of UK accounting requirements. Thanks to improved modules that support corporation tax and accounts production for small companies, the cloud-based software continues to build on its powerful foundations. Xero has said it will also be launching an open beta for Personal Tax during 2021. With Xero’s intuitive online accounting software, you can get beautifully simple views of where your cash is going and put time-consuming tasks on autopilot. Any entrepreneur understands the need to stay in touch with their business at all times.

Multiviews scalable pricing enables us to be a great fit for rapidly growing small businesses and medium-to-large enterprises, typically those beginning to exceed $6 million in annual revenue. Odoos fully-integrated, customizable, an open-source suite of business applications intends to serve SMBs but is designed to meet the needs of companies regardless of size and budget.

If paying taxes makes you cringe, tax credits and deductions should make you smile. If you need additional time to file your federal and state returns, EY TaxChat™ can prepare and file your extension forms for you. Plus, if you’re interested in tax tips from the pros throughout the year, this section is for you! From practical tips to in-depth tax topics, we’ve compiled various resources to keep you informed. The good news is our EY tax professionals are here to address the complexities of your tax filings. EY TaxChat™ can help you navigate through these complexities of state filing requirements. EY tax professionals consistently work with multistate filers, to submit the proper forms, credits and state tax returns.

The company also holds regular webinars, which prove invaluable for any partners who have signed up. The software is nicely streamlined too, with a single sign-on that works just as it does for logging into Xero itself. If you’re an accountant or bookkeeping professional and enrolled in Xero’s partner program then you can get to use Xero Tax at no extra cost in the UK. In order to do that you’ll obviously need to be in the accountancy businesses and signed up to the partner program. Xero Tax is the perfect compliment to Xero’s small business platform and provides a plethora of great tools for professional accountants. PCMag.com is a leading authority on technology, delivering Labs-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology.

Xero Practice Manager also includes a mobile app that is compatible with both iOS and Android devices, providing users with easy time entry capability as well as access to various management tools and resources. The Starter plan has all other features except that it does not come with payroll, does not have federal or state e-file or e-pay, has no payroll direct deposits and checks, and cannot handle multiple currencies. Simply synchronize the financial data in your inventory and orders directly from your commerce networks using Xero. In my opinion the ticket raising and waiting for someone to respond and then eventually hearing from someone who then doesn’t provide the answers to your problem. Then you respond, and wait again for their response and do that about 10 times before you have your problem resolve! I much prefer Quickbooks support service which you get to speak to a tech support on the phone with screen sharing and have your issue resolved in no time.

Check out these alternative options for popular software solutions. Construction Management CoConstruct CoConstruct is easy-to-use yet feature-packed software for home builders and remodelers. This review will help you understand what the software does and whether it’s right for you. If you’re looking for a more affordable solution, you might consider Wave accounting as an alternative to Xero accounting. Moreover, despite the useful additional features you receive with the Established plan, the cost of this plan makes a steep jump as well, costing twice as much per month as the Growing plan. Additionally, although these limitations are alleviated with the Growing plan, the difference between the cost for these two plans is substantial, with the Growing plan costing over three times as much as the Early plan. Comparatively, you can find other solutions on the market—Wave, QuickBooks Online, etc.—who have plans with similar capabilities at a lower cost than the Growing plan.

States have varying tax residency rules, which are crucial to understand to avoid unexpected state taxes and filing requirements. For business owners, contractors and gig-workers, the freedom of being your own boss comes with the requirement to pay self-employment tax. We can prepare and file the necessary returns for you, including federal Schedules C, E and SE to report your business income and expenses, and ultimately calculate your self-employment tax. We stay current on tax laws to identify the deductions and credits applicable to you. Being self-employed is a major achievement, but it comes with additional responsibilities.