Content

These can be sent to the new employee for them to view and sign digitally. If this is the case, you can email each document’s information to keep the process efficient. You can ask if they have questions about these forms once you meet with them in person. This can help supervisors and HR managers hire several new employees quickly and efficiently without falling behind on their routine.

Thus, you should review your state’s requirements and find a policy that suits your business. If you have filled out the Form I-9 and reviewed the necessary documents, you can now proceed to the next process. This type of assessment is necessary to determine how well a candidate will fit in your organization. Keep in mind that a poor culture fit can affect the daily interactions of workers with their teammates. That being said, you should choose a candidate whose culture is parallel to your organization’s. They can develop a list of effective questions to help you in your hiring needs. Candidates who have generated good results from their previous job can be a good team player.

Be sure to review your state’s requirements and find a policy that suits your business. The National Federation of Independent Businesses has a helpful guide. You need to report newly hired and rehired employees to your state’s labor agency. For more information on your state’s requirements, check out the SBA’s New Hire Reporting Requirements. However, because people tend to associate with others like them, relying on staff referrals can make for a less diverse workplace. Having a more diverse workforce is better for your business.

Every year, employers must report to the federal government wages paid and taxes withheld for each employee. This report is filed using Form W-2, wage and tax statement.

Talk To An Employment Rights Attorney

Post the position internally on the job opportunities bulletin board in your lunchroom and on your company intranet for one week. If you anticipate having difficulty finding a qualified internal candidate for the position, then state in the posting that you are advertising the position externally at the same time. The new hire reporting program requires employers to report information on all new employees for the purpose of locating parents who owe child support. To find the name and address of your state’s new hire reporting agency, see the State New Hire Reporting page at the Administration for Children & Families website (). On the W-4 form, employees tell you how many allowances they are claiming for tax purposes, so that you can withhold the correct amount of tax from their paychecks. (You don’t have to file the form with the IRS.) You can find this form at You should ask employees to fill out a new W-4 form each year if they want to change their allowances. If you are hiring your first employee, you must file documents with and pay taxes to various government agencies.

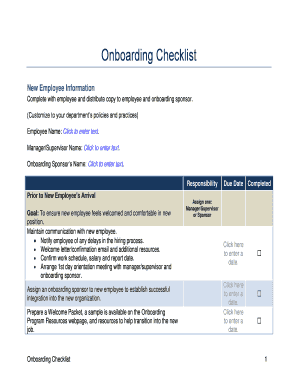

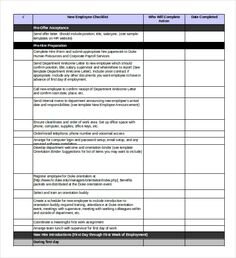

Creating a new hire checklist can ensure items are complete before the employee arrives. A new hire checklist helps supervisors and HR managers ensure they have completed everything needed to successfully onboard a new employee.

Deliver Your Projectson Time And Under Budget

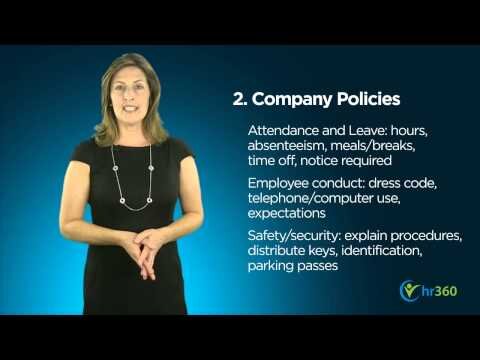

This is also a good time to explicitly explain their responsibilities and expectations in the position. You can also go over the benefits, who they immediately report to, who they work with and, if applicable, who they will supervise. No matter how experienced or skilled they might be, you’re going to want to give them a tour of how this organization operates. Introduce them to other employees, and provide a general idea of the structure and function of the organization. The Department of Labor requires employers to post labor law posters and notices in the workplace. Failure to comply with this requirement can lead to fines and penalties. Your interview questions are supposed to assess each skill you are looking for in a candidate.

If you need assistance in fully fleshing out positions, feel free to read over other companies’ postings for job duties and descriptions to help craft your own. The offer letter, the job description, and the Company Non-Compete or Confidentiality Agreement are provided to the candidate.

Apply For An Employee Identification Number

There are many other items you may want to add to your new hire checklist depending on your objectives. You may decide to update and revise your onboarding checklist based on changing needs or employee feedback. Let your current employees know what the new hire will be doing and share a few interesting facts to help break the ice. For example, you can share the employees’ hobbies, interests and a brief professional background. This announcement should encourage other team members to say hello and extend a personal welcome when they see the new hire around the office. Welcome the new hire to the team by sending a new employee announcement email or by sharing the news of their arrival during a company meeting .

Hiring with Workable For every hiring challenge, Workable has a solution. Learn more about the features available and how they make each recruiting task easier.

The amount you withhold is based on the employee’s Form W-4 information. Use the IRS’s income tax withholding tables to determine the amount. To make sure employees are eligible to work in the United States, they need to fill out Form I-9, Employment Eligibility Verification. When you collect Form I-9, the employee must also bring in original documents proving their identity and employment eligibility. The final page of Form I-9 provides a list of acceptable documents employees can choose from. When you are ready to hire, extend the job offer to the candidate. Will you pay them weekly, biweekly, semimonthly, or monthly?

In fact, studies show racially diverse teams outperform non-diverse ones by 35 percent. Additionally, 57 percent of employees feel their companies should be more diverse. Ask your best employees if they know anyone who might be a good fit for the role. Referrals save you time because they’re already vouched for and can keep you from having to sort through a mountain of resumes. Next, think about what responsibilities you’d like the person in this position to take on in the future. Deciding how much to pay your new employee depends on the kind of work you need done, the role’s seniority, and your budget.

Generally, employers who pay wages subject to income tax withholding, Social Securit, and Medicare taxes must file IRS Form 941, Employer’s Quarterly Federal Tax Return. Depending on the state where your employees are located, you may be required to withhold state income taxes. Visit SmallBusiness.com’s state and local taxpage for more information. This registration is designed to help the state collect child support payments from employees.

- This results in decreased productivity, cultural imbalance, and a bad reputation.

- If you’re genuinely inundated with options, consider assigning a points system.

- Check with your state business license office for your requirements.

- Once resumes start pouring in, you may find yourself overwhelmed with the options you suddenly have available.

- You can set up each employee with access to personalized information.

- Hold screening interviews during which the candidate is assessed and has the opportunity to learn about your organization and your needs.

It’s easy to get this number; you can get it online or by phone or fax. Before you hire your first employee, there are some steps to take and some laws, regulations, and taxes to set up and understand.

For specific information, read the IRS’Employer’s Tax Guide . You must keeprecords of employment taxesfor at least four years. Before hiring your first employee, you need to get an employment identification number . It’s also referred to as an Employer Tax ID or as Form SS-4. Help for starting the hiring process and to ensure you are compliant with key federal and state regulations. If you don’t already, then you should consider building an employee handbook for your employees. An employee handbook ensures that employees are aware of the various company policies and procedures.

There are many ways to do this other than salary and wages, for example incentives and non-financial rewards. Even if you have just one employee, it’s important that you define and agree on what is expected of them from day one.

This is a state-mandatory insurance that provides wages and medical benefits to employees if they are injured on the job. Rates are determined by your state and vary based on factors like industry, payroll, and past claims. Every small business owner starts their employer journey by hiring their first employee. To get through the process, learn how to hire your first employee. As soon as you offer the position and the employee verbally accepts, you can begin the process to have them officially hired.

It will also help you figure out whether your company needs to hire in-house staff or outsource from a service provider. Federal Unemployment Tax Act tax is an employer-only tax of 6% on the first $7,000 of employee wages per year. However, most employers receive a tax credit of up to 5.4%. With the maximum tax credit, you would only pay 0.6% on the employee’s wages up to $7,000. Last but not least, hiring your first employee means obtaining workers’ compensation insurance.

A clear, thoughtful job description helps you hire the right person. Run your draft through Textio, a machine-learning platform that flags gender-biased words and jargon, to help you write a more effective job posting and find the best hires. Whether you’re hiring one employee or several, it’s important to follow the steps above. And don’t forget to think about how you will retain and reward excellent work.